Independent Expert

The Independent Expert

Mr Carmine Papa of PKF Littlejohn LLP has been appointed by Lloyd’s as an Independent Expert. His appointment has been approved by the Prudential Regulation Authority (“PRA”) in the UK, in consultation with the Financial Conduct Authority (“FCA”). His role is to consider the impacts of the transfer on all policyholders. He has written a report of his considerations and findings for the Court to consider.

Mr Papa’s principal conclusion is that no policyholder will be adversely affected by the transfer.

Profile

Carmine Papa, is a Partner of PKF Littlejohn LLP and a Fellow of the Institute of Chartered Accountants in England and Wales. He has been involved with the Lloyd’s insurance market in a number of capacities for the last 35 years, including assessment of the Lloyd’s Syndicates insurance liabilities and assessing the quality of the actuarial projections to assess those liabilities.

He has been appointed by Lloyd’s to act as the Independent Expert in connection with this transfer. His appointment has been approved by the PRA in consultation with the FCA. He has no financial interest in the Corporation of Lloyd’s or Lloyd’s Insurance Company S.A. (“Lloyd’s Brussels”)

PKF Littlejohn LLP currently acts as auditors and professional advisers to a number of Syndicates. Currently the Independent Expert does not have direct involvement with Syndicate audits nor does he currently advise Syndicates in a professional capacity. Neither PKF Littlejohn LLP nor the Independent Expert have acted for the Corporation of Lloyd’s for at least the last 10 years and have never acted for Lloyd’s Europe in any capacity.

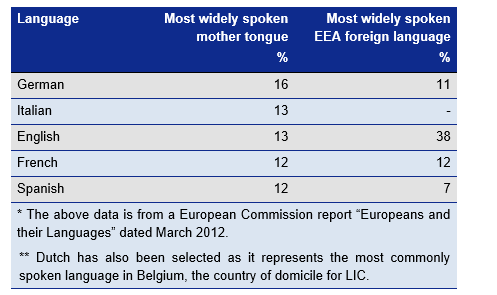

The Independent Expert’s report can be accessed via the Document Library. Due to its technical content his full report is only available in English. A summary of his full report is available in French, Spanish Italian, German and Dutch.

Independent Expert Report

Download full report

The Independent Expert’s full report can be accessed below as a pdf download. For ease of reference, the full report is also available to view in the drop down boxes below, chapter by chapter.

Visit document library

A useful summary of the full report can be accessed in the document library

Chapter 1: Introduction

1.1.1 On 23 June 2016, a majority of the people who voted in the European Union (EU) referendum voted for the UK to leave the EU. Following this vote, on 29 March 2017 the UK Government informed the Council of the European Union that it intended to leave the EU under Article 50 of the Lisbon Treaty. The original withdrawal date was to be 29 March 2019, but this date has been extended and on 24 January 2020 the UK and the EU signed an agreement (Withdrawal Agreement) which took the UK out of the EU with effect from 31 January 2020. The Withdrawal Agreement has a transition period which ends on 31 December 2020.

1.1.2 Following the transition period, absent any agreement otherwise, UK domiciled insurance entities (including Members at Lloyd’s) will no longer be able to underwrite and service insurance contracts already written, throughout the European Economic Area (EEA) using their current Freedom of Services and/or Freedom of Establishment Permissions.

1.1.3 Servicing of insurance contracts will include the settlement of claims currently notified, or notified in the future, attaching to Lloyd’s policies written between 1993 and 2020 where the Policyholder is located in the EEA and/or where all or part of the Policy relates to EEA risks.

1.1.4 Policies written prior to 1 January 1993 were transferred to Equitas Insurance Limited under a previous transfer under Part VII of the UK Financial Services and Markets Act 2000 (FSMA) and so do not form part of this transfer.

1.1.5 As a result of the above changes post the transition period, and subject to any new transitional measures agreed between the UK and the EEA, the Members of Lloyd’s acting through their Syndicates, will no longer be able to service policies which fall within the jurisdiction of the EEA regulators without breaching legal or regulatory authorisation requirements in the EU (ignoring any temporary domestic permissions regimes). In particular, following the loss of passporting rights, the payment of claims to policyholders and other activities in respect of the Transferring Policies may be subject to regulatory or criminal sanctions.

1.1.6 Certain EEA member states have announced that they will apply a temporary national run off regime for policies of UK based insurers following Brexit (Temporary Run Off Regime). Such measures would mean that Transferring Policies subject to a Temporary Run Off Regime would not immediately need to be transferred under the Scheme. However, notwithstanding the operation of these Temporary Run Off Regimes, Lloyd’s has decided to transfer all policies that would otherwise fall within the scope of a Temporary Run Off Regime on the basis that such an approach provides a more certain and permanent solution to Brexit.

1.1.7 In my opinion, unravelling parts of the Scheme to take account of the Temporary Run Off Regimes would result in significant impracticality for Lloyd’s and its Members and further uncertainty for policyholders (not least because of the differing approaches and time periods to such temporary regimes across EEA member states). This would leave open the risk that a further transfer would be required at a later stage to sweep up any residual policies which are no longer protected by a Temporary Run Off Regime. In my view there can be no certainty that any Temporary Run Off Regime will be sufficiently adequate and enduring to protect policyholders on a long term basis.

1.1.8 Lloyd’s has, therefore, decided to transfer those policies (or parts of policies) which fall within the definition of “Transferring Policy” to Lloyd’s Insurance Company SA (LIC). LIC is a public limited insurance company registered in Belgium and regulated by the Banque Nationale de Belgique (NBB) and the Financial Services and Markets Authority (Belgian FSMA) (responsible for the equitable treatment of financial consumers and the integrity of the financial markets) to write certain classes of insurance business. Details of how the proposed Part VII transfer will operate are summarised in Section 4.

1.2.1 Any proposed transfer of insurance business from a UK entity to another entity, whether resident in the UK or elsewhere, has to be sanctioned by the High Court of England and Wales (Court) pursuant to Part VII of FSMA. Section 109 of FSMA requires a report to be prepared for the Court by an expert (the Independent Expert) to aid it in its deliberation. The purpose of this report is also to inform the Prudential Regulation Authority (PRA), the Financial Conduct Authority (FCA) and Lloyd’s Policyholders (including third party claimants against those Policyholders) of the impact of the proposed transfer on the security and service levels of both transferring and non-Transferring Policyholders.

1.2.2 This report has been prepared under Section 109 of the FSMA in a form approved by the PRA in consultation with the FCA. The report has been prepared in accordance with PRA guidance on Expert Reports published on 26 July 2018 and the FCA’s approach to the review of Part VII insurance business transfers published on 29 May 2018. This report also complies with applicable rules on expert evidence and SUP18 of the FCA Handbook. Should other parties choose to rely in any way on the contents of this report, then they do so entirely at their own risk.

1.2.3 To the fullest extent permitted by law, PKF Littlejohn LLP and I will accept no responsibility or liability in respect of this report to any other party, other than as set out in my firm’s engagement letter. This report is also subject to the terms and limitations of liabilities set out in the above engagement letter. An extract of my engagement letter which sets out the scope of my work is contained in Appendix 2.

1.3.1 This report covers the proposed Part VII transfer of certain insurance business of certain Members, former Members and estates of former Members at Lloyd’s for any of the 1993 to 2020 years of account in respect of current and potential insurance liabilities attaching to policies, or parts thereof, written by those Members which, immediately after the transition end date, require an authorised EEA insurer to carry out or service such a Policy (or part thereof) in order to ensure no legal or regulatory insurance authorisation requirements in the EEA are breached.

1.3.2 Included in this Scheme will be certain EEA risks which do not require an authorised EEA insurer to administer these policies following the transition end date.

- a number of Coverholders were not able to set up the required procedures by 31 December 2018 and Lloyd’s granted an extension to certain Managing Agents to allow about 300 Coverholders to continue to write EEA business, the last extension expiring on 12 April 2019;

- as a result, Xchanging continued to accept EEA business under a Lloyd’s Syndicate stamp up to 12 April 2019;

- certain in-scope inwards reinsurance business, but only where the cedant is domiciled in Germany, will continue to be written by Members in 2020.

1.3.4 The Part VII transfer does not cover the assets and liabilities, or potential liabilities, attaching to the following:

- policies that are Long-Term Insurance Contracts (life policies)

- Non-EEA Policies (as defined in the Scheme Document)

- policies not capable of being transferred pursuant to Section 111 of FSMA (if any)

- a policy, or part thereof, which would otherwise fall within the definition of an EEA Policy, but which was written subject to the Lloyd’s licence in Australia, Canada, Hong Kong, Singapore, South Africa and/or Switzerland (the Excluded Jurisdiction Policies)

- any Non-Insurance Liabilities of the Members arising in connection with the Part VII transfer, such as Conduct Liabilities or Tax liabilities.

Excluded Non-Insurance Liabilities include, amongst others, the following:

- Liabilities of Members not arising in connection with the Transferring Business.

- Liabilities/obligations arising in connection with the sale, management or conduct of the Transferring Policies prior to the date of transfer including mis-selling liabilities, losses and obligations arising from:

-

- complaints, claims, legal action or settlements

- failure by Members to comply with applicable law/regulations or industry practise

- penalty fines levied as a result of any judgement or arbitration in respect of the above.

- Legal costs in investigating and defending the above.

- Tax liabilities arising, or relating to the period, prior to the date of transfer arising in connection with the Transferring Business.

1.3.5 For clarification purposes, the proposed Part VII transfer is intended to cover the following policies (or parts thereof), if not excluded under the above paragraph:

- direct insurance policies written which relate to EEA situs risks or have been issued to Policyholders resident in the EEA

- multi-jurisdiction direct insurance policies which have been issued to Policyholders resident in the EEA or part of the risk situs is within the EEA. Only the EEA part of the Policy is subject to the Part VII transfer

- inward reinsurance policies written where the cedant is domiciled in Germany.

1.3.6 In summary, policies which will transfer under the Scheme are:

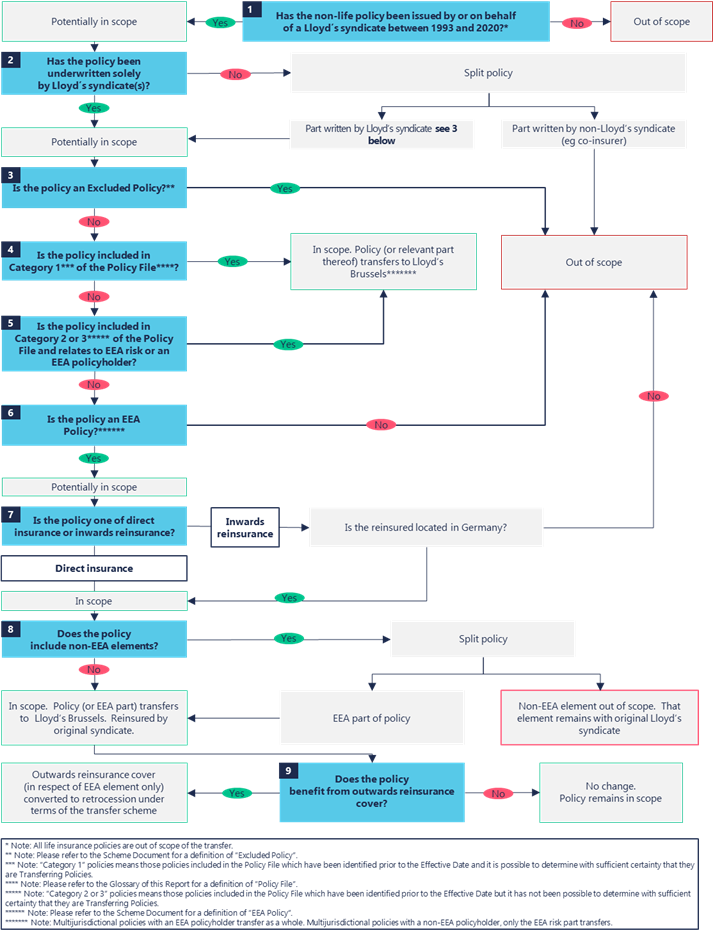

- (a) policies (or parts thereof) identified as at the Effective Date which are not Excluded Policies and fall into one of the following categories:

- Category 1: policies which have been identified as having a risk situated in the EEA and/or a policyholder resident in the EEA;

- Category 2: policies which have been identified as being multijurisdictional policies which may have EEA risk elements and the policyholder is either unknown or a non-EEA resident and it has not been possible to determine with sufficient certainty that they are Transferring Policies. Such policy will be a Transferring Policy if it is determined (at the point when sufficient information is available) that the policy relates to a risk situated in the EEA or was issued to a policyholder resident in the EEA;

- Category 3: policies which have been identified but Lloyd’s has not yet determined whether or not the policy covers a risk situated in the EEA and/or is issued to or is held by a policyholder resident in the EEA and it has not been possible to determine with sufficient certainty that they are Transferring Policies. Such policy will be a Transferring Policy if it is determined (at the point when sufficient information is available) that the policy relates to a risk situated in the EEA or was issued to a policyholder resident in the EEA

- (b) policies (or parts thereof) which are not identified as falling within the above categories and which immediately after the Transition End Date will require an insurer authorised by an EEA regulator to carry out or service such policy in order to ensure no legal or regulatory insurance authorisation requirements in the EEA are breached and are not Excluded Policies.

