The sharing economy has grown exponentially, fundamentally changing the business landscape.

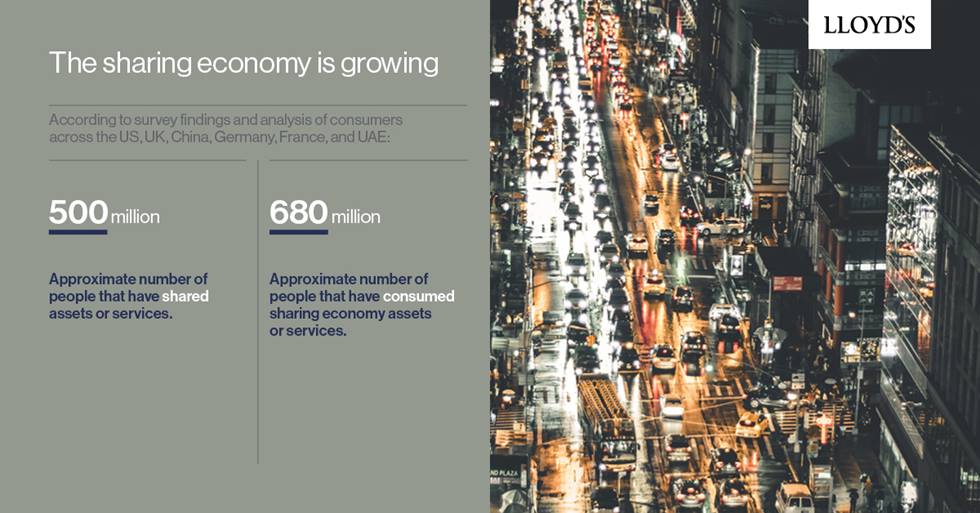

With approximately 500 million people sharing assets or services across six key markets, and close to 680 million people making use of them, Lloyd’s and Deloitte partnered to systematically analyze the sharing economy with the aim of understanding where insurance can support growth and opportunity in this booming sector.

The study highlights that while currently a number of platforms have mechanisms to protect users, ranging from transaction-embedded insurance to guarantee schemes, insurers must think beyond traditional products and services in order to effectively meet the needs of the shared economy.