The economic impact

To help understand the need to build societal resilience and preparedness against potential geopolitical conflicts, we have calculated the impact this scenario could have across our three severity levels on businesses and the wider economy.

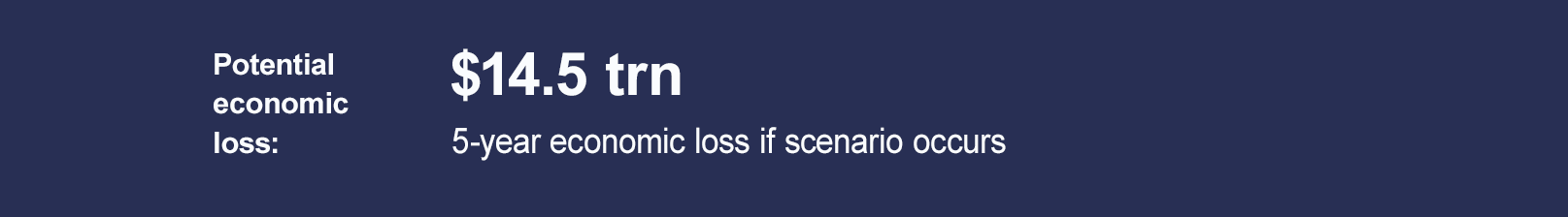

If this major geopolitical conflict scenario were to break out, the global economic impact could reach $14.5 trillion over a five-year period (this represents the probability weighted average across the three severities we have modelled), with an expected economic loss of $1.4 trillion (the economic loss multiplied by the probability of the event occurring).

The global losses across the three severity levels modelled range from $7.8 trillion in the least severe scenario to $50 trillion in the most extreme, equivalent to a reduction in global GDP of between 1.2% and 7.6% over the period.

The invasion of a major economy by a superpower significantly reshapes global dynamics and geopolitics, however the economic effects vary between countries depending on the degree of their involvement and exposure to events.

The invaded territory: The invaded territory would be inflicted with humanitarian suffering, casualties and extensive physical damage to critical infrastructure. Financially they would be knocked out of the global economy due to the disruption to daily life and the diversion of state resources towards the purchase of fuel, weapons, and medical supplies. The financial impact would likely be compounded by a drop in outside investment.

The superpowers: The invading superpower would face sanctions and trade agreements will be impaired as the two superpowers decouple from the global economy. This would cause huge disruptions across international supply chains and trade routes.

Allied states: Depending on the level of their involvement, smaller allied states may also face sanctions from the opposing superpower. The impact on their economies would be exacerbated as compared to larger nations, as they would lack the internal economic capacity necessary to mitigate the disruption to their trading patterns, (e.g. by providing heavy subsidies to local manufacturers). Secondly, the volume of their trade with either of the superpowers, and the invaded territory, may be significant and difficult to quickly substitute through trade agreements with other states.

Neutral states: Neutral state economies would be less impacted as they may be able to maintain economic ties with both superpowers and their respective coalitions. They may even make short-term economic gains by acting as alternative producers and supply chains. In the long-term, growing deglobalisation would likely negatively impact states that rely heavily on international trade, particularly for technologically advanced consumer goods with long supply chains, such as electronic devices.

You can use the interactive tool below to explore the potential economic cost of our scenario across the three severity levels.

Recovery

The following chart shows the impact and economic loss from our scenario across the 5-year period we have modelled, with the conflict beginning in 2023.

The initial shock to the economy from the Major level scenario would be short lived as under this severity the conflict would be resolved within the first year. In the Severe severity level a two-year conflict would have lasting global economic impacts due to the intervention and involvement of other major powers. In the Extreme level scenario, the global economy fails to return to baseline GDP within the five-year modelling period, as the three-year conflict involves a wide range of nations, resulting in prolonged global disruption.

Regional risk

How exposed could your region or country be?

How a country recovers economically from a geopolitical conflict depends on how directly involved it was and how reliant its population is on the goods that would be delayed or lost due to the supply chain disruptions. There would be a significant cost implication for those closest to the conflict or most reliant on international trade, and if resources are severely limited, scarcity would drive prices up. This could also cause social and political unrest at home, causing further economic shock.