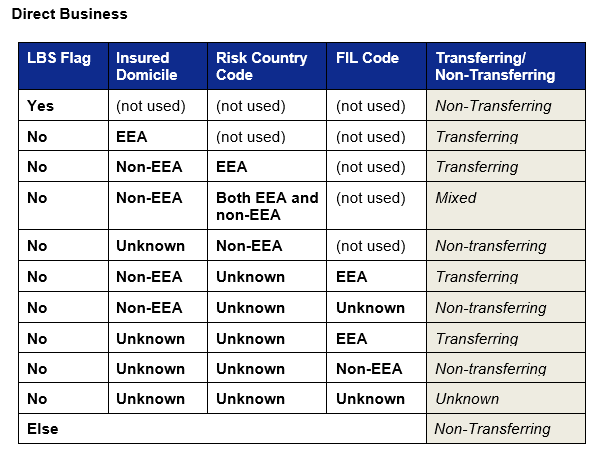

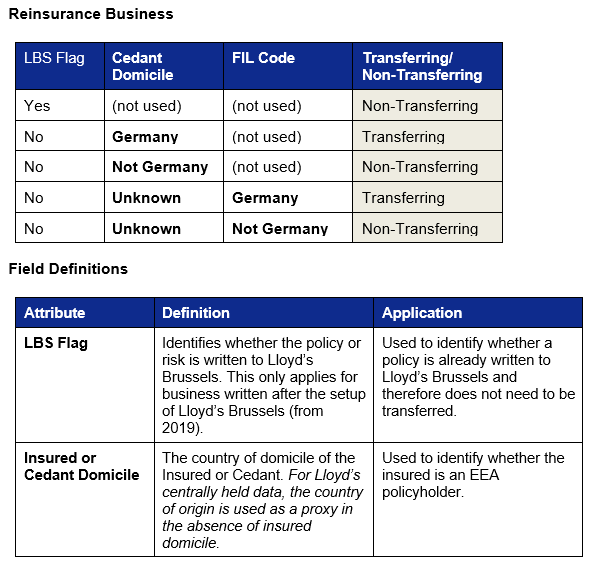

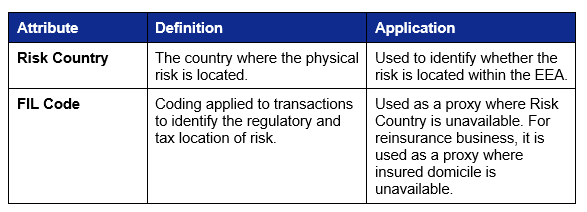

1.3.7 An overview schematic of the policies in-scope of the proposed Lloyd’s Part VII transfer is set out below.

1.4.1 I, Carmine Papa, am a Partner of PKF Littlejohn LLP and a Fellow of the Institute of Chartered Accountants in England and Wales. My detailed curriculum vitae is included in Appendix 3.

1.4.2 I have been appointed by Lloyd’s to act as the Independent Expert in connection with this transfer. My appointment has been approved by the PRA in consultation with the FCA. My fees will be met by Lloyd’s directly and I have no financial interest in Lloyd’s or LIC.

1.4.3 I have been involved with the Lloyd’s insurance market in a number of capacities for the last 35 years, including assessment of the Lloyd’s Syndicates insurance liabilities and assessing the quality of the actuarial projections to assess those liabilities.

1.4.4 My firm, PKF Littlejohn LLP, currently acts as auditors and professional advisers to a number of Syndicates. Currently I have no direct involvement with Syndicate audits nor do I currently advise Syndicates in a professional capacity. My firm’s fees for those Syndicates we currently act for as Syndicate auditors and professional advisers represents less than 2% of PKF Littlejohn LLP’s total fees for our last financial year. Neither PKF Littlejohn LLP nor I have acted for Lloyd’s for at least the last 10 years and we have never acted for LIC in any capacity.

1.4.5 I have no reasons to believe that my independence is impaired as a result of any matter set out above.

1.4.6 In preparing this report I have been assisted by my team, however, any review or analysis from my team has been carried out under my supervision. Further, where appropriate, I have taken my own independent legal and actuarial advice. The report has been written in the first party singular and the opinions expressed therein are my own.

1.4.7 I have not independently verified the data and information provided to me by Lloyd’s, or by any other parties, accordingly my work does not constitute an audit of the financial and other information. Where I believe it was appropriate, and as indicated in this report, I have applied certain review procedures to satisfy myself that the information provided is reasonable and consistent based on my experience and knowledge of the Lloyd’s and wider insurance market. I have also met in person, or conducted telephone conference calls, with representatives of Lloyd’s, LIC and their professional and legal advisers.

1.4.8 I confirm that I have made clear which facts and matters referred to in this report are within my own knowledge and which are not. Those that are within my own knowledge I confirm to be true. The opinions I have expressed represent my true and complete professional opinions on the matters to which they refer.

1.4.9 Representation letters have been provided to me from officers of both Lloyd’s and LIC (see Appendix 4) in respect of matters which could not be verified by other means. All information I have requested has been made available to me by both Lloyd’s and LIC, provided such information was in their possession.

1.4.10 In coming to the opinions I have expressed in this report, I have taken the following approach:

- obtaining an understanding of the potential effect of Brexit on the insurance industry and, in particular, on how it may impact on future passporting arrangements

- gaining an understanding of how Lloyd’s and LIC operate within Lloyd’s and the wider insurance market

- obtaining an understanding of how the regulatory and solvency requirements are applied to both the Lloyd’s market in the UK and to LIC under Belgium regulations

- identifying the group of Policyholders who may be impacted by the proposed Part VII transfer

- obtaining an understanding on how the proposed transfer will impact financially and non-financially on affected Policyholder groups

- considering the reasonableness of any assumptions made by Lloyd’s and LIC in order to assess the impact of the proposed approach

- I have conducted certain review procedures and stress testing, as I believe to be appropriate, to satisfy myself of the veracity of my opinion.

1.4.11 Throughout this report I make reference to financial items or events which have no material adverse effect. I consider an event or outcome to not have a material adverse effect if, in my opinion, the expected impact of the event is very small, such that it would not influence the decisions of a reader either on its own or in conjunction with other similar defined events. In assessing whether an event impact is very small, I have considered the following:

- the very low probability of the event occurring

- a very low financial impact of the event

- a combination of the two matters above.

Similarly, I consider an event to have low probability if, in my opinion, the chance of it occurring is so small that it would not influence the decisions of a reader of this report. I consider an event to be unlikely if it has a low probability of occurring.

1.4.12 Throughout this report sections highlighted in bold reflect my opinion on the subject matter. Definitions for capitalised terms may be found in the Glossary.

1.4.13 In reporting to the Court on the proposed transfer, my overriding duty is to the Court.

1.4.14 I confirm that I am aware of the requirements of Part 35 of the Civil Procedure Rules, Practice Direction 35 and the Protocol for Instruction of Experts to give Evidence in Civil Claims.

1.5.1 This report must be read in its entirety. Reading individual sections in isolation may be misleading. I will publish a supplementary report confirming (or not) my findings prior to the final Court hearing planned to be heard in October 2020.

1.5.2 Section 2 includes my executive summary which summarises the key points of the proposed Part VII transfer and my conclusions on those points.

1.5.3 The remaining sections of the report deal with the following matters:

Section 3 An overview on how the Lloyd’s market operates.

Section 4 A brief description of the structure of the proposed Part VII transfer and my opinion and conclusion on its key terms and risks.

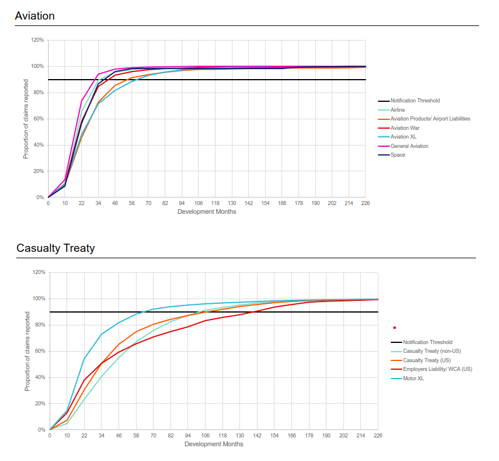

Section 5 The actuarial projections of the liabilities attaching to the Transferring Policies.

Section 6 The impact of the proposed Part VII transfer on non-Transferring Policyholders, including the impact on Lloyd’s solvency capital and my conclusion thereon.

Section 7 The impact of the proposed Part VII transfer on Transferring Policyholders, including the impact on LIC’s solvency capital and the details of the operational procedures planned to be put in place by LIC following the transfer and my conclusion thereon. This section also deals with the impact on LIC’s current policyholders.

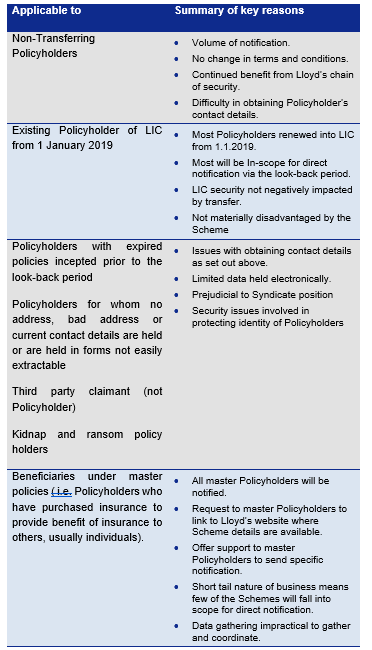

Section 8 Details of Lloyd’s Policyholders notification strategy, including the waivers to be sought from the Court and my conclusion thereon.

Section 9 Other matters not covered by the above sections, including COVID-19.

Chapter 2: Executive summary

2.1.1 On 23 June 2016, a majority of the people who voted in the European Union (EU) referendum voted for the UK to leave the EU. Following this vote, on 24 January 2020 the UK and the EU signed an agreement (Withdrawal Agreement) which took the UK out of the EU with effect from 31 January 2020. The Withdrawal Agreement has a transition period which ends on 31 December 2020.

2.1.2 Following the transition period, absent any agreement otherwise, UK domiciled insurance entities (including Members at Lloyd’s) will no longer be able to underwrite and service insurance contracts already written, throughout the European Economic Area (EEA) using their current Freedom of Services and/or Freedom of Establishment Permissions without breaching legal or regulatory authorisation requirements in the EU (ignoring any temporary domestic permissions regimes).

2.1.3 Servicing of insurance contracts will include the settlement of claims currently notified, or notified in the future, attaching to Lloyd’s policies written between 1993 and 2020 where the Policyholder is located in the EEA and/or where all or part of the Policy relates to EEA risks.

2.1.4 Lloyd’s has, therefore, decided to transfer certain policies (or parts of policies) which fall within the definition of “Transferring Policy” to Lloyd’s Insurance Company SA (LIC) a wholly owned subsidiary of Lloyd’s. LIC is a public limited insurance company registered in Belgium and regulated by the Banque Nationale de Belgique (NBB) and the Financial Services and Markets Authority (Belgian FSMA).

