- Following two successful predictions in the 2014 and 2018 FIFA World Cups, England emerge from Lloyd’s model (based on collective insurable value of players) as 2022 FIFA World Cup champions.

- In total, tournament players have an estimated insurable value of almost £22bn, an increase of nearly £9bn since 2018.

- England legends will give their reaction at an event in the Lloyd’s Building tonight with World Cup hat-trick hero Sir Geoff Hurst and former Lioness Fara Williams.

- Insurance increases resilience and provides security for professional athletes. On an annual basis, Lloyd’s writes over £150m in sports-related Accident and Health (A&H) policies.

Lloyd’s, the world’s leading marketplace for commercial, corporate and specialty risk solutions, is predicting that England will beat Brazil in the final and emerge victorious at the 2022 FIFA World Cup – with France, Argentina and Spain falling just behind. The same model correctly identified Germany as winners in 2014 and France in 2018.

Research published with the support of the Centre for Economics and Business Research (Cebr) ranks the teams based on the collective insurable value of their players. The assessment of each insurable value comprises a variety of metrics such as wages, sponsorships, age and on-field position.

With an estimated insurable value of £3.17bn, England edge out France (£2.66bn) and Brazil (£2.56bn) to claim the top spot. By way of overall comparison, the average insurable value of one England or France player is more than the entire Costa Rica squad.

Using this methodology to play out the tournament in full, Lloyd’s model sees the Three Lions finish top of Group B, before securing knock-out wins against Senegal, France, Spain and Brazil.

The research is designed to emphasise the need for athletes at all levels and in all sports to consider their insurance protection packages and coverage. Lloyd’s unique market model brings together the world’s insurance and sports experts to help players from all levels of the game access bespoke cover and comprehensive risk solutions.

The panel event being held at the Lloyd’s Building in London on 10th November will include Guy Bonwick from Axis, one of the leading A&H sports underwriters, who will discuss how many professional footballers playing below Europe’s top divisions can find themselves in financial instability with relatively short-term contracts and a catastrophic injury could prematurely end their careers.

“Insurance can play a key role in building confidence and resilience, knowing you’re covered if the worst happens.Bruce Carnegie-Brown - Chairman, Lloyd’s

As Lloyd’s goes for the hat-trick of correct World Cup predictions, we’re shining a spotlight on the need for protection at all levels of the game – professional and amateur – to help clubs, competitors and communities make braver decisions both on and off the pitch.”

Other key findings include:

