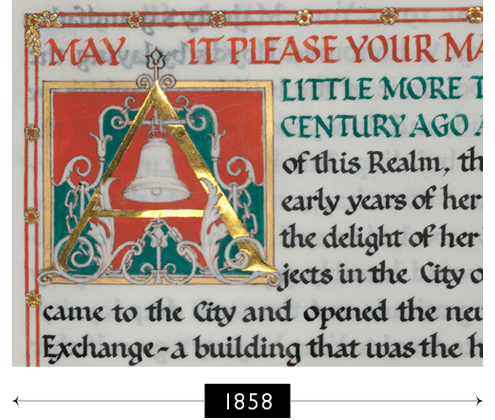

Lloyd's has been at the heart of progress for over 300 years. Industrialisation and the age of machines brought momentus changes to society. As revolutionary ideas became reality, and with war always a possibility, Lloyd's came of age - adapting to sieze new opportunities and building the capital of trust. Discover more about our rich history in our timelines and videos.

Sweeping change, new standards

Travels through our history

1827-1956

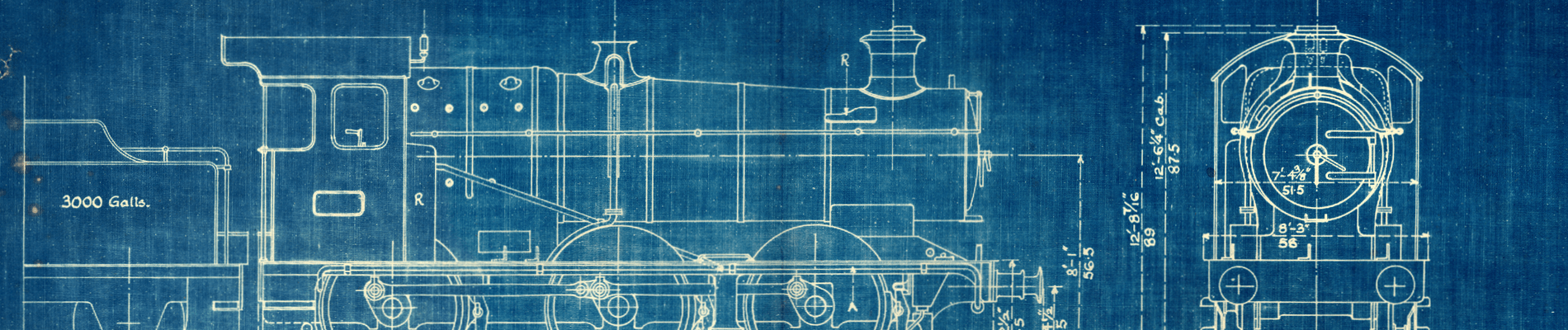

1827: Ship to shore intelligence

Underwriters began to provide reports directly to Lloyd’s, gathered via semaphore signals passed from ships to shore along a chain of hilltop signal stations that Lloyd’s had established along the coast. The semaphore flags and signals can still be found in the decorative panelling in the Lloyd’s Old Library.

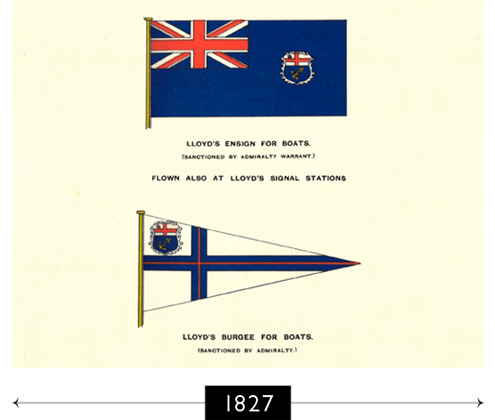

1834: Changing fortunes

After a difficult period when Lloyd's saw subscribers fall away, due to a Bill allowing wider competition in the insurance industry, George Richard Robinson was appointed Chairman; helping Lloyd's to recover its prestige over the next decade and a half. Stamp duty was reduced on policies, Lloyd's List became a daily paper, Lloyd's Register was founded, and the Agency system was extended.

1838: A temporary home

When The Royal Exchange burnt to the ground in 1838, Lloyd's moved to South Sea House temporarily, returning in 1844 when the Royal Exchange was rebuilt. An underwriting box first installed in the Royal Exchange in 1928 and used in the Lloyd's market for almost 70 years, can still be seen on the History Floor at Lloyd's.