2.1.5 Lloyd’s has considered alternatives to the proposed Part VII transfer including taking advantage of Temporary Run Off Regimes that certain EEA member states have announced will apply. Such measures would mean that Transferring Policies subject to a Temporary Run Off Regime would not immediately need to be transferred under the Scheme. However, unravelling parts of the Scheme to take account of the Temporary Run Off Regimes would result in significant impracticality for Lloyd’s and its Members and further uncertainty for policyholders, especially given the non-uniform manner in which Temporary Run Off Regimes have been set up across EEA member states and their limited time duration.

2.2.1 Lloyd’s is a society incorporated as a statutory corporation by the Lloyd’s Act 1871. Lloyd’s does not underwrite risks on its own behalf. Lloyd’s is a market, run by the Council of Lloyd’s, where Members acting through insurance Syndicates, arrange insurance for their customers. A Lloyd’s Syndicate is made up of a group of underwriters (Members) who can be individuals, partnerships or corporate entities which put up the underwriting capital against their share of the insurance risk accepted and are liable for any subsequent profit or loss.

2.2.2 The operations of a syndicate are managed by a Managing Agent, an independently owned company set up to manage the Syndicate on behalf of the Members of that Syndicate. Managing Agents may manage the affairs of more than one Syndicate.

2.2.3 Lloyd’s Syndicates have no separate legal personality and, therefore, it is the Members themselves who underwrite risk and remain liable for business written by the Syndicate.

2.2.4 Members join a Syndicate only for a calendar year with the Syndicate accepting risks incepting in that calendar year only. Thereafter, if a member wishes to continue to underwrite they must join the subsequent calendar year of that, or another, Syndicate.

2.2.5 Lloyd’s is responsible for the oversight of the market in which syndicates and other entities operate within.

2.2.6 When a Syndicate accepts a risk from a Policyholder, each member of the Syndicate for that particular underwriting year is legally liable for their share of any claims which attach to those policies. Members are only liable for their share of the risk and have no liability for other Members’ share of the risk.

2.2.7 The capital structure which provides security to Policyholders of the Lloyd’s market is unique in the global insurance market.

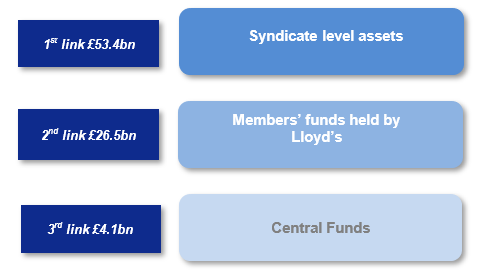

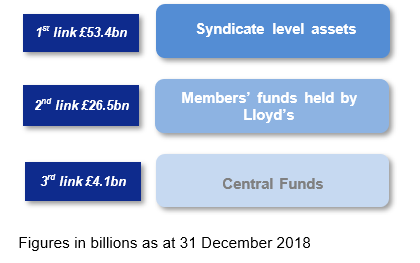

2.2.8 There are three links to this security:

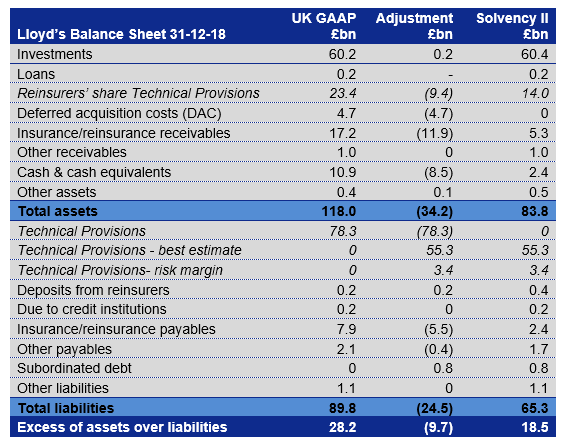

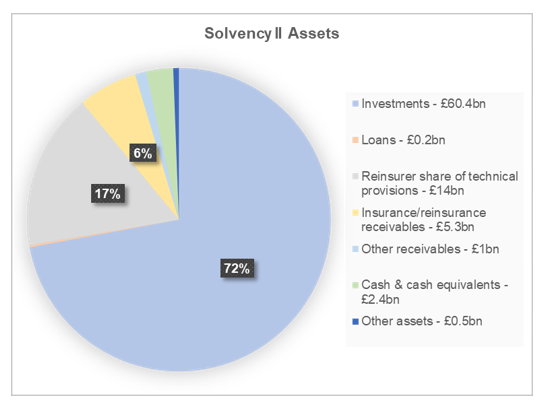

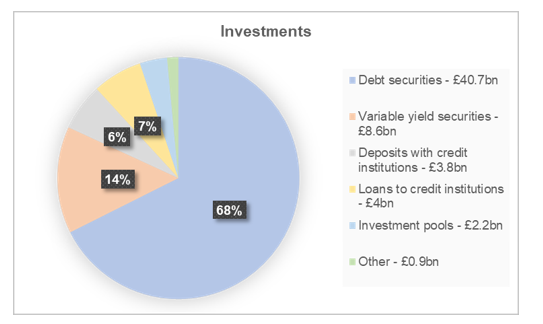

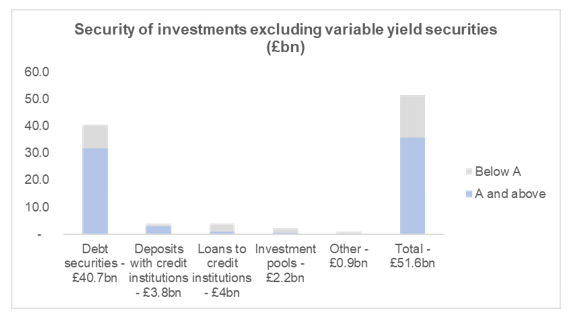

- Figures in billions as at 31 December 2018

2.2.9 The first two links are held in trust primarily for the benefit of Policyholders. They can only be used to settle a Member’s liability for policies either directly written by that member or reinsured by the Reinsurance to Close process. A Member’s assets are only at risk for policies written on their own account and are not available to settle other Members’ losses.

2.2.10 The third link contains mutual assets held by Lloyd’s which are available, subject to the Council of Lloyd’s approval, to meet any Members’ liabilities, which cannot be met out of the Members own funds.

2.3.1 LIC was authorised to write new insurance business from 1 January 2019. LIC has an insurance and reinsurance license at the NBB for all of the non-life classes of business that will be transferred to it under the proposed Part VII transfer.

2.3.2 LIC is a vehicle which was established by Lloyd’s to allow EEA policyholders continued access to Lloyd’s market expertise in a manner compliant with EU regulation post Brexit.

2.3.3 LIC reinsures 100% of the insurance business it underwrites with Syndicates in the Lloyd’s market under current reinsurance agreements. Each insurance risk is reinsured with the same Syndicate managed by the Managing Agent that has bound the insurance risk on behalf of LIC. An outsourcing agreement, by which underwriting services (and other activities) are provided by a Managing Agent as a service provider to LIC, has been entered into between LIC and each Managing Agent.

2.3.4 Each year Managing Agents wishing to reinsure EEA business must propose a business plan to LIC. These plans are reviewed and approved by LIC’s Chief Underwriting Officer and Underwriting Committee and the business plan considered and adopted by the LIC Board. Under the current reinsurance agreements with Lloyd’s Syndicates, LIC is entitled to a commission calculated by applying a percentage to the gross written premium receivable by LIC.

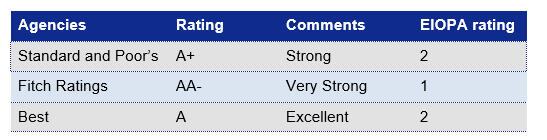

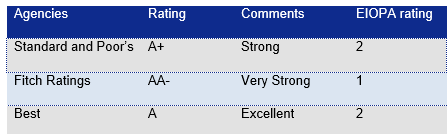

2.3.5 LIC has been given the same ratings as those for the Lloyd’s market in the UK as Lloyd’s Syndicates reinsure 100% of the risks underwritten through LIC. These ratings are AM Best (A Excellent), Standard & Poor’s (A+ Strong) and Fitch Ratings (AA- Very Strong).

2.4.1 The scheme covers the proposed Part VII transfer of certain insurance business of certain Members, former Members and estates of former Members at Lloyd’s for any of the 1993 to 2020 years of account in respect of current and potential insurance liabilities attaching to policies, or parts thereof, written by those Members which, immediately after the transition end date, require an authorised EEA insurer to carry out or service such a Policy (or part thereof) in order to ensure no legal or regulatory insurance authorisation requirements in the EEA are breached.

2.4.2 Details of how the Scheme will operate are as follows:

- Each Transferring Policy will be transferred from the current Lloyd’s Syndicates to LIC.

- Liabilities (other than Excluded Liabilities) attaching to the Transferring Policies will be transferred and become a liability of LIC. Accordingly, these liabilities will cease to be a direct liability of the Syndicate Members.

- All rights, benefits, powers and obligations of the Members exercised through the Syndicate, in connection with the Transferring Business, will also transfer to LIC.

- Any Transferring Policyholder will have rights against LIC instead of the member(s) of the Syndicate; LIC will effectively step into the shoes of the Members.

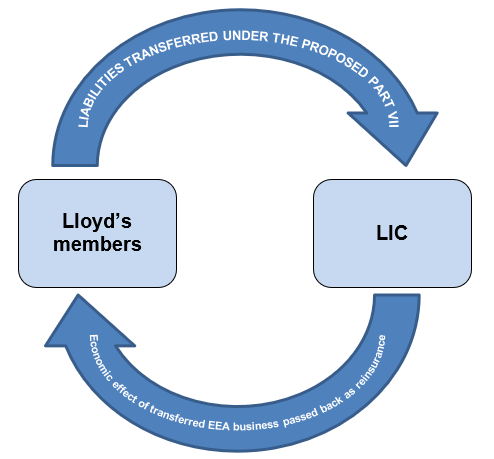

2.4.3 Prior to the Effective Date of the Scheme, LIC and in each case, the Members of each relevant Syndicate will enter into 100% quota share reinsurance contract agreements to cover the business transferred to LIC (together, referred to as the QS Reinsurance Contracts). When the QS Reinsurance Contracts become effective the insurance liabilities under the Transferring Policies transferred to LIC, by the proposed Part VII Scheme, will be fully reinsured back to the Members of the same Syndicate, that originally underwrote the policy.

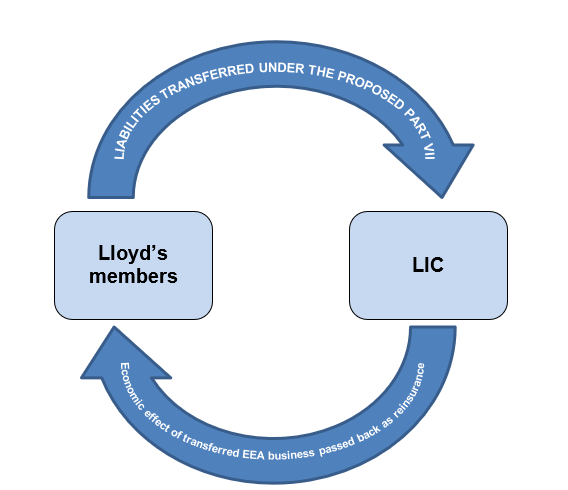

2.4.4 As result of the QS Reinsurance Contract, economically the liabilities attaching to the Transferring Policies will, in my opinion, continue to rest with those Members who originally underwrote those policies, or subsequently assumed those liabilities through the Reinsurance to Close process. I have represented this schematically as follows:

2.4.5 Each Syndicate on behalf of its Members has purchased different reinsurance programmes (Outward Reinsurance) to protect the business the syndicate writes. These policies will therefore cover some of the liabilities attaching to the Transferring Policies. These Outward Reinsurance programmes will vary annually both in coverage and in reinsurer participation.

2.4.6 Under the proposed Scheme, the existing Syndicate Outwards Reinsurance Agreements will not be transferred with the Transferring Policies to LIC. Accordingly, Lloyd’s intend to seek Court approval to convert, as part of the terms of the Scheme, these existing Outwards Reinsurance Agreements to attach to all or any part of each Syndicate’s QS Reinsurance Contract with LIC. This effectively converts the existing Syndicate Outwards Reinsurance to retrocessional cover.

