Harvesting opportunity

Exploring crop (re)insurance risk in India

India is the world’s second largest agricultural economy with an Agriculture Gross Domestic Product of USD 392 billion, yet crops are vulnerable to a wide-range of weather events and more than 60% remain uninsured.

The Government have introduced the PMFBY crop insurance scheme to tackle the protection gap which will require the capacity and resources of the international (re)insurance market.

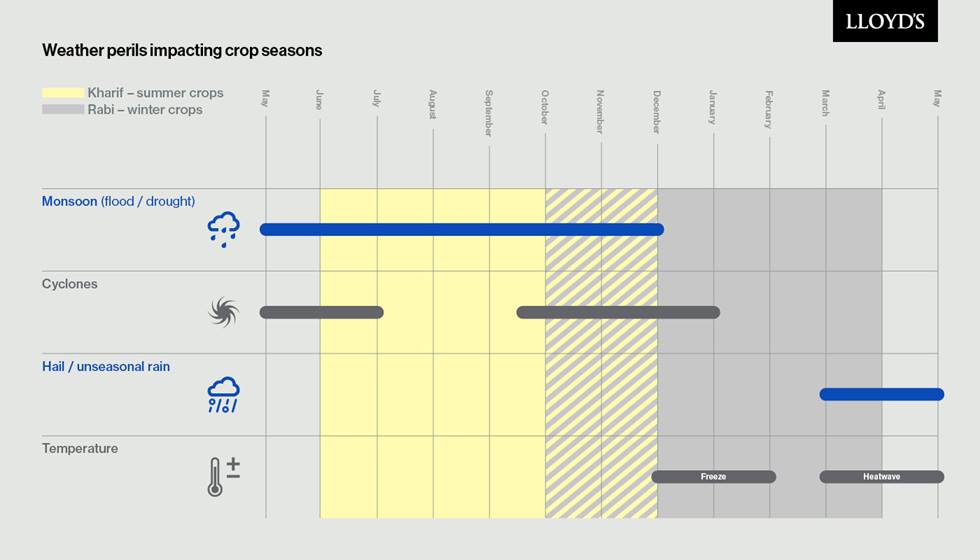

This report provides insurers interested in reinsuring crop business schemes in India with an overview of the (re)insurance market, a detailed description of the impact of weather (monsoon and extreme events) on crop yields and losses, and a description of the benefits of using probabilistic crop models to quantify India’s crop risks.

By understanding Indian (re)insurance crop risks better, insurers can improve their portfolio exposure management, set appropriate limits and gain the confidence to expand into this fast-growing market.

An Emerging Risk Report from Lloyd's Innovation

This report is aimed at underwriters and exposure managers who are or will be exposed to crop risks in India.

Download