1858: The Lutine bell is recovered

After several salvage attempts, in 1858 HMS Lutine yielded her most famous find – the Lutine Bell, which was returned to Lloyd's and hung from the Rostrum of the Lloyd's Underwriting Room.

Traditionally struck for news of an overdue ship, once for the ship’s loss and twice for its safe return, the bell was originally sounded to ensure that all brokers and underwriters were made aware of the news simultaneously. Today it is only rung to mark special occasions.

1859: Underwriting the pages of history

When describing the Underwriting Room at Lloyd's, a journalist wrote: "Not a breeze can blow in any latitude, not a storm can burst, not a fog can rise, in any part of the world, without recording its history here."

1866: Building trust

By 1866, new candidates to Lloyd's were required to provide a deposit or guarantee to support their underwriting, becoming obligatory from c.1870.

1870: Adapting to demand

One of many innovators, marine underwriter Frederick Marten, elected an Underwriting Member in 1882, invented the concept of large syndicates. Lloyd‘s had been losing ground to the new and wider company market due to its smaller capacity – most syndicates had only two or three members. Marten began writing for a 12-man syndicate, astounding the Underwriting Room by the size of the lines he could write, and marine business flowed to Lloyd's.

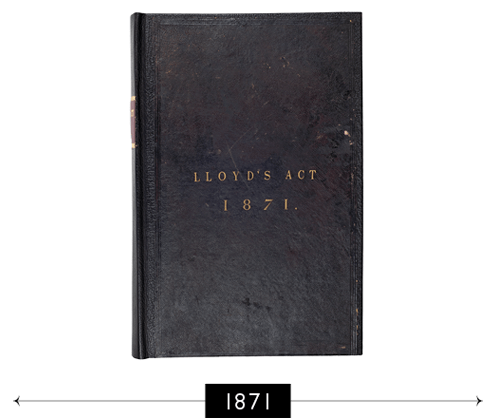

1871: The early days of regulation

The first Lloyd's Act was passed in Parliament, incorporating the Society of Lloyd's as a statutory corporation for the first time and establishing its first detailed constitution - making it illegal for anyone who was not a recognised Lloyd's underwriting member to sign their name to a Lloyd's policy. This, in essence, certified the economic importance of insurance.

1872: A growing reputation

In 1872, a Boston fire saw Lloyd’s pay £1m in claims – ‘Honouring its debts,’ said one commentator, ‘with a promptness which drew nothing but admiration from the American public.’

1874: A wider outlook

Henry Hozier became Secretary of Lloyd’s, reforming overseas claims so they could be settled in foreign ports for the first time. Hozier recognised the importance of intelligence and became a pioneer of wireless telegraphy. By 1884 Lloyd’s had 17 coastal telegraph offices in the British Isles and 6 abroad, sharing vital intelligence with the Admiralty.

1877: Cuthbert Heath - market visionary

Non-marine policies were introduced to Lloyd’s by Cuthbert Heath, one of Lloyd’s most famous and illustrious members. Heath would go on to forge a highly adventurous path and was instrumental in opening up the American insurance market for Lloyd's. Heath wrote Lloyd's first burglary, hurricane and earthquake policies and would become a key figure in early aviation insurance. Find out more here.

1902: The Burnard Failure, Introduction of auditing

Financial failures began to highlight the lack of an audit process at Lloyd’s. The failure of one particular underwriter, Burnard, who went broke with his Names forced to pick up a tab for £100,000 in debts, created a public scandal. Cuthbert Heath and underwriter Sidney Boulton called a special committee meeting, which resulted in the planned creation of an audit, introduced in 1908. For the first time, underwriters had to submit their accounts to audit and be certified as solvent. Now policyholders could be entirely satisfied that Lloyd’s underwriters had the means to meet their claims.

1903: Delegated authority and expansion

Cuthbert Heath gave delegated authority to Alfred Schroder in Amsterdam to write insurance on his behalf – the first time this had ever been done. By the 1930s, Heath had an international contracts department, delegating to agents in India, New Zealand, Belgium, Denmark and Norway. In 1930, Heath sent John Cope to Shanghai, Calcutta, Alexandria and Athens; in some cases, the first agent from London to visit these places. Eventually, Lloyd’s would be licensed to accept business from more than 200 countries and territories worldwide.