2.5.1 I have not independently verified the data and information provided to me by Lloyd’s, or by any other parties, accordingly my work does not constitute an audit of the financial and other information. Where I believe it was appropriate, I have applied certain review procedures to satisfy myself that the information provided is reasonable and consistent based on my experience and knowledge of the Lloyd’s and wider insurance market. I have also met in person, or conducted telephone conference calls, with representatives of Lloyd’s, LIC and their professional and legal advisers.

2.5.2 In coming to my opinions expressed in this report, I have taken the following approach:

- obtaining an understanding of the potential effect of Brexit on the insurance industry and, in particular, how it may impact on future passporting arrangements

- gaining an understanding of how Lloyd’s and LIC operate within Lloyd’s and the wider insurance market

- obtaining an understanding of how the regulatory and solvency requirements are applied to the Lloyd’s market in the UK and to LIC under Belgium regulations

- identifying the group of Policyholders who may be impacted by the proposed Part VII transfer

- obtaining an understanding on how the proposed Part VII transfer will impact financially and non-financially on affected Policyholder groups

- considering the reasonableness of any assumptions made by Lloyd’s and LIC in order to assess the impact of the proposed approach

- I have conducted certain review procedures and stress testing, as I believe to be appropriate, to satisfy myself of the veracity of my opinion.

2.5.3 In completing the above work my team, where appropriate, has complied with TAS 100: Principles for Technical Actuarial Work and TAS 200: Insurance as issued by the UK Financial Reporting Council. My team has also complied with the Institute and Faculty of Actuaries professional standards APS X1 and APS X2.

2.6.1 In my opinion, the key risks attaching to this proposed Part VII transfer are:

- The risk that the QS Reinsurance Contract will not fully reinsure the risk attaching to the Transferring Policies back to the applicable Lloyd’s Syndicate;

- The risk that Court does not have the power under the FSMA to convert the existing Syndicate Outward Reinsurance into retrocessional cover;

- The risk that for the Syndicate reinsurers, domiciled outside the UK, the court system in their country of domicile will not recognise the Court Order.

2.6.2 Based on the independent legal advice I have received, and my understanding of the willingness of all parties to rectify any future misunderstanding in the terms of the pro-forma QS Reinsurance Contract, I have concluded the failure of the QS Reinsurance Contract is not a material risk.

2.6.3 I have also obtained legal advice in relation to the scope of the Court’s powers under section 112 of FSMA including the power to convert the existing Syndicate outward reinsurance into retrocessional cover pursuant to the terms of the transfer Scheme. The advice I have received supports Lloyd’s and its own advisers view that the Court does have the power to make such a Court Order.

2.6.4 In my opinion, the effect of the proposed Court Order should mean that the same Outwards Reinsurance is in place for Members pre and post transfer and that all Policyholders, after the transfer, will benefit from the same ability of Members to make recoveries on their Outwards Reinsurance as is currently in place.

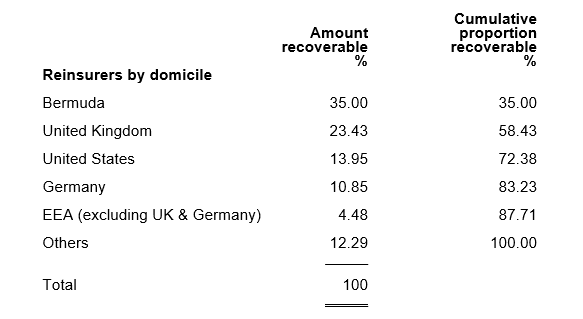

2.6.5 In order to assess the risk whether non-UK Courts are likely not to recognise the Court Order in respect of reinsurers not domiciled in the UK, Lloyd’s has taken advice, which I have relied on, from their legal representatives in the United States, Bermuda and Germany. These countries together with the UK represent approximately 83% of the Member Outward Reinsurance exposure.

2.6.6 Based on this legal advice, I have been able to conclude that the risk that a reinsurer in an overseas jurisdiction will succeed in challenging a Court Order, which converts the existing Syndicate Outwards Reinsurance to retrocessional cover, is not a material risk.

2.6.7 I have further concluded that, as the economic exposure of the Outwards Reinsurers to policies written by the Members remains the same pre and post Transfer and there will be no material adverse effect on the Outwards Reinsurers as a result of this proposed Part VII.

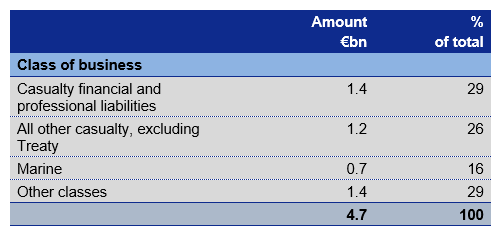

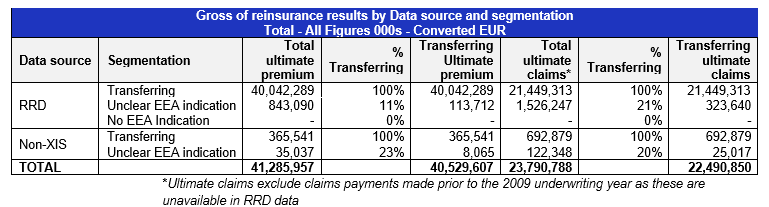

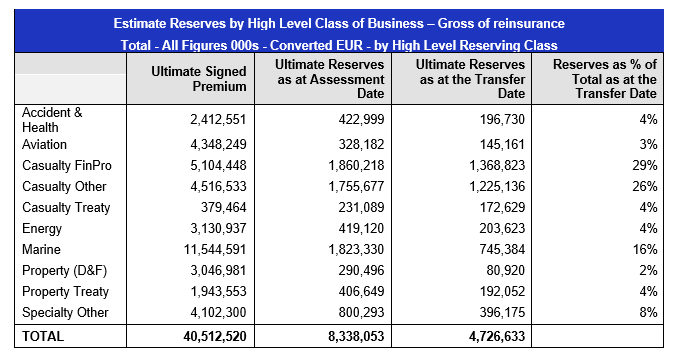

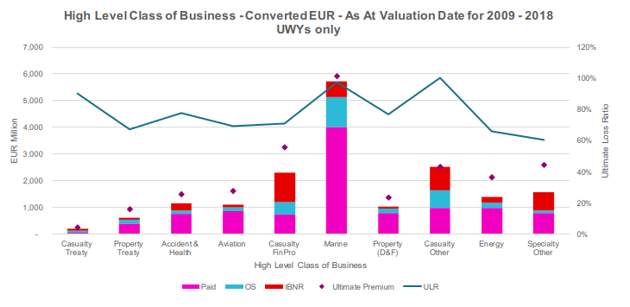

2.7.1 Lloyd’s has estimated that the total insurance liability which will transfer at the effective date of the scheme will be €4.7bn on an ultimate basis excluding ULAE. Most of these liabilities relate to three classes of business as follows:

Based on my work, I have been able to conclude that the above estimate reflects the current best estimate of the value of the liabilities attaching to the Transferring Policies at the time of the Effective Date.

2.7.2 Throughout this report as LIC’s solvency is determined in Euros and all amounts referred to are in Euros (unless otherwise stated). As at 31 December 2019 the rate used to convert Euros to Pounds Sterling was €1 = £0.85 or alternatively £1 = €1.18.

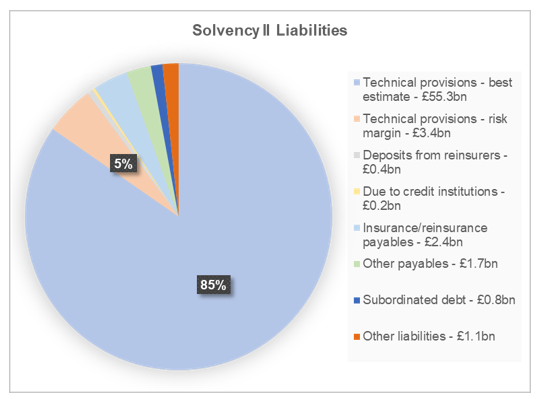

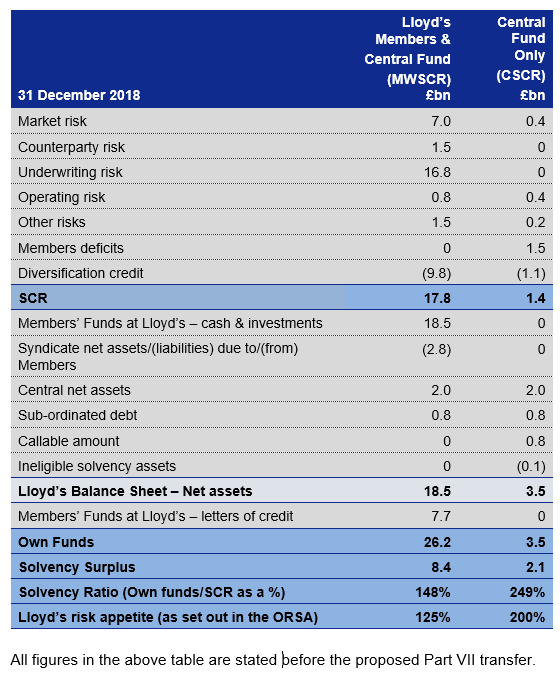

2.7.3 The Solvency Capital Requirements (SCR) is a measure of the regulatory capital requirement insurers are required to maintain by the appropriate Solvency II regulations and is an estimate of the capital required to ensure that an insurer is able to meet its obligations over the next 12 months. Given the uniqueness of the Lloyd’s market, Lloyd’s is required to calculate the two SCR’s as follows:

- The Market Wide SCR (“MWSCR”) – this includes all risks of Members of Lloyd’s across the market and can be covered by eligible funds from all three links in Lloyd’s chain of security, including those arising from Syndicate activities, Members’ funds at Lloyd’s and the Central Fund.

- The Lloyd’s Central SCR (“CSCR”) – this captures only risks faced by the Central Fund, in the event that Members fail to meet their liabilities even having complied with Lloyd’s capital setting rules. Only eligible capital available to Lloyd’s centrally may be used to cover the CSCR.

Eligible funds (both market level and centrally held) exclude any assets which are ringfenced for Lloyd’s overseas subsidiaries, including LIC.

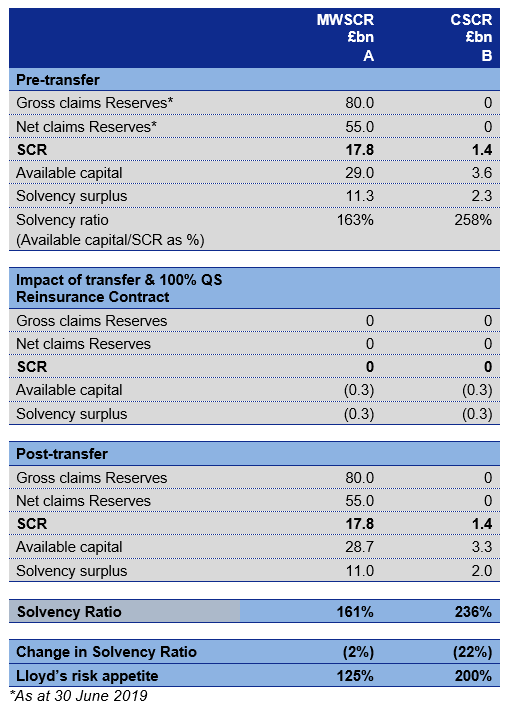

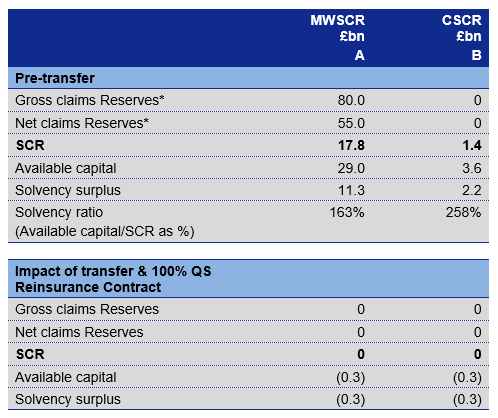

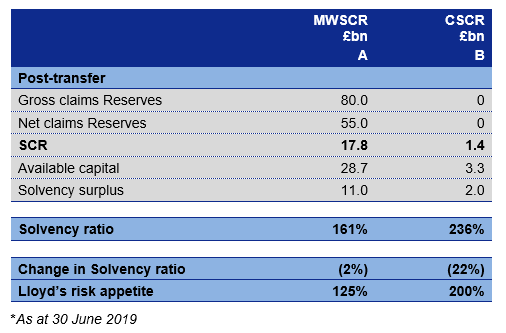

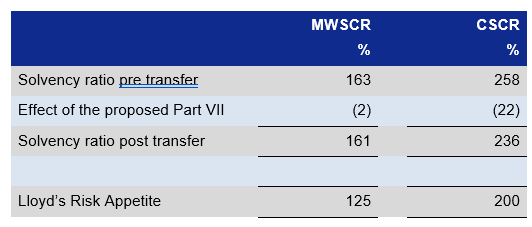

2.7.4 I have estimated the impact on both Lloyd’s MWSCR and CSCR Solvency Ratio’s as a result of the proposed Part VII transfer to be as follows:

2.7.5 There is no material impact on the gross or net claims Reserves in column A of the above table, as the gross liabilities attaching to the Transferring Policies are replaced on a like for like basis, with liabilities under the QS Reinsurance Contract with LIC.

