Placing risk: today's realities, future possibilities

How the market experiences placement, and what a future of digitalised working really means

01 Oct 2020

One of the foundational building blocks of the Future at Lloyd’s transformation programme is our understanding of the ‘end-to-end’ process and the user’s experience. In this case, of placing risk within the Lloyd’s marketplace. Our research team dedicated the first half of this year – to truly understand what users experienced during the placement process.

While the placement process remains relatively consistent, how the market experiences it will vary depending on a variety of factors, for example: how long they’ve been in the market, their line of business, and how fluent they are in the use of specific technologies. We conducted a series of immersive interviews and workshops that addressed the current state, and also some of the broader future ambitions for placement.

Who was involved?

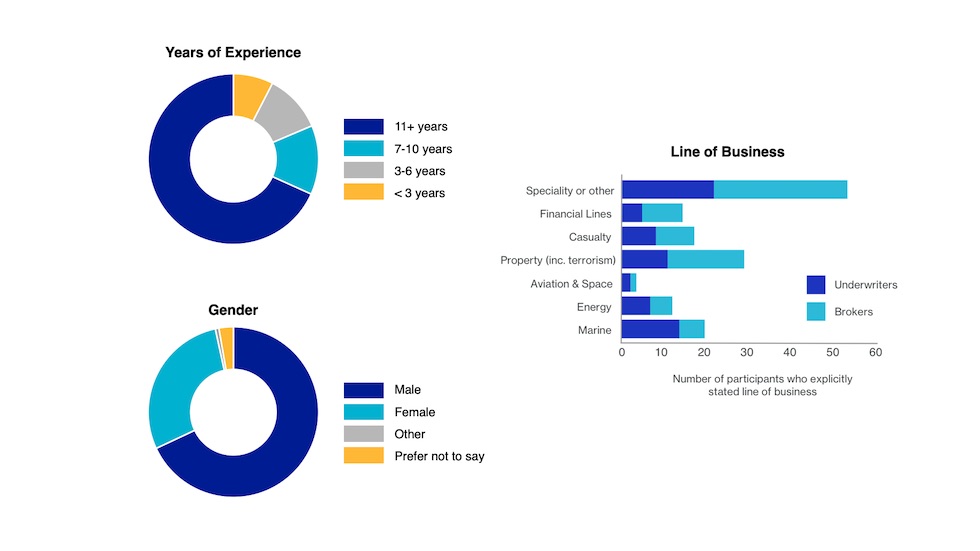

We had 159 separate engagements with market participants, including managing agents, Lloyd’s brokers, retail brokers and coverholders, across a selection of different research methods. We conducted a series of semi-structured interviews, creative workshops and digital interactive conversations. Those involved were a diverse sub-section of the marketplace bringing a variety of different levels of experience, lines of business and specific job roles.

Key insights

The top-line research validated our thinking and focus on three core components within the programme transformation:

- Improving and enhancing the experience by removing process inefficiencies and unlocking quality data

- Reducing cost, time and effort

- Demonstrating our unique standpoint to fulfil any risk requirement

Our primary investigation was to understand the experience of placing risk at Lloyd’s, the challenges, the needs and requirements of stakeholders and the benefits for the market. Given the moment of mass-scale remote working that we’re in, it was an interesting time to conduct this research.

Despite being forced to work from home, the market surprised itself by coping well in the busy renewal season of 2020. This sudden shift gave our users a glimpse of the potential realities and benefits of a ‘digital first’ marketplace. Whilst participants seemed to cope well in the short-term, many concerns were raised about how ‘remote working’ would impact the future of the marketplace, particularly around talent development and collaboration. While the general consensus for a smooth, digitised process is desired, it’s clear that nothing beats real-world interactions for securing more complex risk:

“I hope that with this virtual and all the other digital stuff, they do not lose sight of the importance and trust factors that come from live interaction. The levels of trust and the levels of familiarity that are needed to underwrite and have a consensus. It can't be duplicated to the highest level beyond live. Live is at the absolute highest of levels.”Retail Broker

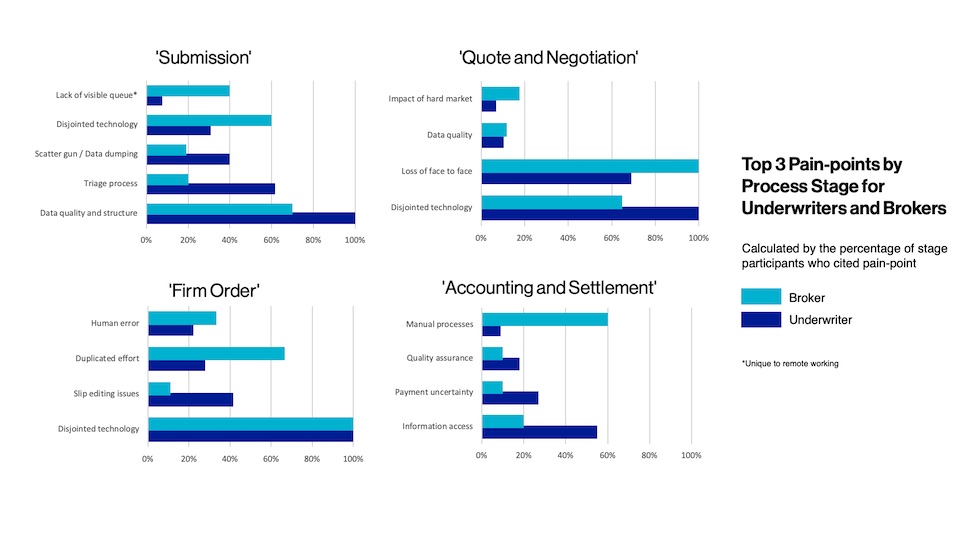

On the flip side, too much human intervention was also cited as a problem in terms of manual inputs and processes, especially across accounting and settlement. Removing the probability for human error is another key area of focus for the Future at Lloyd’s, which means we’re looking into how aspects of placement can leverage technology correctly, streamlining the experience and reducing time.

Another key insight from our research was the impact of a hardening market. We spoke to participants about the increase in deal flow to the market and how this, while overall positive, comes with its own set of challenges around triaging submissions and last-minute requests. The conversations also highlighted shifts in process and workload: more quote iterations as brokers explore their options, how a lot of negotiations are becoming very truncated and how more time is being spent ensuring the slip is perfect as a greater scrutiny on Claims means there’s no room for error. Discussions around this theme helped to streamline our thinking about the level of flexibility required for any new systems proposed.

“Now, in a hard market it may take me four or five visits. The length of time it takes to do the deal and the quality of information required is exponentially different.”Lloyd’s Broker

Quality information, and specifically quality data, was also another topic up for discussion with our users. In the context of risk, once data is entered it will automatically flow through the placement process and onto other parts of the insurance process. Which means that in a digital first marketplace, quality data will be critical. Our placement team are collaborating closely with market users to understand how we ensure ‘right first time’ data entry and how that data can then benefit each step of the future insurance process.

We’re also focused on determining how we can collect the minimum amount of data possible from market firms to meet requirements of insurance lifecycles, and also how we can standardise data consistency before being presented. We’re confident that the transition of quality structured data will bring the biggest benefits to Lloyd’s, not only at placement but all the way through to claim settlement and reporting.

What’s coming next for Future at Lloyd’s placement?

The research will be used to inform how we design our solutions to improve the user experience for all stakeholders in the placement journey. As with every aspect of the Future at Lloyd’s transformation, we’re taking an iterative approach to developing new products and systems – including risk placement.

We will continue to invite you to regularly partake in research groups and workshops that help us design and build a digital ecosystem that puts the market at the centre of the experience. To be part of the journey, sign up here.