Lloyd's has been at the heart of progress for over 300 years. The rise of electronics, telecommunications and computers opened the doors to space expeditions, research and, most importantly, information on the cold truths of a warming planet. Extensive losses due to natural and man-made disasters led to reconstruction and renewal in order to be future ready and pioneering women at Lloyd's stepped over old business frontiers. Discover more about our rich history in our timelines and videos.

New frontiers and greater risk

Travels through our history

1965-2014

1965: Pioneering satellite insurance

Lloyd's syndicates provided the first space satellite insurance, covering physical damage to the Intelsat 1 on pre-launch. From 1974-82 Lloyd's continued to underwrite policies for up to US$100m each. In 1984 Lloyd's launched a successful salvage mission to recover two rogue satellites, sending a shuttle and 5 astronauts into orbit to reclaim them.

1973: Lloyd's first female broker

Liliana Archibald became the first female Lloyd’s broker. As she left the building after her first day, she observed, “The roof was still on.” Today, Lloyd’s is a committed champion of gender equality and diversity, leading the field in encouraging open and inclusive cultures across the insurance industry.

1978: First black broker

David Flint became the first Black broker in the Underwriting Room. After 45 years in the market, he said: “I never saw my race, others did. On reflection, I see my journey as a pioneering pathway, encouraging others to follow.

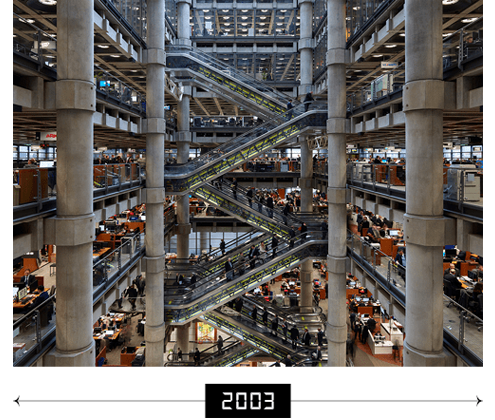

1986: An iconic new home

A revolutionary new building, commissioned by Lloyd's, became Lloyd's home in 1986. Richard Rogers and Partner's 'inside out' masterpiece was opened by Her Majesty Queen Elizabeth and became an instant City landmark. The youngest ever building to be granted Grade 1 status, it remains one of the most exciting buildings in the world.

1987: Piper Alpha disaster

Piper Alpha became the worst offshore oil disaster in terms of lives lost and industry impact. The North Sea oil production platform was the world's single largest oil producer, accounting for 10 per cent of North Sea oil and gas production. With US$1.4 billion insurance losses, it was the industry’s costliest man-made catastrophe and a turning point for Lloyd’s and the insurance industry as a whole.

1987: Extensive losses

Lloyd’s entered the most turbulent and traumatic time in its history. The combined claims of US asbestos pollution and health hazards, with a series of gigantic oil, wind and fire events brought Lloyd’s near to collapse, leaving Lloyd’s Names liable for extensive losses of £8bn, over the following five years.

1988: Furthering knowledge

Lloyd’s Tercentenary Research Foundation was established to mark 300 years of Lloyd’s. In its first three decades, the Foundation contributed more than £3m to academic research into risk, through its partnerships with specifically commissioned academic institutions and research organisations.

1993: Road to recovery

Chairman Sir David Rowland guided Lloyd’s through its recovery from the losses of the late eighties and early nineties by implementing Reconstruction and Renewal (R&R). This was the start of creating a modern, robust and secure Lloyd’s with the first corporate member being introduced in 1994. By 1997, reinsurance agreements and R&R Settlement proposals were accepted, ending one of the most difficult periods in the market’s history.

1995: Overhaul of risk

The Realistic Disaster Scenario (RDS) framework was introduced in 1995 compelling syndicates to demonstrate an accurate handle on risk accumulations for major offshore complexes.

1996: The first female Active Underwriter

Mel Goddard becomes the first female Active Underwriter at Lloyd’s, leading a key market syndicate.

1999: Opening up new markets

Lloyd's Asia opened its doors in Singapore and has since grown to the largest of Lloyd's regional insurance platforms. It is now the leading hub for specialist insurance across the entire Asia Pacific region.

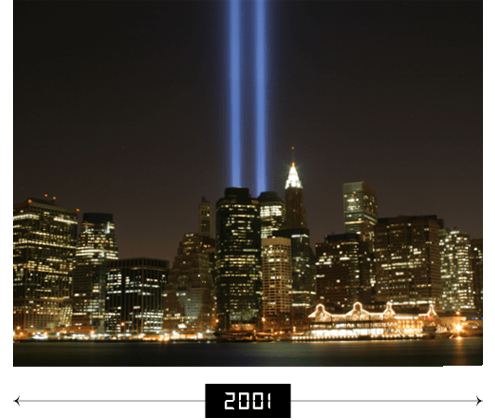

2001: 9.11

The terrorist attack in New York City on September 11, 2001 changed the world’s perception of risk forever. Nearly 4,000 people died in the attacks and many in the insurance industry lost colleagues and loved ones. It was Lloyd’s largest-ever single loss. In the wake of the attacks, Lloyd’s syndicates paid out billions of dollars, settling scores of multimillion-pound claims from affected businesses. Months after the attack, as America began to try to rebuild and heal, US Treasury Secretary John Snow spoke movingly about the way Lloyd's had supported the USA, declaring, ‘We are indebted to you'.

