Lloyd's has been at the heart of progress for over 300 years. As a maritime nation expanded its influence and established trading routes across the globe, Edward Lloyd's coffee shop by the river Thames became the centre of marine intelligence and founded the modern insurance industry. Discover more about our rich history in our timelines and videos.

Coffee and commerce

Travels through our history

1652-1811

1652: Coffee and commerce

First imported to the UK in 1652, coffee quickly became the fashionable drink of the new professional classes. When the Great Fire of London saw much of the city destroyed, it was the coffee shops that emerged as a gathering place for transacting business, so trade and commerce could recover and continue to develop.

1688: The first recorded mention of Lloyd's

Edward Lloyd’s Coffee House in Tower Street was referred to for the first time in the London Gazette. There were more than 80 coffee shops, each one a centre of special interest for different groups of entrepreneurs and merchants. Lloyd’s coffee house specialised in shipping information and was popular with ship owners and captains returning from overseas voyages. Lloyd's began renting out ‘boxes’ (tables) where entrepreneurial businessmen took the opportunity to sell insurance to ship owners in the event their ship did not return.

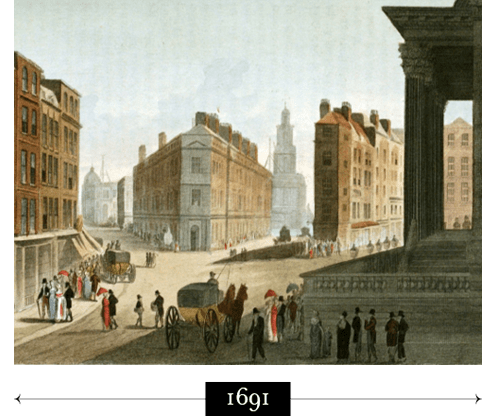

1691: A prestigous new address

16 Lombard Street, in the very centre of the business world, becomes Lloyd’s new home and the location for marine underwriting by individuals.

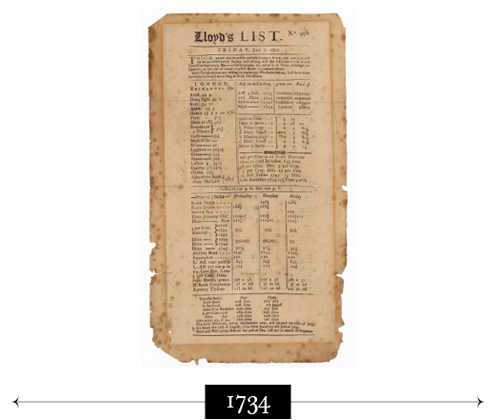

1734: The Lloyd's List

Lloyd’s Coffee House published daily shipping news, informing people about departures and arrivals, the cargo aboard each ship, where other country’s fleets were operating and where pirates were known to be active. The first official edition of the 'Lloyd’s List' was first published by Thomas Jemson in 1734 using the Lloyd's name, which had built a reputation for reliable intelligence that the shipping community were prepared to pay a subscription for. One of the world’s oldest continuously running journals, the paper still provides weekly shipping news through an online edition of the List.

1739: The centre of maritime intelligence

Victory over the Spanish at the battle of Porto Bello in Panama opened up the possibility of British trade to the Spanish colonies. Richard Baker, one of the few known Masters of Lloyd's Coffee House, delivered the news to 10 Downing St; Lloyd's had cemented a national reputation for trusted maritime information.

1750: The subscription market develops

While there are no precise records of how the market was organised at this time, a Quaker businessman wrote in his journal that he visited Lloyd’s Coffee House and “subscribed the book at two guineas a year.” He had joined the subscription market which was formally established in 1771.

1764: Setting the standards we still recognise today

One of the most important trials in insurance law history helped to establish the English law of maritime insurance. The Mills Frigate, a vessel that Lloyd's had insured, set out on a voyage in a 'weak, leaky and distressed condition'. It was forced to dock in St Kitts after springing a leak, and with no possibility of repair or returning home with its cargo it was condemned. Several court cases around a subsequent claim concluded that a ship must be 'seaworthy' before leaving shore and that a policy would not be paid 'on a ship which suffered from a latent defect unknown to both parties to the contract'. A decision that hit the City of London 'like a thunderbolt'.

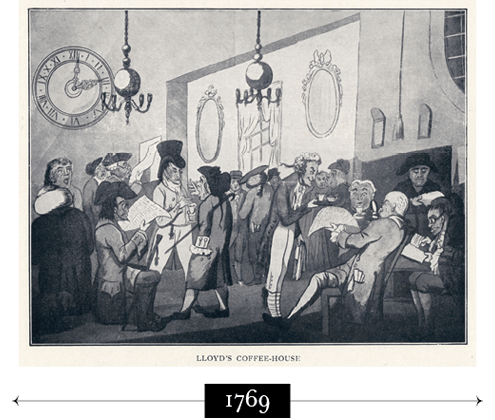

1769: New Lloyd's established at 5 Pope's Head Alley

A group of professional underwriters, keen to disassociate themselves from a growing reputation for gambling on 'speculative' lines of risk for quick profit, broke away to establish a New Lloyd’s coffee house at 5 Pope’s Head Alley, London. After a few years of intense rivalry, the so-called ‘Old Lloyd’s’ ceased to exist. In its wake came New Lloyd’s, formally founded in 1771, as a bastion for professionalism and order.

