COVID-19 will see historic losses across the global insurance industry

Lloyd’s market set to pay out up to US$4.3bn to customers.

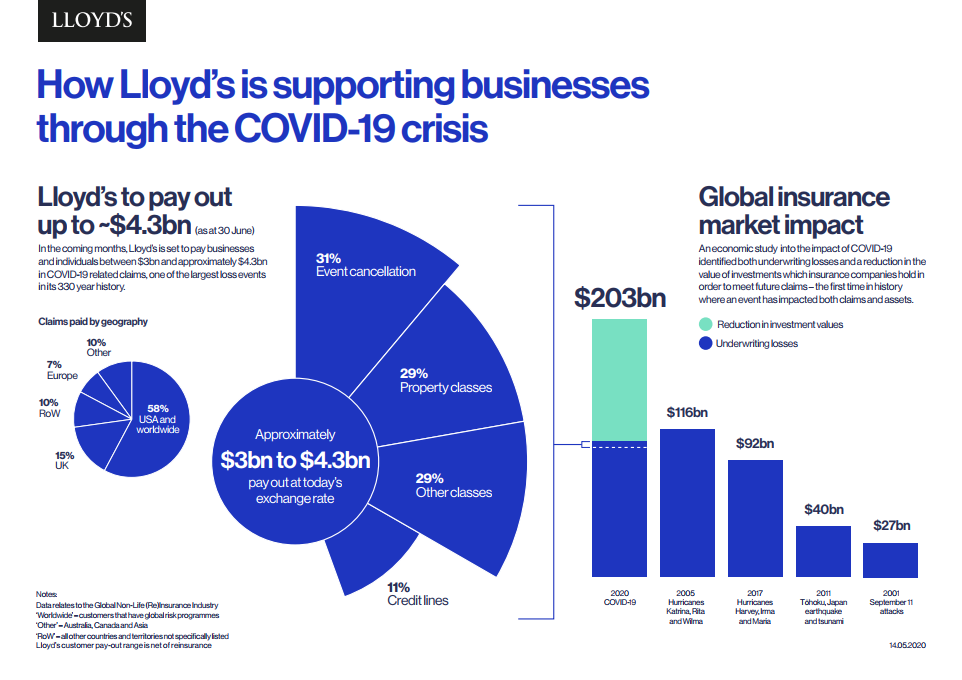

Lloyd’s, the world’s leading (re)insurance market, today revealed that it will pay out in the range of $3bn to $4.3bn* to its global customers as a result of the far-reaching impacts of COVID-19. This is on a par with 9/11 in 2001 and the combined impact of hurricanes Harvey, Irma and Maria in 2017, all of which led to similar pay outs by the Lloyd’s market**. These losses could rise further if the current lockdown continues into another quarter.

Lloyd’s believes that once the scale and complexity of the social and economic impact of COVID-19 is fully understood, the overall cost to the global insurance non-life industry is likely to be far in excess of those historical events.

To understand the impact of the pandemic on the global non-life insurance industry, Lloyd’s undertook an economic study of the potential losses. This looked at both underwriting losses through the Profit and Loss Account, as well as the reduction in the value of investments which insurance companies hold to fund future claims payments. The economic study took account of the current pay out estimates assuming continued social distancing and lockdown measures through 2020; as well as the forecast drop in GDP globally.

The estimated 2020 underwriting losses covered by the industry as a result of COVID-19 are approximately $107bn, on par with some of the biggest major claims years for the industry, such as when three catastrophic windstorms have struck (2005: hurricanes Katrina, Rita and Wilma; 2017: hurricanes Harvey, Irma and Maria). Importantly, these natural catastrophes were geographically contained events, occurring over the course of hours and days – vastly different in nature to the global, systemic and longer-term impact of COVID-19.

In addition, unlike other events, the industry will also experience falls in investment portfolios of an estimated $96bn, bringing the total projected loss to the insurance industry to $203bn.

John Neal, CEO of Lloyd’s“The global insurance industry is paying out on a very wide range of policies to support businesses and people affected by COVID-19. The Lloyd’s market alone is currently expected to pay claims amounting to some $4.3bn, making it one of the market’s largest pay-outs ever. What makes COVID-19 unique is the not just the devastating continuing human and social impact, but also the economic shock. Taking all those factors together will challenge the industry as never before, but we will keep focused on supporting our customers and continuing to pay claims over the weeks and months ahead.“

“Alongside making record pay outs, we have been turning our attention to what more we can do to support business and society through this incredibly difficult time. In addition to our £15m package of charitable donations, we have set aside £15m in seed capital to explore how the industry can create or house structures which support economic recovery and mitigate against future events of this magnitude. We are also working with our Advisory Committees to develop a number of initiatives to support our customers and economic recovery in the short, medium and long-term.”

In addition to managing wide-ranging pay outs across sectors and geographies, the experts, entrepreneurs and innovators drawn together by the Lloyd’s market have already started creating new policies to support the immediate health response as well as the longer-term exit strategy. This includes the search for diagnostics, treatments and vaccinations, where one Lloyd’s syndicate^ is insuring more than 100 individual clinical trials taking place around the world investigating all stages of COVID-19.

