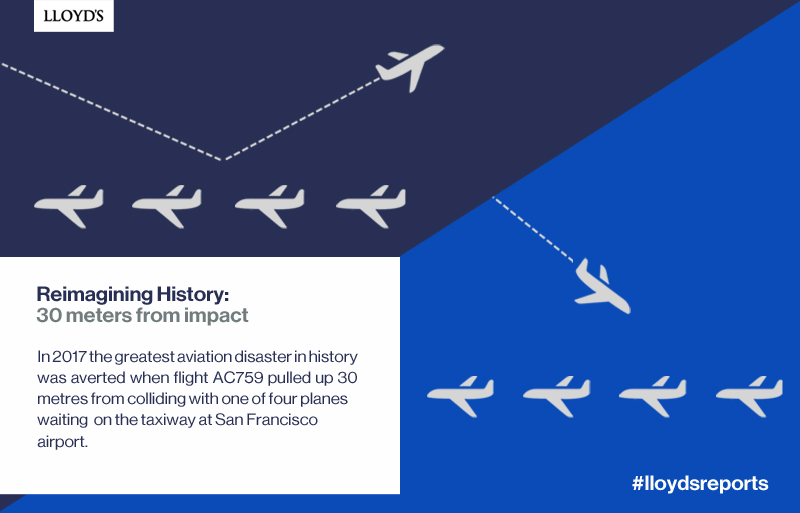

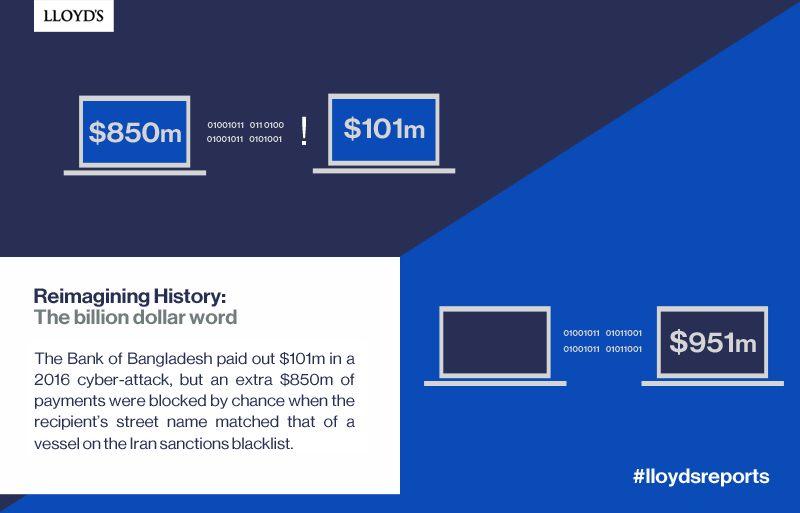

Reimagining History

How counterfactual analysis helps insurers better understand risk by asking "what if?"

What if the wind had blown onshore when the Fukushima nuclear plant was struck by a tsunami in 2011? What if West Africa had been embroiled in civil war during 2014’s Ebola crisis?

Whenever an event occurs that takes the insurance market by surprise, questions are asked how the loss might have been averted or reduced. It is also useful for insurers and other interested parties to ask how the loss might have been worse.

This approach, known as downward counterfactual analysis is the subject of ‘Reimagining History, the latest Emerging Risk Report from Lloyd’s innovation in partnership with RMS.

An Emerging Risk Report from Lloyd's Innovation

The report aims to encourage insurers to think about risk in a different way by highlighting counterfactual analysis’ potential to mitigate data bias, test model results, analyse tail risk and identify potential high impact events. It also details how counterfactual analysis can be carried out in practice and acts as a starting point for future research.

Download