2.7.6 Following the Part VII transfer there is a reduction in the Central Fund assets of £0.3bn due to funding the extra costs to be incurred by LIC arising as part of the transfer of the business and the capital injection required to enable LIC to meet its solvency requirements. This impacts the solvency ratios as follows:

- A 2% decrease in the MWSCR. However, the revised solvency ratio of 161% is still well above Lloyd’s risk appetite of 125%.

- A 22% decrease in the CSCR to 236%. Even after this reduction, the Central Fund solvency ratio is well above the Lloyd’s risk appetite of 200%.

2.7.7 Following the proposed Part VII transfer, I have concluded that the Lloyd’s and Members available capital to meet liabilities reduces by £0.3bn to £28.7bn (column A). However, this amount includes the surplus of Syndicate net assets and a surplus of Members’ funds at Lloyd’s, which at 31 December 2018 amounted to £23.4bn. This latter element cannot be used to pay the loss of one Member out of the assets of another Member. Therefore, the actual resources available to settle Policyholders claims are, in my opinion, significantly more restricted than the £28.7bn of available capital shown in paragraph 2.7.4.

2.7.8 Lloyd’s has stated in its Solvency and Financial Condition Report as at 31 December 2018 that all of the Members were solvent. However, I have concluded that if any future stresses to solvency fall unevenly across Members, then certain Members could become insolvent whilst other Members remain solvent but their assets cannot be used to meet the insolvent Members shortfall.

2.7.9 Lloyd’s seeks to protect against this by having in aggregate a 35% uplift of solvency assets for each Members above their individual SCR capital requirement. In addition, following the proposed Part VII transfer, Central Fund assets of £3.4bn, will still be available to meet Policyholders liabilities should individual members not have sufficient funds to do so.

2.7.10 The only change, in my opinion, impacting the Members as a result of this proposed Part VII transfer is that their liabilities to claims arising on the Transferring Policies will be replaced by an identical liability to LIC.

2.7.11 Individual Members of Lloyd’s underwrite on their own behalf and therefore whether a Policyholder’s valid claims are met will, in my opinion, primarily rest with the financial security of the individual Members. Only once a Member is unable to settle a valid claim will Lloyd’s, subject to their discretion, use the assets of the Central Fund to meet the Policyholder’s liabilities.

2.7.12 As a result of the proposed Part VII transfer and the Members entering into the proposed QS Reinsurance Contracts, the exposure of Members to Policyholder’s claims is, in my view, unchanged pre and post this proposed Part VII transfer. None of the Members current assets will be used to fund LIC, and therefore the security of Members funds to settle potential claims for non-Transferring Policyholders claims is not materially affected by this proposed Part VII transfer.

2.7.13 The non-Transferring Policyholders security will however, in my view, be impacted as €388m (£328m) of Central Fund assets will be used to fund the Solvency Capital Requirement of LIC and the additional running costs of LIC to process the transferred liabilities. These funds will no longer be available to settle non-Transferring Policyholders claims should the individual Members, not have the necessary funds to settle their claim.

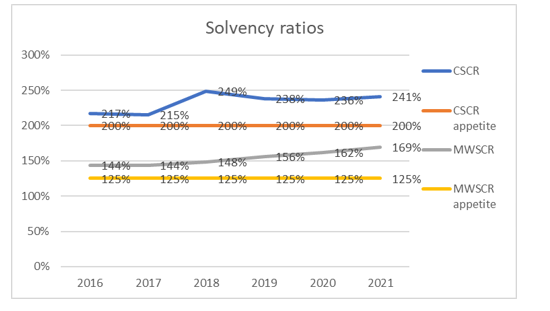

2.7.14 I have concluded that the MWSCR calculated by Lloyd’s is a measure of how robust the Members, in aggregate, could handle a substantial claim or series of claims which would otherwise require a substantial call on the assets of the Central Fund. The MWSCR Solvency Ratio, following the proposed Part VII transfer, remains well above the risk appetite set by Lloyd’s and therefore the security available for non-Transferring Policyholders following the proposed Part VII transfer will, in my opinion, continue to remain strong.

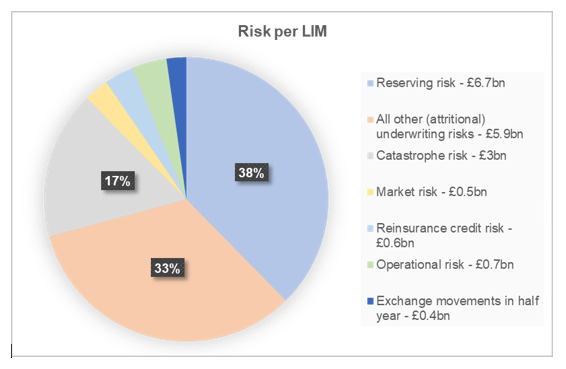

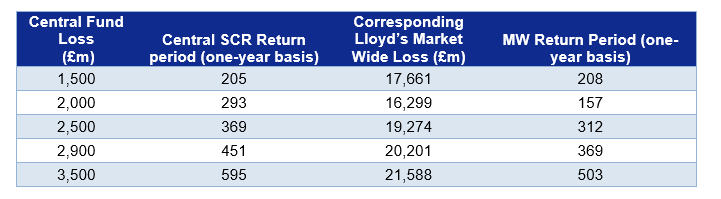

2.7.15 I have reviewed the process and procedures Lloyd’s has adopted to assess current and future risks and I am satisfied that the risk of a major cash call on the Central Fund is unlikely in the foreseeable future and would require a series of catastrophic events to occur in the same financial year. Lloyd’s has estimated that it would require a Lloyd’s market wide loss of £20.2bn which the internal model Lloyd’s uses to calculate it Solvency Capital Requirement (LIM) predicts to be a 1 in 450 year event to reduce the Central Fund assets by £2.9bn.

2.7.16 Accordingly, I have concluded that Policyholders whose risks are not being transferred to LIC will not suffer a material adverse effect as a result of the proposed Part VII transfer, as the Central Fund, subject to Lloyd’s discretion, will have sufficient funds to meet Policyholders’ claims (in the event of a Members default) for all reasonably foreseeable events.