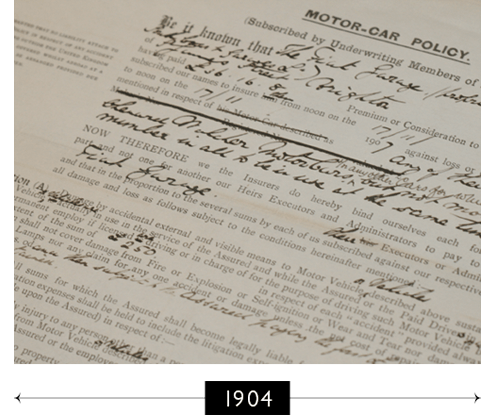

1904: The first motor policy

The motorcar was invented in 1885 and Lloyd's underwriters are the first to offer car insurance. More familiar with marine policies, the insurance documents describe the car as a "ship navigating on land".

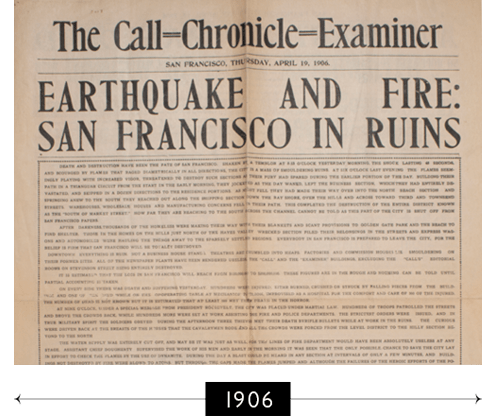

1906: The San Francisco earthquake

Early in the morning of 18 April 1906, a massive earthquake (8.25 on the Richter scale) shook San Francisco and sparked uncontrollable fires that raged for three days, taking several thousand lives and leaving half the population homeless. As one of Lloyd’s leading earthquake underwriters at the time, Cuthbert Heath faced an enormous bill. Heath famously instructed his San Franciscan agent to 'pay all of our policyholders in full, irrespective of the terms of their policies.' The earthquake cost Lloyd’s more than £40m (more than £792m in today’s currency), and the aftermath of the disaster laid the foundations for many of today’s modern risk modelling and building practices.

1911: Second Lloyd's Act

The 1911 Lloyd's Act amended the 1871 Act, to allow Lloyd's to act in non-marine insurance. Setting out in detail the Society's objectives, it included the promotion of its members' interests and the collection and dissemination of information.

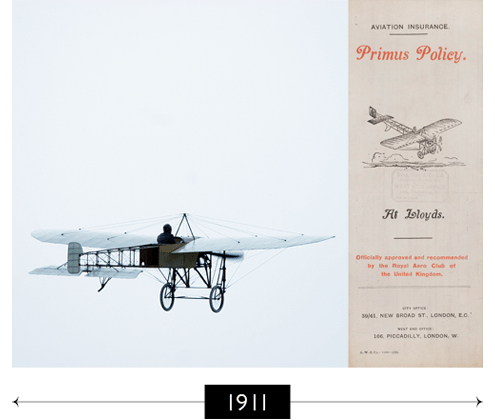

1911: The first aviation policy

The first-ever aviation insurance policy was written at Lloyd's. However, policies were stopped a year later after bad weather caused a series of crashes. Cuthbert Heath, ever the visionary, started the British Aviation Insurance Association in 1919. In 1921, the venture was closed ‘in view of the fact that there seems to be no immediate future in aviation insurance and that there is no business to be had’. However Heath did insure Charles Lindbergh and his single-seat, single-engine monoplane Spirit of St Louis for $18,000 on its non-stop flight from the USA to Europe. The Association was revived in 1930.

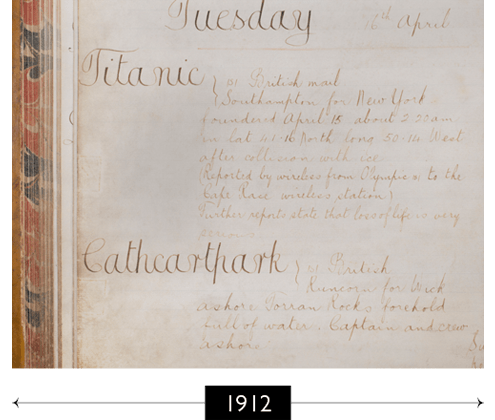

1912: The loss of the Titanic

The Titanic was insured at Lloyd's for £1m - 20% of the market's total capacity at the time and the largest-ever marine risk. In April, it become the largest marine loss in history. The “unsinkable” ship collided with an iceberg during her maiden voyage and went down in the freezing waters of the North Atlantic in just two hours and 40 minutes, with the loss of over half the ship's crew and passengers. Within one month, Lloyd's insurers paid out claims in full.

