What is Lineage?

Lineage is a cost effective online tool used for the reporting and settlement of Canadian binding authority business. It also generates reports for regulatory reporting.

Personalised customer service is offered through the Lloyd’s Center of Excellence (LCoE) via phone or email.

Who Can Use Lineage?

Coverholders (CH)

Third Party Administrators (TPAs)

Lloyd’s Brokers (LB)

Syndicates (SYN)

Find out more

Settlement Services

- Settlement as per terms of trade of premiums, paid claims, claim advances and other expenses

- Cash flow history and projections in real-time, drill down capability to transaction level, etc.

- Automatic settlement of brokerage

- Direct settlement from Coverholder to Lloyd’s Trust accounts

Compliance

- Submission of required regulatory information to statistical agencies on behalf of stakeholders

- Daily validation to ensure no insurance transactions were effected with individuals or entities identified on the sanctions monitoring list.

- Full audit trail between reported and settled policies (assist anti-fraud measures)

Business Controls and Management

- Claims control - above authority, advances, ability to set reclaim dates

- Caters for contracts where claims handled by Third Party Claims Administrator

- Reduced duplicate/triplicate entry

- Reduced operational costs

- Further lightens Lloyd's Brokers' administrative burden and facilitate renewals negotiations

- On-line access to Binding Authority, policy and claims information

Data Validation and Security

- Ensures that all confidential financial information is secure

- Robust validation ensures data quality and integrity of data

Reporting

- A multitude of daily, monthly and quarterly reports are produced automatically and made available to Stakeholders

- Automatic transfer of information to Bordereau Management softwares through Web Services

- Reports Dashboard - where Stakeholders can customise and extract their information

Data Upload

- Upload of Commercial and Habitational policy data from a Coverholder’s system to Lineage

- Upload of claims data from TPA or Coverholder system to Lineage

- Download of policies and claims from Lineage to a stakeholder's system

Audit

- Various information and reports available to facilitate the work of auditors

There is no cost to Underwriters, Lloyd’s Brokers, Coverholders or TPAs for the use of Lineage

Accounting & Settlement (A&S)

When a transaction is created in Lineage it is displayed in real time to A&S where it is allocated in the settlement Cash flow, in accordance with the applicable terms of trade, to the appropriate eligible settlement parties:

- Lloyd’s Underwriters

- Lloyd’s Brokers

- Canadian Coverholders

- Third Party Claims Administrators (TPA)

- Canadian policyholders using the Premium Payment Plan (PPP)

- Lloyd’s Canada Inc.

A&S aggregates a series of transactions between the various participants into a single net settlement for each party.

Settlement occurs on a monthly basis except for Single Large Loss advances that are settled on a daily basis.

A&S is tied in to the Xchanging systems.

Report Facilities

Report Dashboard allows users to conduct analysis on the performance of their business by extracting information and key business metrics directly from Lineage.

The Reports Catalogue provides details of all available reports.

Information Gathering Through Data Entry or Data Upload

Parties with a binding authority contract entered in Lineage can input, manage and consult their data (Organization Profile, Binding Authority, Policies and Claims) directly through Lineage, thereby improving the quality and accuracy of information.

Lineage Tools & Resources

The Lineage Tools & Resources section of the Knowledge Base is where you can find handy references that will facilitate the use and understanding of the Lineage applications and reports.

- Codes and references (Coverage Codes, Kind of Loss Codes, Calendars, FAQs and many more!)

- Step by step instructions for each Lineage service (Binding Authority, Business Intelligence, Policies, etc.)

To learn about the most recent enhancements, please read the latest Lineage Release Notes:

For more details on past enhancements, you can refer to the “Lineage Release Notes” and “Lineage Release Notes – Archives” sections of the Knowledge Base.

FEEDBACK AND SUGGESTIONS

We welcome your feedback relative to any of the Lineage features as we continue to make every effort to respond to the needs of our stakeholder community.

As always, please contact us at info@lloyds.ca with any comments or questions.

