Lloyd’s Oversight Framework

Lloyd’s Oversight Framework creates an efficient and joined-up approach to provide the conditions for the best businesses to thrive and drive decisive interventions for underperforming businesses.

The Oversight Framework:

- Ensures focus on the oversight outcomes we seek to achieve;

- Provides a way of differentiating managing agent approaches based on their materiality;

- Allows managing agent senior management to interpret and apply Lloyd’s expectations in the way most appropriate to their business;

- Provides clarity, transparency and efficiency across the market for all participants;

- Is resilient to change over time by focusing on principles and outcomes, rather than prescriptive rules;

- Focuses on the most important key areas of operating at Lloyd’s.

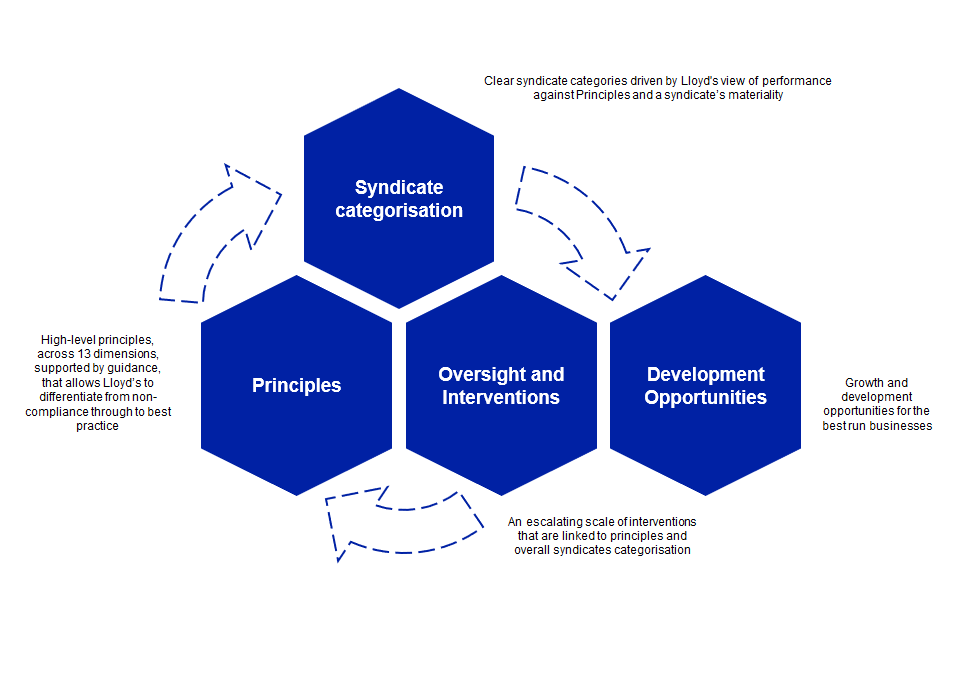

The three elements of the Oversight Framework

The Lloyd’s Oversight Framework has three interlinking elements that work together to support more differentiated and impactful oversight.

The Principles for doing business at Lloyd’s

The Principles articulate the fundamental responsibilities expected of all managing agents in order to support the market’s overall performance, capital strength, financial and reputational credibility.

The suite of 13 Principles are outcomes based and allow for more differentiation according to syndicate materiality. These are the basis against which we view and categorise all syndicates and managing agents in terms of both their capability and performance.

Syndicate Categorisation

One consistent approach to syndicate and agent categorisation based on assessment against the Principles, both on a qualitative and quantitative basis, across the 13 Principles.

Under the framework, there are five different categories:

- Outperforming

- Good

- Moderate

- Underperforming

- Unacceptable

Interventions and Incentives

Oversight and the application of interventions are directly informed by a syndicate’s categorisation.

For businesses on the lower end of the scale, a range of interventions can be applied to remediate and ensure they return to expected performance.

For those businesses at the top end of scale there will continue to be a range of incentives to support growth and development to help those businesses thrive.

Principles for doing business at Lloyd’s

The Principles articulate the fundamental responsibilities expected of all managing agents in order to support the market’s overall performance, capital strength, financial and reputational credibility. The suite of 13 Principles are outcomes based and allow for more differentiation according to syndicate materiality. These are the basis against which we view and categorise all syndicates and managing agents in terms of both their capability and performance.

Principles Board Attestation Guidance

The Principles Board Attestation is an annual process, providing a formal opportunity to share and agree Principle and sub-principle ratings between managing agents and Lloyd’s. Lloyd’s requires managing agents to conduct an exercise to assess themselves against the Principles and provide supporting rationale.

Market Oversight Plan 2026

The Market Oversight Plan provides managing agents with a summary of the Corporation’s view of the key risks facing the market in 2026 and the proposed oversight relating to those risks.

Useful information

Requirements and standards

Requirements and standards for being part of the Lloyd's market, Acts and byelaws and Brand guidelines.

Project Rio: Resource hub

This page is the Project Rio Resource Hub where you can find a recording of all the Market Briefing sessions and a copy of the slide decks.

Appointments to senior positions

Lloyd’s requires that all senior appointments are notified. Notification should be made using the forms found in this section.

Change of control for underwriting agents

The approval of controlling interests in an underwriting agent requires Lloyd’s, PRA and FCA approval. Learn about the procedure which should be adopted when there is a proposed change of control in respect of an underwriting agent or approved run-off company.