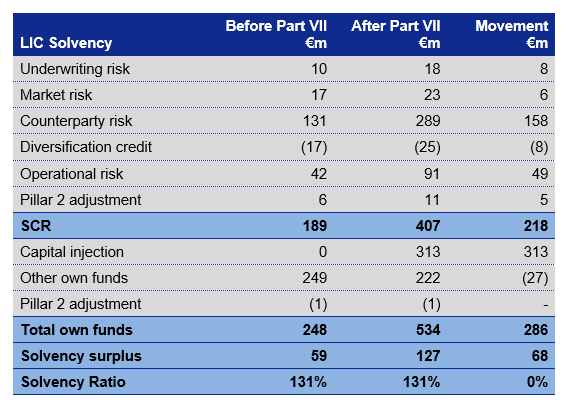

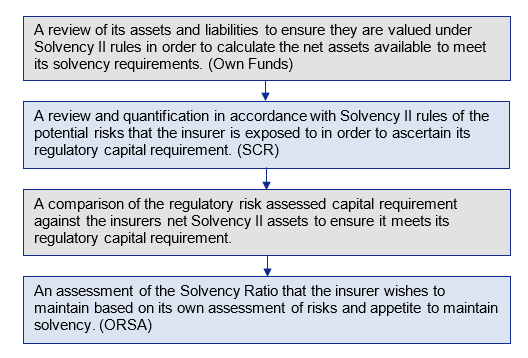

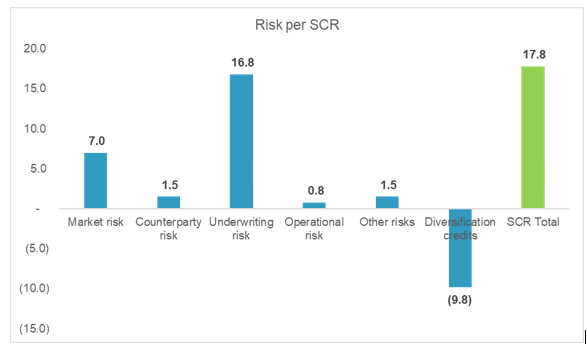

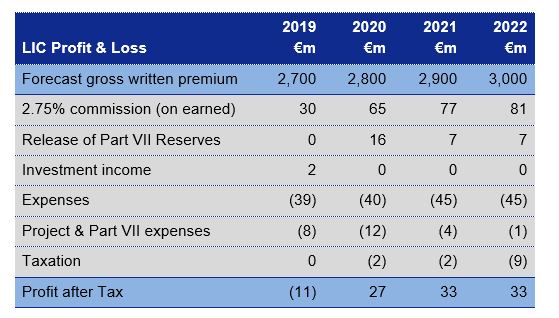

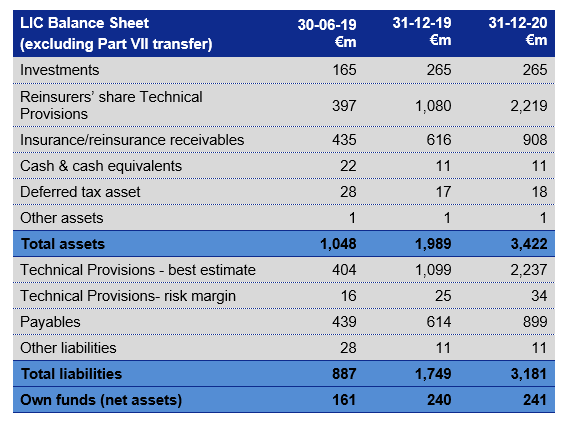

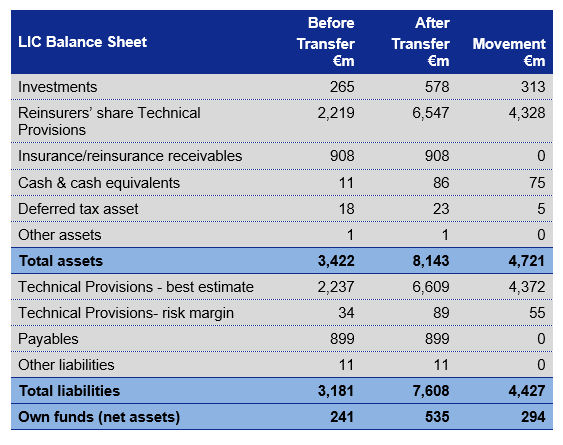

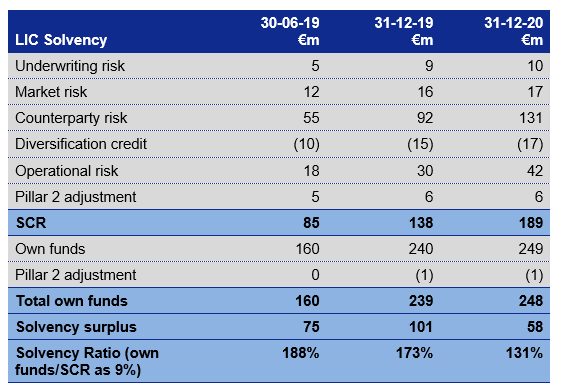

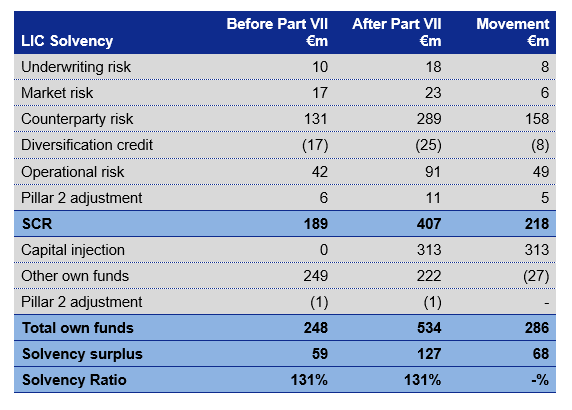

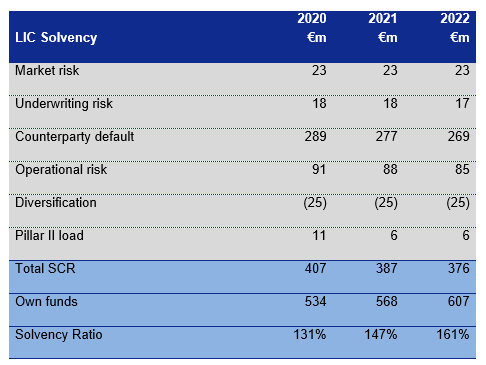

2.8.1 In order to calculate its solvency requirement, LIC uses the standard formula to calculate its solvency capital. I have estimated the impact of the Part VII transfer on LIC Solvency Ratio at 31 December 2020 to be as follows:

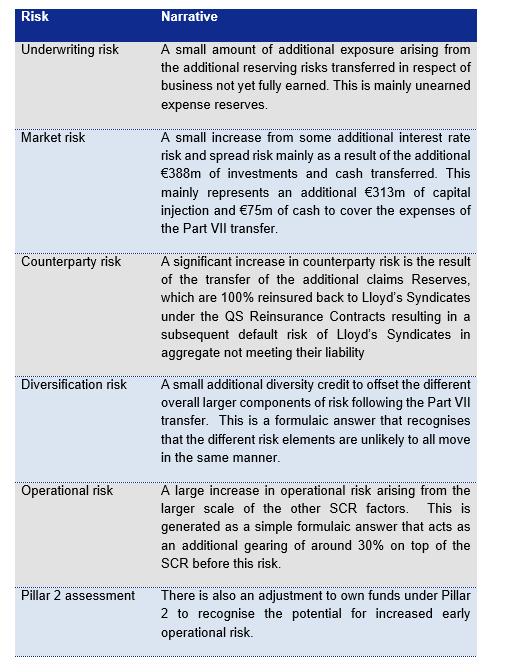

2.8.2 The most significant change arises on the assessment of counterparty risk. Counterparty risk is the risk of a counterparty not settling amounts fully when due. The increase is due to the additional gross liabilities transferred to LIC under the proposed Part VII transfer and the recoverability of those liabilities from the Members under the QS Reinsurance Contract.

2.8.3 Overall there is no material change in the Solvency Ratio for LIC as a result of the Part VII transfer as Lloyd’s intends to increase LIC’s Own Funds in order to mitigate any adverse impact on LICs Solvency II capital requirements as a result of the Part VII transfer.

2.8.4 The board of LIC has modelled the company’s solvency position based on the forecast profit and loss and balance sheets to 31 December 2022.

2.8.5 The projected SCR requirement is expected to gradually reduce, primarily due to the counterparty risk decreasing as Part VII liabilities decrease at a faster rate than new business liabilities are added. The reason for this reduction is as part of LIC’s assumptions in projecting its SCR requirement it is expected that loss ratios for new business, which is supported by Lloyd’s market data, are slightly lower than the loss ratios of the Part VII Transferring Liabilities which gives rise to reduced future Reserves and therefore a lower counterparty risk in the future. The own funds gradually increase mainly through retained cash from the LIC retained commission on new business exceeding expenses and the release of the Part VII expense reserve established to run off the liabilities attaching to the Transferring Policies. The resultant Solvency Ratio improves over the period and stays well above the 125% target risk appetite set out by the board.

2.8.6 I have compared the results of the SCR produced by LIC with the results of re-performing their calculation using an alternative standard formula model, both before and after the transfer. I have also stress tested some of the more significant components of the SCR calculation. Therefore I am satisfied that LIC’s current solvency capital and its projected solvency capital following the Part VII transfer have been calculated on a reasonable basis.

2.8.7 In my opinion, the key risks in forecasting LIC’s solvency capital is the counterparty risk. This is the risk that the Syndicate and the Lloyd’s Central Fund will be unable to meet valid claims from LIC’s current underwriting and the liabilities arising from the proposed Part VII transfer.

2.8.8 The SCR loading for counterparty risk following the transfer of the proposed Part VII transfer is an increase of €158m based on an increase in ultimate insurance liabilities of €4.7bn which are then 100% reinsured back to the Members.

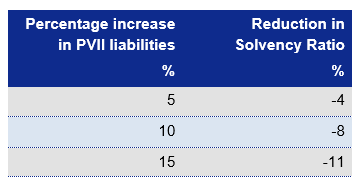

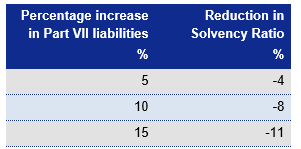

2.8.9 In the table below, I have calculated the effect on LIC’s Solvency Ratio resulting from a potential 5, 10 and 15 percent underestimate of the insurance liabilities being transferred under this proposed Part VII:

2.8.10 The above table shows even if the quantum of projected liabilities on the actuarial projections are understated by 15%, then LIC’s Solvency Ratio, at the Effective Date, will reduce to 120% which is below LIC’s risk appetite but above the minimum capital requirement. In my opinion, as claims relating to the Part VII Transferred Liabilities are settled and recovered from the Members the counterparty risk reduces and the Solvency Ratio will increase and will likely exceed the 125% risk appetite by 31 December 2021.

2.8.11 The proposed capital injection by Lloyd’s of €313m will, in my view, cater for any currently reasonably foreseeable underestimation in the calculation of insurance liabilities being transferred to LIC. In arriving at the above opinion, I have also taken into account Lloyd’s current intention to provide enough funding to LIC to enable it to operate and meet its Solvency Capital Requirement going forward.

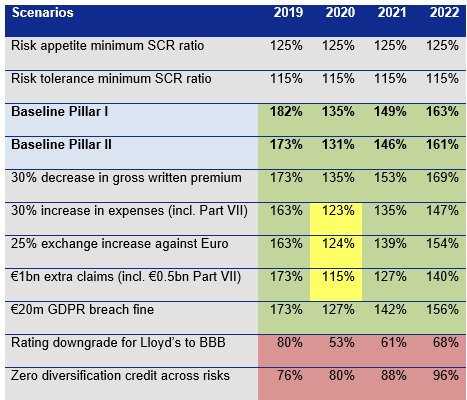

2.8.12 The board of LIC have identified the following additional potential risks which the company faces following the Part VII transfer:

- Decrease in gross premium written

- Increase in expenses (including Part VII expenses)

- Increase in exchange rate

- GDPR breach fine

- Rating down grade of the Lloyd’s market to BBB.

2.8.13 The above risks together with the risk of the liabilities attaching to the proposed Part VII transfer proving to be under reserved have been stressed by LIC in their latest ORSA.

2.8.14 For most of the scenarios LIC’s solvency ratio remains above the minimum SCR and the risk appetite. In some scenarios the solvency ratio is still above the minimum SCR but below the risk appetite but recovers in future years. The only two scenarios where they fall below the minimum SCR is a rating downgrade, in Lloyd’s credit rating, to BBB and not being able to take credit for the diversification of risks. In my opinion the risk of not being able to take credit for the diversification of risks, as defined in the EIOPA regulations, is an extreme and unrealistic scenario.

2.8.15 Lloyd’s current credit rating by the various credit agencies is as follows:

2.8.16 During the second half of 2019 Best and S&P rated Lloyd’s outlook as stable. Fitch also upgraded Lloyd’s from a negative to a stable outlook in November 2019 based on insurance pricing improvements and the ongoing Lloyd’s profitability initiatives, although this has returned to a negative outlook in April 2020 following the emergence of the COVID-19 pandemic. A reduction down to EIOPA credit quality step 3 being a rating reduction to a BBB rating.

2.8.17 Although the Part VII transfer potentially increases the risk for LIC in many scenarios there is no major solvency impact created by any of the stress scenarios modelled by Lloyd’s, which I have re-performed, that are considered likely. The greatest impact, although I consider it to be unlikely, is that arising from a downgrading of Lloyd’s credit risk.

2.8.18 However, in my opinion, ultimately whether a Policyholder’s valid claim is met will depend on the strength of Lloyd’s Central Fund rather than a downgrade in Lloyd’s credit risk. Lloyd’s modelling shows that it would need a Lloyd’s market wide loss of £20.2bn which the LIM predicts to be a 1 in 450 years event for the Central Fund to come under significant pressure which, I believe it is not a material risk. Should the Lloyd’s market suffer a future loss of the size set out set out above, the Transferring Policyholders would still face the impact of a depleted Central Fund if the proposed Part VII transfer does not go ahead. Accordingly, the Transferring Policyholder’s ability to recover any claim from the Central Fund in the event of such a potential future loss would be no worse off than before the proposed Part VII transfer.

2.9.1 Lloyd’s primary regulators are currently the PRA and the FCA, and there will be no supervisory change for non-Transferring Policyholders as a result of the transfer. Following the transfer there will be a change in regulatory environment for Transferring Policyholders as LIC’s primary regulator is the NBB together with the Financial Services and Market Authority (Belgium).

2.9.2 I have concluded that although there will be a change in the prudential and conduct supervisor of the Transferring Policyholders, I do not believe the effect of any of these changes will be material, particularly as both Lloyd’s and LIC are likely to continue to comply with the requirements of Solvency II, the EIOPA Guidelines and the European Insurance Distribution Directive for the foreseeable future.

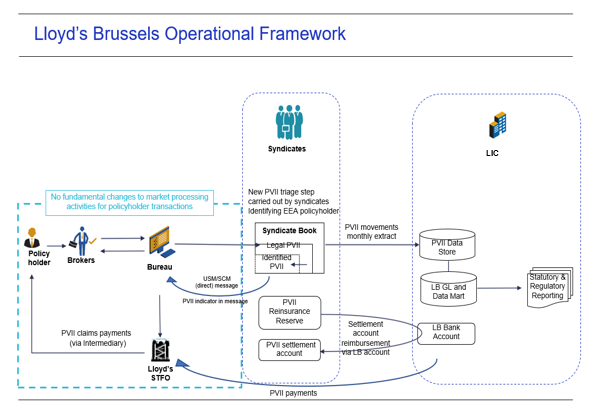

2.10.1 Most of the Policyholders are currently introduced to Lloyd’s Members through intermediaries (Brokers, Coverholders, Service Companies). Following the transfer, the Policyholders will continue to contact these intermediaries with regards to their policies. Although there are additional operational requirements for LIC and Lloyd’s Members, I have concluded that the Policyholder does not need to navigate any new or unfamiliar processes as a consequence of the operating model following the Part VII transfer. Accordingly, I have also concluded that there will be no material adverse effect on the service levels provided to policyholders, both transferring and non-transferring following the Part VII transfer.

2.10.2 Based on my review and analysis, set out above, of the impact of the proposed Part VII on LIC’s Solvency Requirements and on my understanding of the operating systems and procedures LIC intends to introduce, I am able to conclude the following in respect of service levels post transfer:

- There will be no material adverse effect on those Policyholders that are transferring under the proposed Part VII; and

- There will be no material adverse effect on the current policyholders of LIC as a result of the proposed Part VII transfer.