From a regional level Greater China is most exposed to this geopolitical conflict scenario with an expected loss of $4.8 trillion. Europe, which is heavily reliant upon other industrially advanced states for supplies like semiconductors for car and electronics manufacturing, could stand to lose up to $3.4 trillion. The Caribbean is the least exposed region with a modelled impact to GDP of $20.8 billion.

Use the tool below to explore the potential impact of the scenario on your region or country, at three levels of severity identified in the research.

An aggregating model: In this model, a systemic event has a significant ‘ripple effect’ of impacts across the globe. The cost of the event is aggregated up from country and regional levels to provide a global economic loss number.

– For example, the COVID-19 pandemic quickly spread around the world, affecting many countries' economies in a significant way at the same time.

A non-aggregating model: Our non-aggregating model is used for events that have a smaller ripple effect and for scenarios where the global losses are not caused by the trigger event occurring simultaneously in multiple regions.

– For example, a major volcanic eruption is likely to have a much greater impact in the country in which the volcano erupts. In our non-aggregating model, we do not assume that multiple major volcanoes erupt at once.

– Country and regional data in a non-aggregating scenario is based on the event occurring in that region and/or country. Therefore, in a non-aggregating scenario, the sum of countries’ economic losses will not equate to total regional or global economic losses.

In our geopolitical conflict scenario, losses are calculated using an aggregating model.

Our analysis included:

- Establishing a conflict magnitude scale to classify types of war based on various factors, such as length of conflict, casualties, and economic and social impact. Our scenario assumes a conflict between two Superpowers, which is a Level 6 on the 1-6 scale.

- Reviewing the number of historical wars there have been in each of the Conflict Levels since 1947 (the advent of the ‘Long Peace’ in Europe) and expressing this as an annual probability of occurrence.

The impact of geopolitical conflict highly depends on a country’s national capabilities and global standing. We have determined the threat level for each country by considering academic expertise on the countries that are likely to participate in the conflict, both directly and indirectly, accounting for the current geopolitical landscape and alliances. We have also reviewed data on military power and capability, and country import data from the United Nations Comtrade database to account for countries’ dependency on the safe and efficient operation of the conflict restricted trading route.

The economic vulnerability of each city has been modelled based on the quality of its physical assets (building stock and critical infrastructure). Highly vulnerable cities suffer significant levels of damage in a geopolitical conflict scenario.

The subsequent recovery from the initial GDP shock is determined by the socioeconomic resilience of each city. Regional conflicts can disrupt developing economies by straining their supply chains. During times of conflict, countries may have to realign their strategic priorities, shifting resources to sectors like aerospace, technology, and manufacturing, while curtailing imports, particularly from grain and energy rich nations.

Sector risk

Which sectors might be most at risk?

Manufacturing

With a shortage of raw materials, producer countries may not receive payment for goods and importing countries will not be able to use the materials to create new products. In December 2021, a survey of European businesses by INVERTO found that 89% had reported a limited availability of raw materials and 92% expected falling profits as a result. More than two fifths (43%) expected strong price increases which would be worst in aluminium, plastics, ferrous metals and steel, and wood, paper, and cellulose. Three-quarters would pass on price increases to consumers7. Price inflation and falling profits for those businesses trading in and reliant upon raw materials are likely outcomes of our geopolitical conflict scenario.

Semiconductors

Semiconductors are the chips that enable the digital world. They're in our vehicles, electronic devices, medical technology and even power the clean energy solutions being used to enable a sustainable future, like solar or wind farms. No single country has end-to-end dominance over the production and supply segments that result in finished semiconductor chips, therefore an interruption to the semiconductor supply chain would be costly. The 2011 Thai floods, which forced evacuations and manufacturing plant closures in Thailand’s industrial corridor, and the COVID-19 pandemic are both indicators of the vast ripple effects supply chain disruption can have on the semiconductor sector, such as supply shortages and price inflation of the end product. A shift towards geographically diversifying semiconductor manufacturing bases could be a factor in the sector’s resilience to geopolitical conflict in future.

