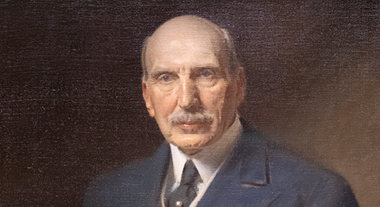

As Chairman of Lloyd's of London, Sir David Rowland guided the 300-year old enterprise through a threatening financial crisis, initiating reforms set in motion in 1993 to save it, thus averting collapse.

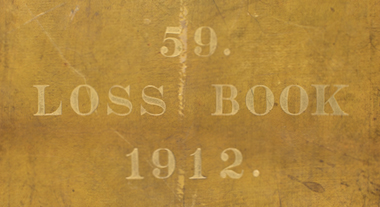

During the 80s and 90s, Lloyd’s faced an unexpectedly large number of claims due to legal awards made in the US for asbestos, pollution and health hazard claims – some relating to losses dating as far back as the 1940s. During this decade, a number of scandals had also come to light, including the collapse of a Lloyd’s syndicate (a group of underwriters who join together to insure high-value risks).

To find a solution to Lloyd’s financial crisis, Sir David made a number of dramatic changes:

- Lloyd's created a reinsurer, Equitas, to reinsure all liabilities incurred by Lloyd's. The new entity was funded by an £859m levy on Lloyd's members.

- For the first time in its history, Lloyd's permitted corporate and institutional investors to underwrite policies. In a revolutionary departure from the long-held practice of members being individuals with unlimited liability, the first corporate members joined the organisation in 1994, with a capacity of £1,595m.

- Lloyd's restricted individual Names' financial obligations to 80 per cent of premium income, with excess losses reverting to a reserve funded by annual membership dues. This meant no one took on more than they could pay out, and that if necessary, a claim could be paid from this central reserve.

- In 1996, a final step in the recovery plan was that Lloyd's adopted annual accounting, achieving a £3.lbn settlement with litigants after a long and bitter standoff.

- Sir David continued to make changes into the late 1990s, making sure that Lloyd's remained the world’s largest and most innovative insurance market. In fact, its overall assets increased from £17.9bn in 1990 to £27.3bn in 1995.

- Sir David was awarded a Gold Medal for Services to Lloyd’s in 1996. The medal has been awarded just 17 times since it was first struck in 1919.