We bring together the expertise to deliver creative cyber risk solutions today for a more resilient tomorrow.

Cyber exposure decoded

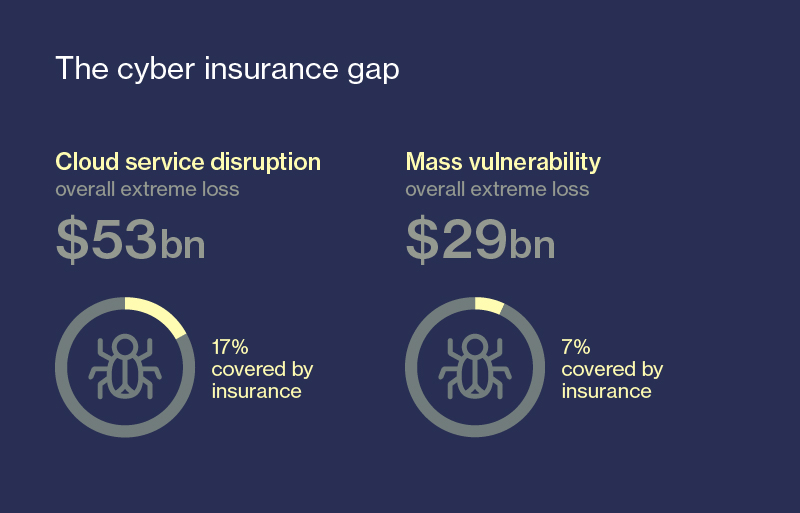

Introducing two scenarios to help insurers quantify cyber-risk aggregation

While digitisation is revolutionising business and daily life, it is also making the global economy more vulnerable to cyber-attacks. As the cyber threat grows so the demand for cyber insurance increases.

Today, Lloyd’s Class of Business team estimates that the global cyber market is worth between $3 billion and $3.5 billion. Despite this growth, insurers’ understanding of cyber liability and risk aggregation is an evolving process as experience and knowledge of cyber-attacks grows.

The aim of this report is to provide insurers who write cyber coverage with realistic and plausible scenarios to help quantify cyber-risk aggregation.

By understanding cyber-risk exposure, insurers can improve their portfolio exposure management, set appropriate limits and gain the confidence to expand into this fast-growing insurance class.

The report is designed for risk managers whose businesses are exposed to the types of cyber-attacks described in the report’s two scenarios: a hack that takes down their cloud-service provider or an attack that causes the failure of a particular operating system across their own company, customers, suppliers and/or business partners.

We have also produced a technical guide for underwriters, exposure managers and managing agents in the Lloyd’s market which details how to apply the methodology to risk portfolios.