2.11.1 So far as it is relevant to this transfer, the Financial Services Compensation Scheme (FSCS) in the UK provides consumer protection and compensation for individuals and small businesses. The Financial Ombudsman Service (FOS) provides private individuals and microenterprises with a free, independent service for resolving disputes with financial companies.

2.11.2 In respect of the FSCS and the FOS, I have also concluded the following:

- Transferring Policies which were protected by the FSCS prior to the proposed Part VII transfer will continue to be protected by the FSCS post-transfer in respect of claims relating to acts or omissions which arise prior to the transfer. Where, as is expected, LIC has an authorised branch in the UK then Transferring Policies which were protected by the FSCS prior to the transfer will also continue to be protected post-transfer in respect of claims relating to acts or omissions occurring after the transfer. Should LIC fail to establish or cease to have an authorised branch in the UK after the transfer then Transferring Policyholders will lose the benefit of FSCS protection in respect of acts or omissions which occur after LIC ceases to have an authorised branch.

- In my opinion the risk that LIC fails to establish, or ceases to have, an authorised branch in the UK and becomes insolvent is not a material risk. Therefore I have concluded that the risk that Transferring Policyholders which had the protection of the FSCS prior to the proposed Part VII transfer of losing that protection after the proposed Part VII in respect of acts or omissions which occur after LIC ceases to have an authorised branch is not a material risk.

- Transferring Policyholders who currently can access the FOS Voluntary and Compulsory Jurisdiction schemes will continue to have access to those schemes following the proposed Part VII transfer in respect of complaints relating to acts or omissions occurring prior to the Transfer.

- Transferring Policyholders who currently are able to access the FOS Compulsory Jurisdiction scheme for activities falling within the scope of the Compulsory Jurisdiction, will lose the benefit of the FOS scheme in relation to acts or omissions occurring after the Transfer where activities which were previously carried on in the UK are, after the Transfer, carried out by LIC in Belgium (or elsewhere in the EEA) unless those activities are directed at the UK. Access to the Compulsory Jurisdiction will be lost if the LIC UK branch ceases to be authorised under the Temporary Permissions Regime in the UK or is not authorised at any point after the end of the Temporary Permissions Regime.

- In my opinion, the loss of access to the FOS Compulsory Jurisdiction scheme only applies in the circumstances set out above and is somewhat mitigated by the complaints management scheme which LIC is intending to implement following the proposed Part VII transfer. I have further concluded that the risk of a loss of access to the FOS Compulsory Jurisdiction scheme in the limited circumstances set out above is not a material risk when compared to the risk that it may become illegal for Members to pay valid claims if this proposed Part VII transfer does not proceed.

2.12.1 All Transferring Policyholders will cease to be policyholders of the Members and become Policyholders of LIC. However, as a result of the QS Reinsurance Contract, LIC will become a Policyholder of the Members (and fall within the Lloyd’s security framework) and will have the assurance that Lloyd’s may, at its discretion, continue to apply the Central Fund to support Members with whom they have entered into the QS Reinsurance Contract. I have obtained confirmation from Lloyd’s that in exercising its discretion Lloyd’s does not intend to distinguish between Members’ liabilities to Policyholders (including LIC) or prioritise the use of assets to prefer one group of Policyholders over any other group of Policyholder.

2.12.2 At the effective date, all Transferring Policyholders will lose the security of the Central Fund should a Member of Lloyd’s be unable to meet his or her insurance liabilities to claims arising on insurance policies they have written in full. However as explained above, LIC will now gain that security as a result of it becoming a Policyholder of the Members through the QS Reinsurance Contract. This means that the Transferring Policyholders’ access to the security provided by the Central Fund, subject to Lloyd’s discretion, will be the same for all practical purposes, pre and post the proposed Part VII transfer.

2.12.3 Therefore, I have been able to conclude that the loss of the Transferring Policyholders direct access to the security provided by the Central Fund will have no material adverse effect on the Transferring Policyholders ability to have their claims settled post transfer as LIC will gain the security of the Central Fund as a Policyholder of the Members, through the QS Reinsurance Contracts. Therefore for all practical purposes Transferring Policyholders will continue to have access to the security provided by the Central Fund.

2.13.1 Prior to the Effective Date, where a Member is unable to meet its liability to the Transferring Policyholders, and the Central Fund is unable to settle that liability on behalf of the Member, the Transferring Policyholder would have access to the FSCS if all relevant conditions apply. After the Effective Date as the Transferring Policyholder is not a Policyholder of the Member, as explained above, the right of access to the FSCS through this channel is lost. However if LIC is in default then the Transferring Policyholders would have access to the FSCS if all relevant conditions apply (i) in respect of claims relating to acts or omissions arising after the Transfer because LIC has established a passported branch in the UK; or (ii) in respect of claims relating to acts or omissions arising after the Transfer, provided LIC has established a branch with full UK authorisation once the Temporary Permissions Regime ends; or (iii) in respect of claims relating to acts or omissions arising before the Transfer, under the “successor” rules if LIC ceases to have or does not establish a UK branch.

2.13.2 Successor rules are included in the PRA’s Policyholder Protection Rules and provide protection where a “successor” (i.e. LIC) has assumed responsibility for acts and omissions of an authorised insurer (i.e. a Member). In this case, a policyholder who is an eligible claimant can also claim compensation from the FSCS in respect of an eligible claim when the successor (i.e. LIC) is in default.

2.13.3 LIC has established a passported branch in the UK and, post exit, the intention is for LIC to seek full UK authorisation for this branch before the end of the Temporary Permissions Regime. Although the authorisation is not guaranteed, there is no reason to date to suggest that the branch will not be authorised. The loss of access to the FSCS for claims relating to acts or omissions arising after the Transfer only applies where LIC is insolvent and is unable to settle its liability to the Transferring Policyholders and has failed to establish or ceases to have a UK authorised branch. Therefore I have concluded that the potential loss of access to the FSCS is not a material risk to the Transferring Policyholders in the circumstance described above.

2.14.1 I do not believe that there are any tax implications which will have a materially adverse effect on the policyholders of either Lloyd’s or LIC as the Transfer will not give rise to any significant VAT liabilities and not give rise to any significant accounting profit or losses which would be subject to corporation tax.

2.14.2 I understand that most costs associated with the Transfer will be incurred whether or not the Transfer proceeds, as the majority of these costs relate to activities occurring prior to the Sanctions Hearing (for example, with respect to legal and professional fees and policyholder communications). These costs have been incurred by both LIC and Lloyd’s.

2.15.1 Based on my review of Lloyd’s overall communication strategy and associated documents, I am satisfied that Lloyd’s overall approach is a proportional approach and will ensure adequate coverage of all parties affected by the transfer.

2.16.1 The impact of COVID-19 virus on the Lloyd’s market will result in significant claims arising on certain classes of businesses that are likely to respond to losses suffered by Policyholders. COVID-19 has also resulted in a significant decrease in the valuation of the investment portfolios of Lloyd’s and the syndicates operating within the Lloyd’s market. This in turn has led to downward pressure on Lloyd’s Solvency Ratios.

2.16.2 Lloyd's is closely monitoring the situation and is collecting the full extent of the 1st quarter 2020 asset losses and incurred liabilities from the Members for the June 2020 coming into line exercise. Further capital collections will be used if appropriate given the development of the situation. Lloyd’s plans to publish a preliminary estimate of the impact of COVID-19 on the Lloyd’s market in early May.

2.16.3 The impact of COVID-19 on the Lloyd’s market is at an early stage and it is difficult to assess the financial impact it may have with any degree of certainty. Nevertheless based on the information made available to me to date, my provisional conclusion is that neither the Transferring Policyholders nor the non-Transferring Policyholders will suffer any material adverse effect as a result of the proposed Part VII Transfer in respect of the impact COVID-19 may have on the Lloyd’s market. I intend to review my conclusion as more information becomes available prior to the Sanctions Hearing and include my findings in my supplementary report. For further details, please refer to paragraphs 9.1.1 to 9.1.14 of this report.

2.17.1 Any proposed transfer of insurance business from a UK entity to another entity, whether resident in the UK or elsewhere, has to be sanctioned by the High Court of England and Wales (Court) pursuant to Part VII of FSMA. Section 109 of FSMA requires a report to be prepared for the Court by an expert (the Independent Expert) to aid it in its deliberation. The purpose of this report is also to inform the Prudential Regulation Authority (PRA), the Financial Conduct Authority (FCA) and Lloyd’s Policyholders (including third party claimants against those Policyholders) of the impact of the proposed transfer on the security and service levels of both transferring and non-Transferring Policyholders.

2.18.1 My overall conclusion is as follows:

- Transferring Policyholders will not be materially adversely affected by the proposed Scheme, and the security of Policyholders’ contractual rights would not be materially disadvantaged by the Scheme;

- the Scheme will not have a material adverse effect on Transferring Policyholders in respect of matters such as administration, claims handling, governance arrangements, expense levels and valuation bases in relation to how they may affect the security of Policyholders’ contractual rights and levels of service provided to Policyholders;

- the non-Transferring Policyholders (including Policyholders of the Excluded Jurisdiction Policies) will be insured by the same legal entities, with exactly the same governance structures, regulatory framework, policy terms and conditions, and their policies will be serviced in the same manner as prior to the Transfer. Accordingly, there will be no material adverse effect on non-Transferring Policyholders as a result of this proposed Part VII transfer;

- the cost and tax effects of the Scheme will have no material adverse effect on the security of all Policyholders’ contractual rights;

- the current Policyholders of LIC will suffer no material adverse effect as a result of the proposed Part VII transfer;

- there will be no material adverse effect on the Outwards Reinsurers as a result of this proposed Part VII;

- I am satisfied that the proposed notification material to be presented to policyholders is appropriate and Lloyd’s approach to communication with Policyholders, including the waivers to the standard communications approach, are appropriate and proportionate.

2.19.1 I confirm that I fully understand that my overriding duty is to the Court, which overrides any obligations I may have to any other party including those from whom I am paid.

I confirm that the content of my report correctly reflects my opinion and I am not aware of any inaccuracies contained therein.

Chapter 3: Lloyd’s market

3.1.1 Lloyd’s is a society incorporated as a statutory corporation by Lloyd’s Act 1871 (Lloyd’s). Lloyd’s is not a company incorporated under the Companies Act 2006 or any of its predecessors and does not underwrite risks on its own behalf. Lloyd’s is a marketplace, run by the Council of Lloyd’s, where Members acting through insurance Syndicates, arrange insurance for their customers.

3.1.2 A Managing Agent is an independently owned company set up to manage the Syndicate on behalf of the Members of that Syndicate. Managing Agents may manage the affairs of more than one Syndicate. A Lloyd’s Syndicate is made up of a group of underwriters (Members) who can be individuals, partnerships or corporate entities which put up the underwriting capital against their share of the insurance risk accepted and is liable for any subsequence profit or loss.

3.1.3 Managing Agents carry out all the underwriting functions on behalf of the Members of a Lloyd’s Syndicate. These functions will include:

- entering into contracts of insurance

- effecting reinsurance and paying claims

- developing a Syndicate business plan and setting its risk appetite

- employment of relevant staff for carrying out the above functions.

Managing Agents are subject to Lloyd’s regulatory overview and are authorised by the PRA and regulated by the PRA and the FCA.

3.1.4 Lloyd’s Syndicates have no separate legal personality and, therefore, it is the Members themselves who underwrite risk and remain liable for business written by the Syndicate.

3.1.5 Members join a Syndicate only for an underwriting year with the Syndicate accepting risks incepting in that calendar year only. Thereafter, if a member wishes to continue to underwrite, they must join the subsequent calendar year of that, or another, Syndicate.

3.1.6 Lloyd’s is responsible for the oversight of the market which includes the following activities amongst others:

- setting minimum standards and monitoring compliance with those minimum standards which Syndicates and Managing Agents must comply with

- agreeing Syndicate business plans and capital requirements and evaluating performance against business plans

- maintaining market stability, protecting its credit rating and preventing underwriting behaviour which threatens the Central Fund

- providing services that the underwriters in the Lloyd’s market require to trade. This includes the infrastructure for processing risks that have been accepted by the Syndicates and maintaining the Lloyd’s international network of trading licences and offices.