Benefits and Stats

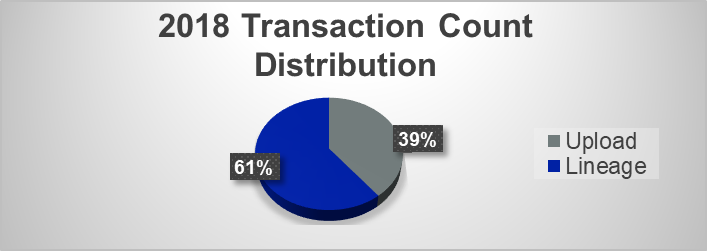

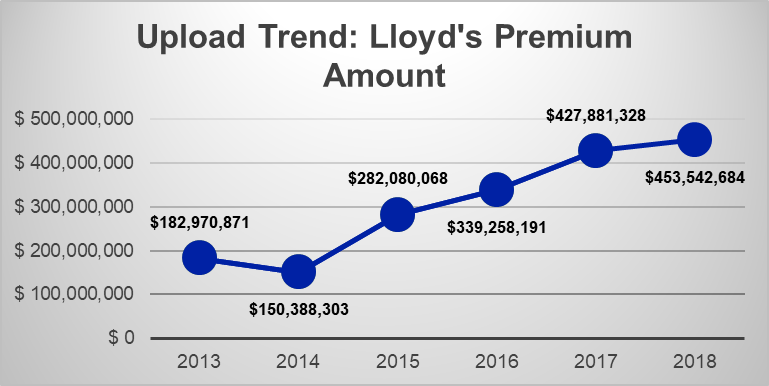

Lloyd’s Canada has been providing Commercial Policy Upload facilities since 2004. In 2018, nearly 39% of our Commercial policies transactions were issued through this electronic interface eliminating double entry of data for our Coverholders, and therefore reducing errors and discrepancies.

We now have four Broker Management System providers who have developed an interface with Lineage and a total of 93 Coverholders who are currently using the feature.

Annually, approximately 5-10 Coverholders register for using the upload facility.

Requirements

XML and CSV specifications have been developed to cater to the different vendor/Coverholder systems.

Process overview

The following process is typically used for the testing and implementation of new upload modules:

- First Phase: Initiation

A meeting is scheduled with the Coverholder, a representative of the Broker Management System used in the Coverholder office and Lloyd’s Canada. The goal of this meeting is to discuss the next steps and explain in greater detail the process of testing and implementing the upload functionality. - Second Phase: Quality Assurance

This is the main phase of the project where the Coverholder is asked to send Lloyd’s Canada upload files containing policy transactions as well as the declaration pages associated to these transactions. The files are then uploaded in the Lineage Test environment and a report of the results is provided to the Coverholder. Typically, four of these test files are required (one file per week). - Third Phase: Production

When the testing is completed and all parties are comfortable with the results, training is provided to the Coverholders allowing them to upload the files created by their Broker Management System directly into Lineage. - Final Phase: Support

For the first three months following the implementation of the upload process, special support is provided to the Coverholder in order to help them correct any errors that could have been generated when uploading files.

OTHER OPTION: Bulk Reporting/Volume entry

To accommodate the reporting of policy information where the information is common and repetitive, we offer a solution known as Volume Entry. It is a service for new and renewal Commercial policies where Lloyd’s Canada will prepare the information in a format that the policy upload facility would accommodate and accept based on the documentation provided by the Coverholder. We will forward the prepared “upload” batch to the Coverholder for their review and approval to proceed. Upon the Coverholder’s acceptance, the data is uploaded into Lineage. Any subsequent transactions attached to the uploaded policy are reported via the Coverholder in the usual data entry method.

Following are possible scenarios for this tool:

- Master policy with many certificates attaching and the coverages/deductibles/limits of insurance/premium are all common. The varying elements will be the name and address of each certificate holder within the master policy.

- A policy with multiple locations where the coverages/deductibles/limits of insurance/premium are all common. The varying elements will be the name and address of each location within the policy.

- Multiple policies where all conditions of coverages/deductibles/limits of insurance/premium are common. The varying elements will be the policy number, name and address of each insured.

The element of eligibility for the Volume Entry service is commonality of data; identical and repetitive.

If you are interested in our Commercial policy upload facilities, please contact us at info@lloyds.ca

Coverholders and Third Party Administrators can upload their claim information directly into Lineage without having to manually enter them.

This feature eliminates duplicate entry, improves quality of data and reduces processing time and effort.

Two file formats are supported: the ACORD Claims XML standard format and the CSV file format.

Should you be interested in implementing this functionality, please contact us at info@lloyds.ca or 1-877-4LLOYDS - we would be more than happy to provide a copy of our specifications documentation.

Contact us for further clarifications/guidance or to arrange a training session on the Lloyd’s Canada Portal (Lineage):

Canada

Lloyd’s Center of Excellence

Telephone: +1 514 864 5444 (from the UK)

1 877 455 6937 (from North America) or

1 877 (4LLOYDS)

Email: info@lloyds.ca

8:30am - 17:00pm (Eastern Standard Time)

For more information, please click on the following link: