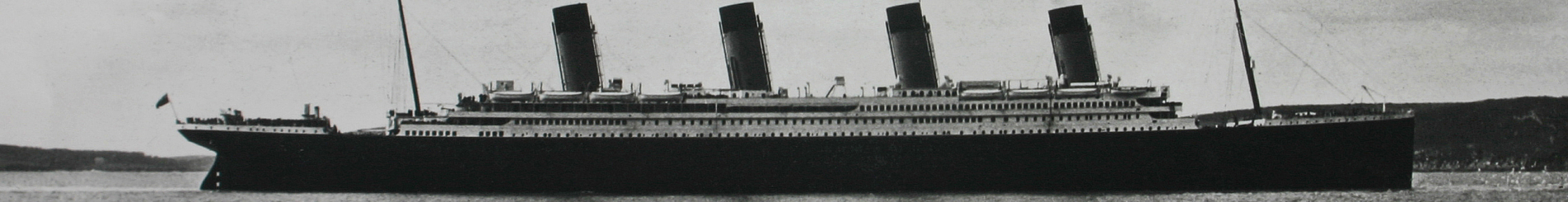

She went down in the freezing waters of the North Atlantic, 375 miles from Newfoundland, in just two hours and 40 minutes. The ship carried 2,224 passengers and crew, however there were 20 lifeboats on board, which would have held a capacity of 1,178 people. Due in part to this catastrophic miscalculation 1,514 souls perished that night.

It was a human disaster on a colossal scale, but it’s also a story with strong links to the history of Lloyd’s, where the ship was insured for over £1m.

