Understanding the end-to-end lifecycle of a risk

How we’re understanding minimum data sets to help us design smarter, faster, easier customer journeys.

Data Executive sponsor & Chief Analytics & Research Officer

August 2020

Your input is integral to the design process, so don’t forget to sign up here, and have your say in the Future at Lloyd’s.

Since our last Data blog, which explored how we are learning from other industries that have both enhanced their minimum data sets whilst maintaining a seamless customer journey, we’ve been doing further work on our own minimum data sets. We have added to our work on simple UK risks by exploring the data needed to place, settle, report and claim against a number of different US property scenarios for an open market risk, a delegated risk and one that focuses on the claims process.

We have also been testing these different scenarios with individuals from across the value chain, both within Lloyd’s and the wider market. We want to ensure that the right data gets surfaced at the right time for processes like quote, calculating tax, accounting and settling premiums and regulatory reporting, for each of our scenarios. A big thanks to the individuals who have contributed and those at PPL, LMA, LMG, LIMOSS and LIIBA for inputting into our work so far – your insights and expertise are invaluable and ensure we stay aligned and on track with the broader Future at Lloyds programme.

Why is the minimum set of data so important?

Data underpins every step of the customer and practitioner journey.

"As we transition Lloyd’s from a document-plus-data business into a purely data-first ecosystem, we need to understand the minimum data needed at each step to enable us to serve our customers more efficiently, speed up transactions and generate valuable insights."

Once we understand the minimum set we’re better placed to answer some fundamental questions about standards and how and when the minimum dataset should be captured.

Questions that have steered our research include: Do we have to manually enter this data field? Can we derive it through enrichment with external data? Or is it possible to calculate it using other fields we have entered? What is the optimal point to capture this data field? And who is best placed to capture it?

It’s our job to ensure these questions get answered in a way that enhances our customers’ experience of the Lloyd’s Market whilst simultaneously improving efficiencies; reducing time spent manually entering data whilst ensuring high data accuracy.

We are also starting to identify larger, strategic data-related questions which will require input from key stakeholders and cross-workstream collaborations before they can be answered. This is something that we will be looking at in Q3 as we begin to shape our data strategy.

What approach are we taking?

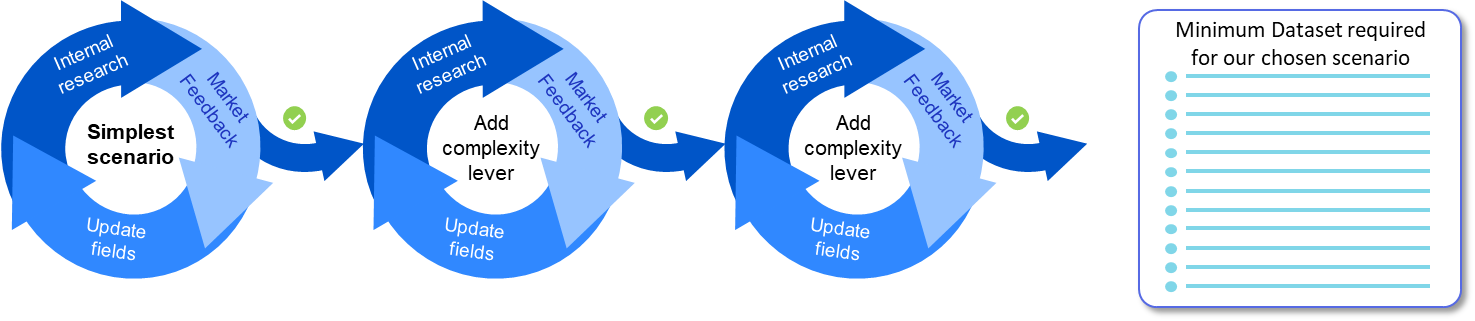

We have begun by identifying the core minimum dataset for the simplest scenarios, in open market, delegated authority and claims, across a specific subset of the end-to-end process. However, we know that all risks are not that simple. So we will incrementally add in layers of complexity - things like adding in multiple locations and territories, increasing the perils involved and the number and types of intermediaries involved - to see how changing the scenario impacts the minimum fields required, and where our “tipping point” is.

In other words, where does it become so niche or complex that synergies in data capture and processing can’t be achieved? We will also include further parts of the process to work towards a single end-to-end view of the data required at each stage of the process for different types of risk – from placement to claims.

What’s next?

By the end of this quarter (Q3), we’re aiming to:

Conclude the minimum data needed to complete the majority of key process steps for our open market scenario: A US company headquartered in Florida is looking to insure several properties in Florida and Texas against all property damage and terrorism

Conclude the minimum data needed to complete some key process steps, with a focus on the settlement, regulatory reporting and exposure management part of the process for our delegated authority scenario: A coverholder in Florida is authorised to sell property (homeowners) policies under a binding authority

Conclude the work on the minimum data needed to complete some key process steps, with a focus on first notification of loss, policy validation, confirming market participants, initiating payment and reporting for our claims scenario: An insured raises a Claim for their house that has been burned down in a fire in Florida

We will also be unifying our open market scenario and our claims scenario. This will ensure a single end-to-end view, while understanding if there are data points we can capture in placement that in turn facilitate straight-through processing in middle and back office (MBO) and claims. We will also be working closely with PPL, Delegated Contract Manager and Oversight Manager (formerly known as Chorus) and Delegated Data Manager (DA SATS) to ensure the minimum data requirements are embedded in the systems that will be used, by you, in the future.

Want to have your say? Good - get involved!

We will be diversifying the kinds of scenarios we want to focus on next in Q3. We’re currently looking for underwriters, brokers and data subject matter experts to help us think about and define new scenarios to plot for continued testing and refinement, as well as input into our strategic questions.

Your input is integral to the design process, so don’t forget to sign up here, and have your say in the Future at Lloyd’s.