3.1.7 When a Syndicate accepts a risk from a Policyholder, each member of the Syndicate for that particular underwriting year is legally liable for his share of any claims which attach to those policies. Members are only liable for their several share of the risk and have no liability for other Members’ share of the risk.

3.1.8 Members agents are entities who are responsible for providing certain duties to Lloyd’s Members such as advising Members on which Syndicate they should participate on, the level of participation and liaising with Managing Agents and Lloyd’s on certain matters.

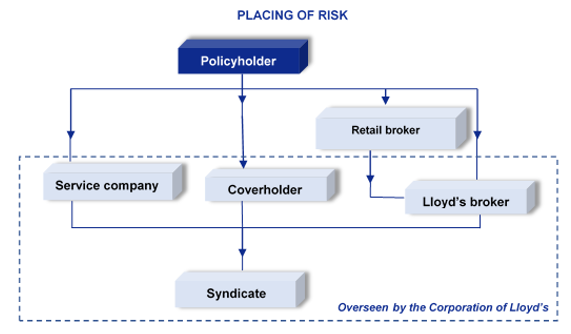

3.1.9 A majority of the risks a Syndicate underwrites originate from the following main sources:

- Lloyd’s Broker

- Line Slips

- an approved Coverholder

- Service Company controlled by the Managing Agent.

3.1.10 The majority of risks written by the Syndicate generally are placed by Lloyd’s Brokers, either directly with a Syndicate or via a Line Slip.

3.1.11 Line Slips are used to underwrite risk where a Managing Agent, on behalf of Members, delegates authority to enter into insurance contracts to be underwritten to another Managing Agent or authorised insurance company.

3.2.1 A Policyholder wishing to insure (or place) a risk with one or more Lloyd’s Syndicates normally approaches one of the following entities to act on his behalf:

- Retail Broker

- Lloyd’s Broker

- Coverholder

- Service Company

3.2.2 A Retail Broker is an entity authorised under the FSMA to advise individuals or corporate entities on their insurance needs and to negotiate insurance contracts on their behalf with insurers in return for a fee or commission. A Retail Broker cannot place a risk with a Lloyd’s Syndicate unless they are an authorised Lloyd’s Broker. Often, a Retail Broker will contact a Lloyd’s Broker in order for that Lloyd’s Broker to approach and negotiate directly with the Syndicate. In these cases, the fee or commission paid by the Policyholder to the Retail Broker is shared with the Lloyd’s Broker.

3.2.3 A Lloyd’s Broker is a Retail Broker authorised by Lloyd’s to facilitate the risk transfer between Policyholders and Syndicates. Normally, this will involve face to face negotiations between the Lloyd’s Broker and Syndicate underwriters.

3.2.4 A Syndicate may also authorise third parties (Coverholder) to accept insurance risks directly on behalf of the Syndicate. These businesses are known as Coverholders and form a vital distribution channel for the Lloyd’s market. The agreement between the Syndicate and the Coverholder is known as a Binding Authority and the business written is referred to as Coverholder business.

3.2.5 A Service Company operates in the same way as a Coverholder but is a wholly owned subsidiary of either the Managing Agent, or the Managing Agent holding company.

3.2.6 For more complex risks, a Lloyd’s Broker may approach a number of Syndicates, across a number of Managing Agents, in order to place the risk. Each Syndicate will then take a percentage of the risk which will be scaled back if more than 100% placed, but may not always be fully placed.

3.2.7 A simplified schematic diagram of how a Policyholder places a risk at Lloyd’s is set out below.

3.2.8 Often Policyholder’s details are only held at Coverholder or Retail Broker level and not necessarily maintained by the Syndicates, Managing Agents or Lloyd’s Brokers.

3.3.1 When a Syndicate places a risk, that risk is allocated to the calendar year when that risk incepts (underwriting year). Each underwriting year of a Syndicate remains open for a minimum of three years when that underwriting year’s results are finalised.

3.3.2 At the end of the third year, the underwriting year is normally closed by reinsuring the risks allocated to that year into a later year of account of that, or another, Syndicate. The premium payable by the year to the later year accepting the risk is determined by the Managing Agent. This process is known as a Reinsurance to Close (RITC).

3.3.3 Any subsequent variation in the ultimate liability attaching to an underwriting year which has been closed by the RITC process is borne by the underwriting year into which it is reinsured.

3.3.4 When the underwriting year of account cannot be closed into a later year it becomes a run-off year of account. As such, the Members of that year continue to bear the economic liability for variations in claims Reserves on policies allocated to that year until an RITC is completed.

3.3.5 The reasons a year cannot be closed are varied but the main ones are that the RITC premium to be charged cannot be assessed by the Managing Agent with the required degree of certainty or that no successor year or Syndicate exists.

3.3.6 The payment of the RITC premium does not eliminate the liabilities of the Members writing on an underwriting year. Should the Members on the reinsuring year be unable to meet their obligations, and other elements of the Lloyd’s chain of security were to fail, then the Members on the closed underwriting year would have to settle any outstanding claims.

3.4.1 The capital structure which provides security to Policyholders of the Lloyd’s market is unique in the global insurance market.

3.4.2 There are three links to this security:

3.4.3 The first two links are held in trust primarily for the benefit of Policyholders. They can only be used to settle a Member’s liability for policies either directly written by that member or reinsured by the RITC process. A Member’s assets are only at risk for policies written on their own account and are not available to settle other Members’ losses.

3.4.4 The third link contains mutual assets held by Lloyd’s which are available, subject to Lloyd’s discretion, to meet any Members’ liabilities, which cannot be met out of any of the Members own funds.

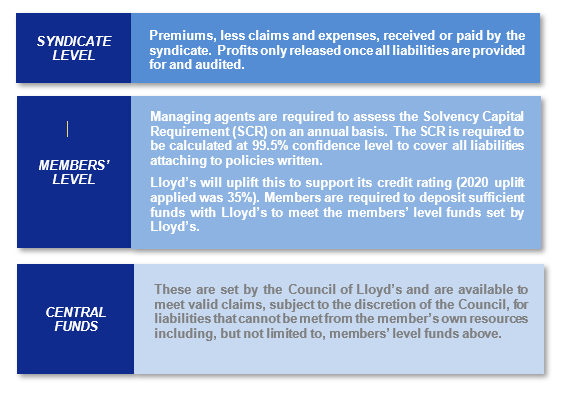

3.4.5 The level of funds is set by Lloyd’s as follows:

Chapter 4: Structure of the Part VII Transfer

4.1.1 In order to ensure the Part VII transfer is expedient and economically efficient, Lloyd’s has designed a single transfer Scheme applicable to all Members which can be considered by the regulators, the Court, the Policyholders and other stakeholders. This will, in my opinion, ensure a uniform approach to the transfer of policies under the proposed Part VII transfer.

4.1.2 Lloyd’s has the authority, under regulations 3 to 5 of the Financial Services and Markets Act 2000 (Control of Transfers of Business Done at Lloyd’s) Order 2001, Lloyd’s Act 1982 and Paragraphs 40 and 42 of the Membership Byelaw, to undertake this course of action. Lloyd’s tested these rights at a preliminary Court hearing in November 2018.

4.1.3 Prior to the Effective Date of the Scheme, LIC and the Members of each Syndicate will enter into 100% quota share reinsurance contract agreements to cover the business transferred to LIC (together, referred to as the QS Reinsurance Contracts). When the QS Reinsurance Contract becomes effective the insurance liabilities under the Transferring Policies transferred to LIC, by the proposed Part VII Scheme, will be fully reinsured back to the Members of the Syndicate, that originally underwrote the policy or assumed the liabilities through reinsurance to close.

4.1.4 As result of the QS Reinsurance Contracts, economically the liabilities attaching to the Transferring Policies will continue to rest with those Members who originally underwrote those policies, or subsequently assumed those liabilities through the Reinsurance to Close process. This can be represented schematically as follows

4.1.5 Each Syndicate on behalf of its current and past Members has purchased different reinsurance programmes (Outward Reinsurance) to cover some of the liabilities attaching to the Transferring Policies. These Outward Reinsurance programmes will vary annually both in coverage and in reinsurer participation.

4.1.6 Under the proposed Scheme, the existing Syndicate Outwards Reinsurance will not be transferred with the Transferring Policies to LIC. Accordingly, Lloyd’s intends to seek Court approval to convert, as part of the terms of the Scheme, this existing Outwards Reinsurance to attach to all or any part of each Syndicate’s QS Reinsurance Contract with LIC. This effectively converts the existing Syndicate Outwards Reinsurance to retrocessional cover.

4.1.7 Retrocessional cover is a type of insurance whereby a reinsurer assumes part of the risk of another reinsurer. In this scenario, the risk intended to be covered, by the Syndicate Outwards Reinsurance, will be the reinsurance of LIC’s liabilities in respect of the Transferring Policies.

4.1.8 The intention of the Scheme is designed to result in as little change as possible for Policyholders and as far as possible to ensure that the Transferring Policies will continue to be serviced in the manner which they are currently serviced without breaching legal or regulatory insurance authorisation requirements in the EEA.

4.1.9 The proposed transfer arrangement (Scheme) will operate as follows:

- Each Transferring Policy will be transferred from the current Lloyd’s Syndicates to LIC.

- Liabilities attaching to the Transferring Policies (other than the “Excluded Liabilities”) will be transferred and become a liability of LIC. Accordingly, these liabilities will cease to be a direct liability of the Syndicate Members.

- All rights, benefits, powers and obligations of the Members exercised through the Syndicate, in connection with the Transferring Business, will also transfer to LIC.

- Any Transferring Policyholder will have rights against LIC instead of the Member(s) of the Syndicate; LIC will effectively step into the shoes of the Members.

- For Transferring Policies which are split between EEA and Non-EEA business, the above rights, benefits and obligations of the Non-EEA business will not transfer to LIC where the Policyholder is domiciled in a Non-EEA country. In this case, both the Syndicate and LIC will owe separate and individual (but not joint or double) obligations and duties under, and be liable for the performance of, their respective elements of the Policy only.

- The Members existing Outwards Reinsurance arrangements will convert to retrocessional cover to all or any part of each Syndicate’s QS Reinsurance Contract with LIC.

4.1.10 Therefore, in my view, based on the 100% QS Reinsurance Contracts to be entered into by LIC and with each Syndicate and the conversion of the Outwards Reinsurance to outwards retrocessional cover, the risk that the actuarial projections of the Transferring Liabilities are either under or overstated will have no material adverse effect on the Transferring Policyholders or non-Transferring Policyholders.

4.1.11 Therefore, I have concluded that the only potentially material adverse effect of a variation of Reserves attaching to the Transferring Policies will be on LIC’s Solvency Capital Requirements (SCR). One element which goes into calculating the SCR is “counterparty risk”, i.e. risk that the recovery under the QS Reinsurance Contract will not be fully realised. My further analysis of this impact on LIC solvency requirements is set out in Section 7.

4.1.12 In my opinion, the key risks attaching to this proposed Part VII transfer are:

- The risk that the QS Reinsurance Contract will not fully reinsure the risks attaching to the Transferring Policies back to the applicable Lloyd’s Syndicate;

- The risk that Court does not have the power under the FSMA to convert the existing Syndicate outward reinsurance into retrocessional cover;

- The risk that for the Syndicate reinsurers, domiciled outside the UK, the court system in their country of domicile will not recognise the Court Order.

4.1.13 In order to assess the risks of the possible failure of the proposed QS Reinsurance Contract to transfer the liabilities attaching to the Transferring Policies back to the appropriate Syndicate, I have obtained my own independent legal advice.

4.1.14 With my legal advisers, I have had a number of contacts with Lloyd’s and their external legal advisers regarding the drafting of the QS Reinsurance Contract. The purpose of these contacts was to understand the terms of the QS Reinsurance Contract and how it was designed to work in practice. As a result of my interaction, together with my legal advisers, with Lloyd’s and their legal advisers I have made several recommendations how the wording of the QS Reinsurance Contract could be strengthened. Lloyd’s have adopted most of these recommendations and changed the original draft of the QS Reinsurance Contract accordingly.

4.1.15 As a result of the legal advice I have received, I have been able to assess that there were three potential risks which may give rise to the QS Reinsurance Contract not fully reinsuring the economic effect of the transferring liabilities back to the applicable Lloyd’s syndicate. These risks were as follows: