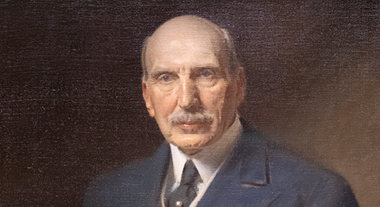

Heath was a prominent Lloyd’s underwriter and is recognised as being the innovator of non-marine insurance. He is also widely hailed as a visionary; he’s credited with creating the market’s first burglary policy and the first earthquake and hurricane insurance. He even insured against Zeppelin attacks during the First World War.

Many of Heath’s ground-breaking approaches to insurance and risk are still in practice at Lloyd’s today.

Cuthbert Heath’s life and career

Heath was born into a naval family in 1859. At the age of 18, Heath started at Lloyd’s on £100 a year, and by 21 he had become an underwriting member.

Over the course of his six-decade career, Heath built a powerful business empire and became famous for pioneering new ways of working. In addition to his work with Lloyd’s, he founded his own brokerage, CE Heath in 1877 and his own insurance company, the Excess Insurance Company. CE Heath was the precursor to Heath Lambert, a brokerage that still exists today.

Heath died in 1939; his memorial service was attended by almost every major financial figure in London. Letters of condolence poured in from the US and every corner of the world. The Economist called him “the first man to see the potentialities of insurance in the modern world”.

Cuthbert Heath’s innovations

At the time Cuthbert Heath was underwriting at Lloyd’s, the London market wrote exclusively for marine and fire risks. It didn’t take long for Heath to change that.

In 1877, Heath was approached by the Hand in Hand Insurance Company for the reinsurance of its fire policies; he made the bold decision to accept the risk. Over the following years, with Heath leading the way, Lloyd’s began to insure risks way beyond the traditional shipping ventures.

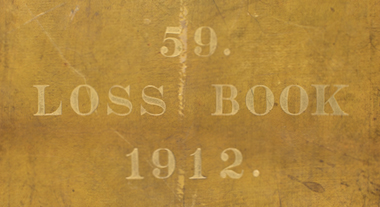

Today, Lloyd’s still prides itself on being the first to provide cover for new and complex risks. In an effort to properly weigh new risk, Heath became the first Lloyd’s underwriter to accumulate detailed probability of loss statistics; he would pay for historic documents and maps detailing windstorms and earthquakes. He became a specialist in the risks he took on and left a legacy for Lloyd’s modern day underwriters.

At the time of the famous San Francisco earthquake, in 1906, Heath was a leading earthquake underwriter with Lloyd’s. His actions after the disaster cemented Lloyd’s reputation in the US. He insisted on paying all claims in relation to the earthquake and fires, and, in doing so, built the foundations of the modern Lloyd’s.