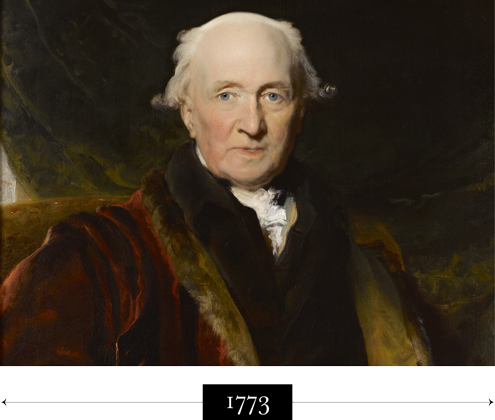

1773: Advancing the profession

John Julius Angerstein, a Lloyd’s insurer, originated the Lloyd’s concept of a “lead” underwriter, setting a rate that others then follow. During this time many involved with Lloyd’s amassed fortunes through the economics of empire and the slave economy. Angerstein was one of those whose wealth allowed him to act as a significant philanthropist and art collector. After his death 38 paintings from his collection were purchased by the British Government, forming the basis of the UK’s National Gallery.

1774: The modern Lloyd's evolves

As Lloyd's evolved into a more formal society, the 'Subscribers to Lloyd's' occupied new premises at the Royal Exchange in Cornhill.

The Lloyd’s Loss Book was introduced during this period, to record details of lost ships. Today’s loss book, still displayed in the centre of the Lloyd’s Underwriting Room, is updated daily using traditional quill and ink. When The Royal Exchange burnt to the ground in 1838, Lloyd’s moved to South Sea House temporarily, returning in 1844 after The Royal Exchange had been rebuilt.

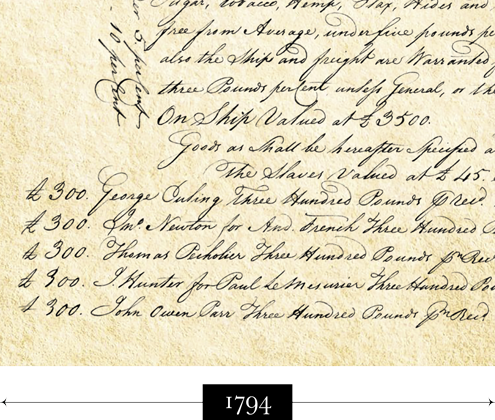

1794: A trusted intelligence partner

Lloyd’s demonstrated how sophisticated its shipping intelligence had become, reporting the capture of a British vessel by a French privateer off Lowestoft (including the lost cargo) before the Admiralty knew that anything had occurred. A mutually useful relationship between Lloyd’s and the Admiralty had been established; Lloyd’s provided information and the Admiralty, protection.

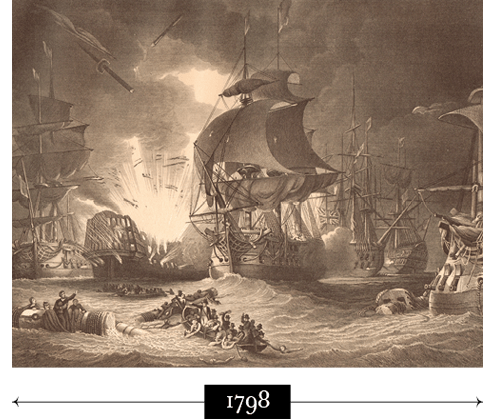

1798: Nelson and the Battle of the Nile

Following the Battle of the Nile and the destruction of Napoleon’s fleet, the Lloyd’s Committee raised £38,000 to help the wounded and bereaved, and donated a silver dinner service to Nelson as ‘a small token of their gratitude.’ To mark the first anniversary of the Battle of the Nile, Sultan Selim III honoured Admiral Nelson with The Order of the Crescent. These and other artifacts can be seen in Lloyd’s Nelson Collection, some of which is on display on the History Floor at the Lloyd’s building in London.

1799: Loss of the Lutine

The French Revolutionary Wars led to the near collapse of Hamburg’s economy. City of London merchants collected £1m in gold and silver bullion to be loaned to Hamburg; to be delivered by HMS Lutine. On 9 October, the Lutine encountered a heavy gale on its voyage and ran aground, with the loss of all crew and treasure. Lloyd’s underwriters had insured the Lutine’s cargo and the claim was paid in full. In 1859, the Lutine Bell would be salvaged and eventually returned to Lloyd’s, where it now hangs in the Rostrum in the centre of the Underwriting Room. In modern times the bell is only used for ceremonial purposes.

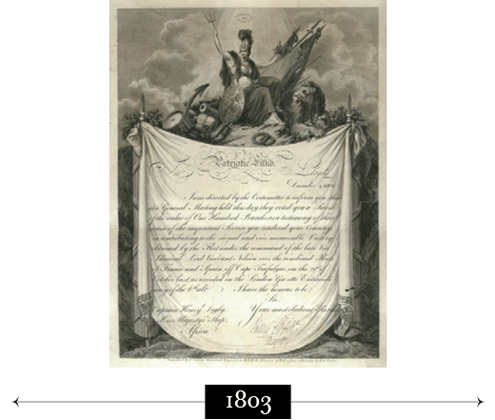

1803: The Napoleonic Wars

As London's dominant marine insurance market, the beginning of the Napoleonic Wars meant Lloyd's was bound up with the outcomes of the hostilities until the British victory at the Battle of Waterloo in 1815. During this period Lloyd's prospered; insurance rates generated large profits and the prices of goods also moved upward, benefiting underwriters. Lloyd's developed close ties with the Royal Navy and established the Patriotic Fund, which still works with armed forces charities to help individuals and their families in urgent need of support.

1811: A global network of intelligence

By 1811, the complexity of the information used by the insurance industry had evolved significantly, but it was the creation of Lloyd’s Agency - a global network of Agents appointed to bring local intelligence to the Lloyd’s market based in London - that profoundly accelerated both the reach and impact of that information.