You can find out more about more supply chain challenges currently facing the semiconductor industry and recommendations on how the insurance industry can more effectively collaborate with semiconductor firms to better support the industry in our 2023 report. Loose Connections: Rethinking semiconductor supply chains

Healthcare

Supply chain interruptions could hinder access to critical medical equipment reliant on global supply chains, such as insulin pumps, blood pressure monitors, MRI, and CT scanners, with around 50% of all medical devices containing semiconductors8. Increased costs and reduced confidence could stall investment in large projects and new equipment, potentially making countries more vulnerable in the event of future infectious disease outbreaks.

Transportation

Conflicts can impact the movement of goods themselves as ships and potentially airfreight are prevented from travelling through the conflict zone. No-fly zones and sanctions may also prevent the movement of goods and people, and cause transport companies to lose revenue or close altogether. Sanctions can also provoke hostile retaliations. In 2022, western sanctions imposed on Russia required leasing companies to repossess all leased planes, prompting Russia to seize $12 billion worth of aircraft. 9

[7] https://supplychaindigital.com/supply-chain-risk-management/raw-material-shortage-hits-european-businesses-says-inverto

[8] https://blogs.deloitte.co.uk/health/2022/07/how-is-the-semiconductor-shortage-affecting-medtech.html

[9] https://www.businessinsider.com/12-billion-worth-leased-aircraft-stranded-in-russia-ukraine-sanctions-2022-3

How can risk owners respond?

The COVID-19 pandemic (exacerbated by acute disruptions such as Suez Canal obstruction by Ever Given and Brexit), and currently the war in Ukraine are the closest the world has come to a global supply chain crisis similar to that which might happen if there were a widespread geopolitical conflict, as explored in our scenario. They have revealed to organisations and governments just how exposed they could be if their supply chains and access to vital resources are significantly disrupted for any length of time. There are steps that can help insulate organisations from the impacts of geopolitical conflict:

Data collection: Understanding the flow of goods in individual supply chains, how customers react, and how third parties impact your own supply chain is a good way to understand where potential weaknesses – or opportunities – lie.

Contingency planning: By understanding the data, it is possible to put plans in place to mitigate supply chain issues. Approaches such as broadening the range of suppliers, finding alternative locations for manufacturing and operations, and developing a system of redundancy could all help maintain business continuity in a crisis. Building strategic stockpiles where reasonable may also help mitigate the fallout from a breakdown in the ‘just in time’ supply chain.

Act responsibly: Global companies with teams in local hubs have a responsibility to support their staff, and to an extent the wider community, in the event of disruption. Protocols should be in place to evacuate or cease operations, as deemed necessary, in the event of unrest or geopolitical conflict.

Digital network resilience: Certain physical and digital redundancies built into internet infrastructure already help to prevent widespread shutdowns and allow relatively quick recovery, but it is important to proactively build resilience too. A regular regiment of offline or external backup processes can keep most information secure and relatively up to date, similarly contingency and business recovery plans allow companies to find ways to carry out their operations while still offline, for example through another network server. Large institutions may wish to consider maintaining a private internet service provider that is less likely to rely on more mainstream internet service providers (ISPs) and is more likely to be immune to a targeted attack.

Download the key insights

We have consolidated the insight and key financial data from this scenario in a summary takeaway document.

Explore the impact of geopolitical conflict

The role of insurance

Disclaimer

This report has been produced by Lloyd's Futureset and Cambridge Centre for Risk Studies for general information purposes only.

While care has been taken in gathering the data and preparing the report Lloyd's and Cambridge Centre for Risk Studies do not, severally or jointly, make any representations or warranties on behalf of themselves or others as to its accuracy or completeness and expressly exclude to the maximum extent permitted by law all those that might otherwise be implied.

Lloyd's and Cambridge Centre for Risk Studies accept no responsibility or liability for any loss or damage of any nature occasioned to any person as a result of acting or refraining from acting as a result of, or in reliance on, any statement, fact, figure or expression of opinion or belief contained in this report. This report does not constitute advice of any kind.

Note that this report does not seek to replace or inform any of the mandatory scenarios which Lloyd’s publishes to support the Realistic Disaster Scenario exercises managing agents are required to undertake in respect of the syndicates managed by them.