2003: Realistic Disaster Scenarios

Lloyd’s introduced Realistic Disaster Scenarios, to allow syndicates to better model their expected losses in the event of major disasters.

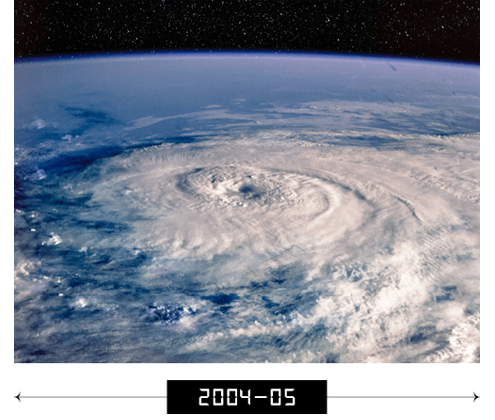

2004-05: Hurricane season

A deadly hurricane season saw Florida battered by hurricanes Charley, Frances, Ivan and Jeanne. Despite heavy industry-wide losses, 86% of Lloyd's claims were settled by Christmas. In 2005, Hurricane Katrina became the costliest natural disaster as well as one of the five deadliest hurricanes in US history. More than a thousand people were killed and tens of thousands were left without homes. Lloyd’s responded quickly, sending thousands of loss adjusters to the region, paying billions of dollars in claims and donating millions of dollars in relief funds.

2007: Committing to climate action

Lloyd’s became a founding member of the ClimateWise Initiative, whose principles guide Lloyd’s approach to climate change; leading in risk analysis, supporting climate awareness, reducing environmental impact and reporting.

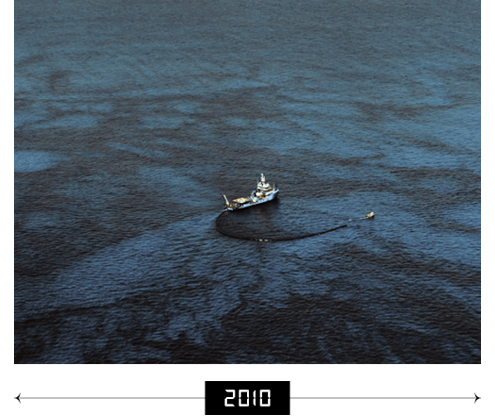

2010: Deepwater Horizon

Following the explosion and sinking of the Deepwater Horizon oil rig in the Gulf of Mexico, which claimed 11 lives, the resulting oil spill is still considered to be the largest accidental marine spill in the history of the petroleum industry. Lloyd’s paid out more than US$600m.

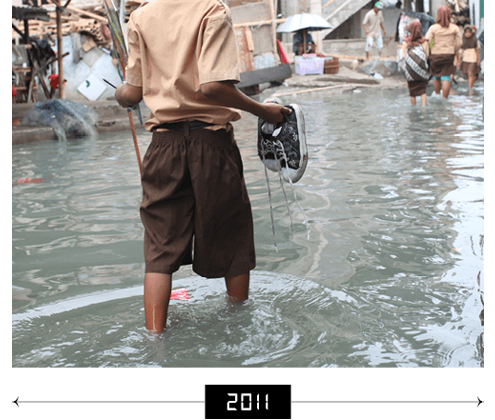

2011: A catastrophic year

2011, one of the costliest years on record after an unprecedented run of natural catastrophes: floods in Australia and Thailand, massive earthquake in New Zealand, devastating tsunami in Japan and an active windstorm season in North America. The market’s experience with major events like these has contributed to the advancement of catastrophe risk modelling and provision. Lloyd’s underwriters were the first to use storm records to combine natural science with financial expertise, in order to analyse changing weather patterns.

2014: First female CEO

Inga Beale became CEO of Lloyd’s, the first woman to hold the position. This was also the founding year of Inclusion@Lloyd’s.

2015: Addressing climate change

In a speech at Lloyd’s, Governor of the Bank of England Mark Carney said insurers are “amongst those with the greatest incentives to understand and tackle climate change in the short term. Your motives are sharpened by commercial concern as capitalists and moral considerations as global citizens... Others will need to learn from Lloyd’s example in combining data, technology and expert judgement to measure and manage risks.” Today, Lloyd’s underwriters are required to consider climate change explicitly in their business plans and underwriting models.

2015: The cost of progress

The Lloyd’s City Risk Index found nearly half the economic risks faced by 301 cities around the world were linked to human-made threats. Risks such as terrorism, cyber attacks, market crashes, nuclear accidents and climate change had now become bigger threats than natural disasters. Insurance has a unique role in protecting society; the Lloyd’s market anticipates and spreads risk in order to protect businesses and communities throughout our rapidly changing world.

2015: First Middle East office opens

Expansion continued as Lloyd’s Dubai established an underwriting hub in the Middle East; supporting fast paced investment in technology, innovation and education to help diversify the region's economies.