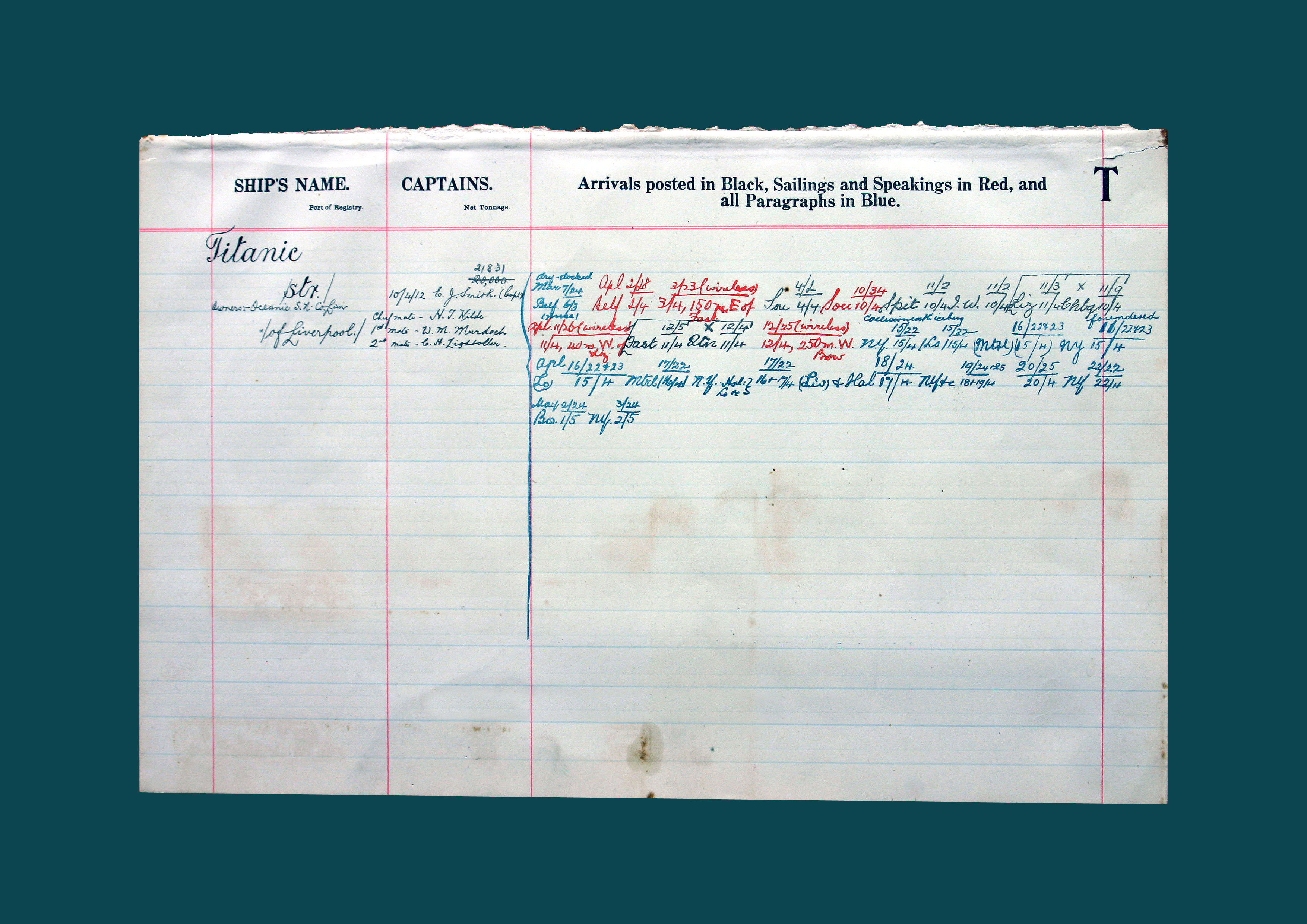

At the time of the disaster, the market, and the media, were still in the early stages of using wireless telegraphy to communicate with ships at sea. Lloyd’s was a significant contributor to the new technology and, with the help of inventor Guglielmo Marconi, had set up signal stations from Cornwall to Canada so that vessels crossing the Atlantic could communicate with land.

Cape Race, Lloyd's signal sataion in Halifax Nova Scotia, was the first to hear the news that the ship was sinking. Other signal stations issued conflicting reports, resulting in great confusion. Two days later, some newspapers still thought the Titanic had survived and was being towed to Halifax.

Lloyd’s, however, understood the situation. Underwriters began to trade ‘overdue insurance’ – a form of reinsurance commonly purchased after a marine incident.