Sitting alongside the £15m package of support for charitable organisations responding to the pandemic, Lloyd’s is also repurposing existing innovation initiatives in its Innovation Lab and Product Innovation Facility to help fast track development of insurance products to support the response to COVID-19.

Lloyd’s plans to announce a series of further initiatives in the coming weeks as it continues to work with government, industry and business to support the short, medium and long-term response to COVID-19. One initiative under consideration includes establishing a ‘Recover Re’ insurance vehicle offering “after the event” cover for pandemic related business recovery, including the current COVID-19 pandemic.

Lloyd’s customer pay-outs are split as follows:

- Geography: US & Worldwide (58%), UK 15%, RoW (10%), Europe (7%), Other (10%).

- Class of business: Event Cancellation (31%), Property Covers (29%), Credit Lines (11%) and 15 Other Classes (29%).

*The preliminary estimate range of $3bn - $4.3bn is derived from two scenarios:

i. Submitted totals together with estimated downside uncertainty range up to and including 16 March 2020.

ii. Submitted totals together with estimated downside uncertainty range as well as assuming material social distancing rules and restrictions persist regionally and/or globally until 30 June 2020.

**Aggregated Lloyd’s market claims pay outs for hurricanes Harvey, Irma and Maria in 2017 = $4.8bn; Lloyd’s market claims pay outs for 9/11 = $4.7bn

¬ Impacts based on base case epidemiological scenario of extreme social distancing for most of Q2 with gradual relaxation of social distancing in H2 2020.

~Some $28bn is expected to be paid in 2020 across a wide range of policies, including Event Cancellation, Property and Travel. Further pay-outs are expected as the effects of COVID-19 continue to unfold, across classes such as Directors’ and Officers’ policies, Professional Indemnity and Credit insurance.

^Newline Syndicate 1218

- Lloyd’s is rated AA- (very strong) with Fitch, A+ (strong) with Standard & Poor’s and A (excellent) with A.M. Best.

- Members’ resources operate on a several bases and are only available to meet each member’s share of claims. Central assets are available at the Council’s discretion to meet the liabilities of any member on a mutual basis.

- This press release includes forward-looking statements. These statements are based on currently available information. They reflect Lloyd’s current expectations, projections and forecasts about future events and financial performance. All forward-looking statements address matters that involve risks, uncertainties and assumptions. Based on a number of factors, actual results could vary materially from those anticipated by the forward-looking statements. These factors include, but are not limited to, the following:

- Rates and terms and conditions of policies may vary from those anticipated.

- Actual claims paid and the timing of such payments may vary from estimated claims and estimated timings of payments, taking into account the preliminary nature of such estimates.

- Claims and loss activity may be greater or more severe than anticipated, including as a result of natural or man-made catastrophic events.

- Competition affecting the basis of pricing, capacity, coverage terms or other factors may be greater than anticipated.

- Reinsurance placed with third parties may not be fully recoverable, or may not be paid on a timely basis, or such reinsurance from creditworthy reinsurers may not be available or may not be available on commercially attractive terms.

- Developments in the financial and capital markets may adversely affect investments of capital and premiums, or the availability of equity capital or debt.

- Changes in legal, regulatory, tax or accounting environments in relevant countries may adversely affect (i) Lloyd’s ability to offer its products or attract capital, (ii) claims experience, (iii) financial return, or (iv) competitiveness.

- Economic contraction or other changes in general economic conditions could adversely affect (i) the market for insurance generally or for certain products offered by Lloyd’s, or (ii) other factors relevant to Lloyd’s performance.

- The foregoing list of factors is not comprehensive, and should be read in conjunction with other cautionary statements that are included herein or elsewhere. Lloyd’s undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

- Foreign exchange rates may materially fluctuate from the rates prevailing at 12 May 2020 (£1 = US$1.23).

Enquiries to:

Nathan Hambrook-Skinner

Senior Media Relations Manager

Tel: +44 (0)20 7327 6125 Email: nathan.hambrook-skinner@lloyds.com

About Lloyd’s

Lloyd’s is the world’s leading insurance and reinsurance marketplace. Through the collective intelligence and risk-sharing expertise of the market’s underwriters and brokers, Lloyd’s helps to create a braver world.

The Lloyd’s market provides the leadership and insight to anticipate and understand risk, and the knowledge to develop relevant, new and innovative forms of insurance for customers globally.

It offers the efficiencies of shared resources and services in a marketplace that covers and shares risks from more than 200 territories, in any industry, at any scale.

And it promises a trusted, enduring partnership built on the confidence that Lloyd’s protects what matters most: helping people, businesses and communities to recover in times of need.

Lloyd’s began with a few courageous entrepreneurs in a coffeeshop. Three centuries later, the Lloyd’s market continues that proud tradition, sharing risk in order to protect, build resilience and inspire courage everywhere.