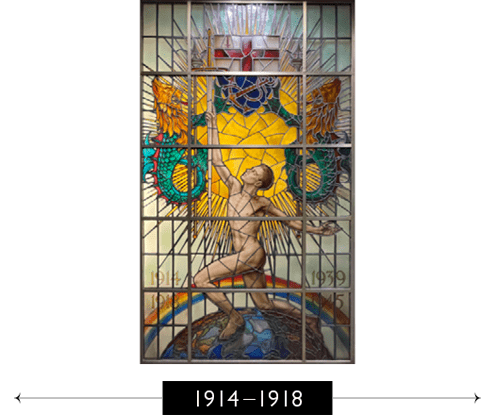

1914-1918: The Great War

Even before compulsory service was introduced, 2,485 men from Lloyd's entered militiary service in the First World War. But Lloyd’s contribution to the war came not just from its workforce; donations were also made to Red Cross Societies, and the Committee of Lloyd's Patriotic Fund continued to support relatives of soldiers and sailors after the Armistice. Some men from Lloyd’s returned to work, but many did not, the Lloyd’s War Memorial window pays tribute to the fallen of both World Wars.

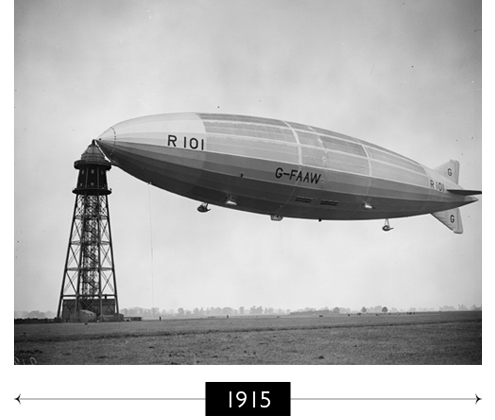

1915: Terror in the sky

Lloyd's provided cover for bombing raids carried out by Count Zeppelin’s airships. Over the next ten years, there was a concerted global effort to develop a commercial airship which could be lighter and cheaper than aircraft. There was a series of ill-starred experiments, but when the Graf Zeppelin successfully circumnavigated the world in 1929, confidence was temporarily restored, until the British airship R101, bound for Karachi in 1930, came down, killing 48. Britain bowed out of the airship race, but the Germans and Americans persevered until, in 1937, Germany’s passenger airship the Hindenburg, insured by Lloyd's, caught fire and was destroyed.

1923: The Central Fund is established

After underwriter Stanley Harrison confessed to running up debts of over £360,000 in a complex motor/credit insurance line, Lloyd's acted to protect clients interests and its own reputation. The principle of mutuality was born, with the combined members agreeing unanimously to pay a share of the debts proportionate to their premium income. Shares ranged from £10,000 to eight pence. Should an underwriter or syndicate fail and be unable to pay its claims, there would now be a Central Fund to fall back on as a last resort.

1928: Leadenhall Street

The Society moved into the first building it had ever owned, at 12 Leadenhall Street, designed by Sir Edwin Cooper.

1939-1945: WW2

Just as it had been a generation ago, Lloyd’s was deeply involved in the events of WW2. The Leadenhall buiding's basements were reinforced with heavy timbers and steel, and a main shelter was created in the sub-basement of the Royal Mail House next door. In September 1939, nearly 500 staff - mostly women - were moved into offices at Pinewood Film Studios in Buckinghamshire. From October 1940 to May 1941, Lloyd's offered around 170 people from London's East End permanent shelter from the bombing and appalling conditions surrounding their homes. Business continued, much as normal.

1956: The civil rights movement

Rosa Parks arrest, for not giving up her bus seat, sparked the Montgomery Bus Boycott. African-Americans organised carpools until insurance agents cancelled their policies. Theodore Martin Alexander, a Black broker working in Atlanta, made arrangements with Lloyd’s.