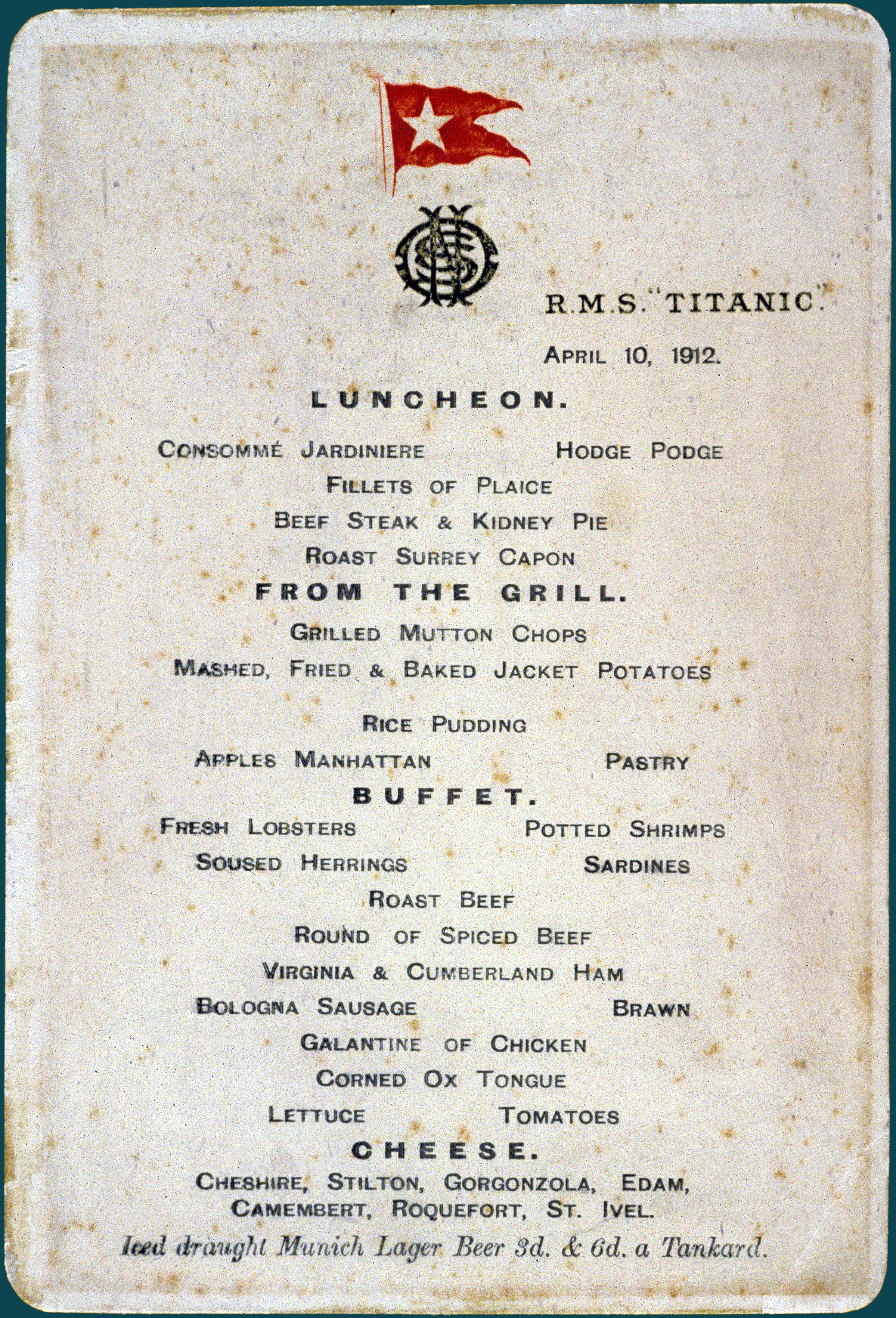

The Chicago Record Herald of 16 April conveyed the market’s heightened emotion under the headline ‘Lloyd’s near to panic: Exciting scenes were witnessed at Lloyd’s underwriting rooms yesterday. Insurance losses in the last six months have been unparalleled in the history of Lloyd’s in liners of the biggest class. Both the Delhi and the Oceana have been wrecked, and now comes the disaster to the Titanic...’

A prestigious risk

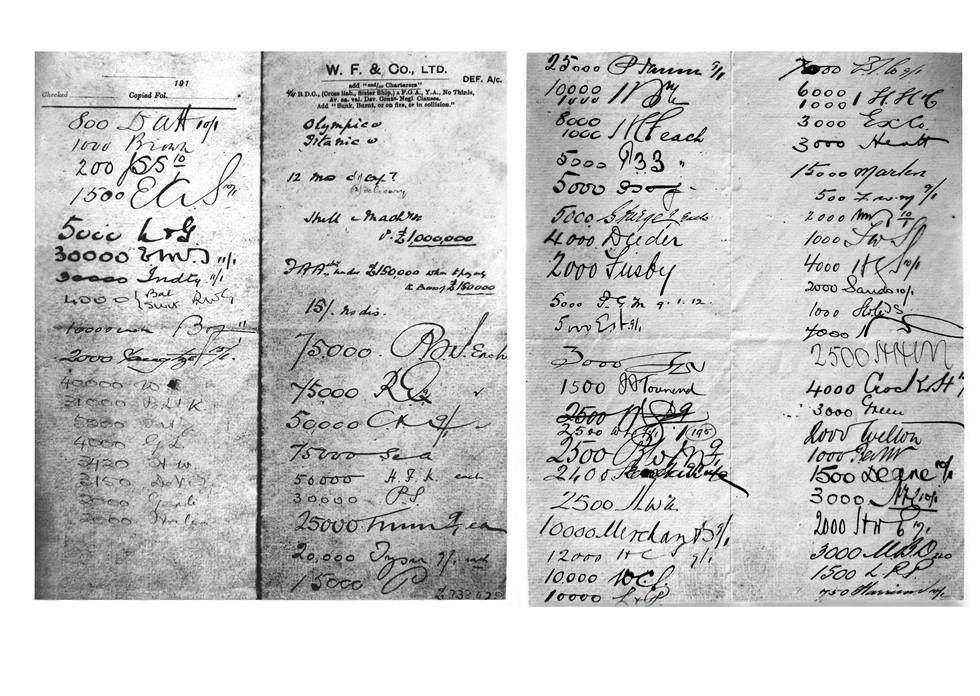

Just a matter of months before on 9 January 1912, broker Willis Faber & Co had come to Lloyd’s underwriting room to insure the Titanic and her sister ship, the Olympic, on behalf of the White Star Line.

It was considered a prestigious risk, with cover for the hull alone standing at £1m. Numerous Lloyd’s syndicates put their names on the slip, covering amounts ranging from £10,000 to £75,000. Willis was able to negotiate a favourable premium for this proudly ‘unsinkable’ vessel of just £7,500.

Lloyd’s pays in full

Despite the high levels of claims arising from the tragedy, insurers paid out in full within 30 days. From Lloyd’s perspective, the Titanic will long be remembered as one of the market’s biggest losses alongside major natural and manmade catastrophes such as the loss of HMS Lutine in 1799, the 1906 San Francisco earthquake and more recently 9/11, Hurricane Katrina and the Japanese earthquake and tsunami of 2011.