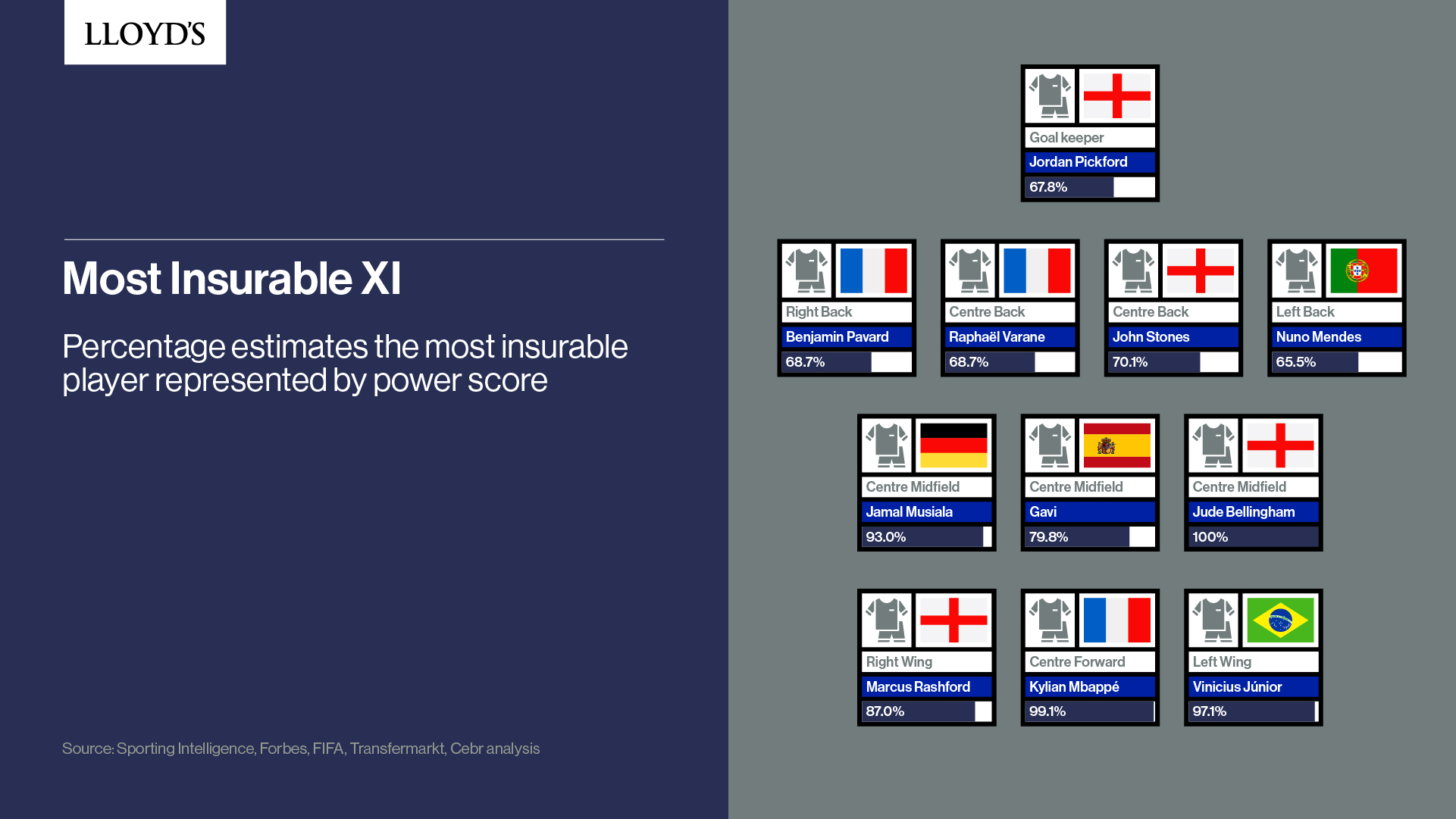

- New for 2022, Lloyd’s has compiled a ‘Most insurable team’ of players taking part across the tournament. England’s Jude Bellingham is rated the most insurable player at the FIFA World Cup, followed by France’s Kylian Mbappé and Brazil’s Vinícius Júnior.

- Players aged between 18-24 have an average insurable value of £32m compared to £12m for players over 31.

- Forward players’ average insurable value remains the highest at £34m.

- Group B, containing England (£3.17bn), USA (£410m), Wales (£180m), and Iran (£101m), is the strongest group in terms of insurable value, amounting to a cumulative £3.9 billion.

Most Insurable XI

How the tournament will play out

Notes to Editors

- The research methodology uses players’ wages and endorsement incomes, alongside a collection of additional indicators, to construct an economic model which estimates players’ incomes. Potential incomes post-playing career have been excluded. These projections formed the basis for assessing insurable values by player age, playing position and nationality. The analysis enabled Lloyd’s to predict who would qualify from their respective groups. Thereafter, Lloyd’s has plotted the path of each team in the knockout stages based upon their insurable values. The team with the highest insurable value in each match is the team Lloyd’s predicts to win and progress. The research was supported by Sporting Intelligence, who provided anonymised footballer salary data for each of the 32 teams participating in the 2022 FIFA World Cup, based upon an indicative 30-man squad for each nation.

- The Power Score, stated as a percentage in the ‘Team of the Tournament’ is a measure for comparing players’ insurable value. It captures each player’s value relative to the maximum, minimum, and median value of all players in the sample data. 100.0 is assigned to the most insurable player at the tournament, 0.0 to the least insurable player, and 50.0 to the median player.

- More news and information available from lloyds.com

Enquiries to

About Lloyd’s

Lloyd’s is the world’s leading marketplace for commercial, corporate and specialty risk solutions. Through the collective intelligence and expertise of the market’s underwriters and brokers, we’re sharing risk to create a braver world.

The Lloyd’s market offers the resources, capability and insight to develop new and innovative products for customers in any industry, on any scale, in more than 200 territories.

We’re made up of more than 50 leading insurance companies, over 380 registered Lloyd’s brokers and a global network of over 4,000 local coverholders. Behind the Lloyd’s market is the Corporation: an independent organisation and regulator working to maintain the market's successful reputation and operation.

We’re working to build solutions for the most current and prevalent threats. As Chair of the Insurance Task Force for HRH The Prince of Wales’s Sustainable Markets Initiative, Lloyd’s is bringing the industry together to insure the transition to net zero. Our research community is pooling expertise from across the industry to provide cutting edge insight on systemic risks from climate change to cyber security.

And through our digital-led strategy, The Future at Lloyd’s, we’re making it easier and cheaper to place, price and process cover in the Lloyd’s market.

About Cebr

Cebr is an independent London-based economic consultancy specialising in economic impact assessment, macroeconomic forecasting and thought leadership.

About Lloyd’s

About Lloyd’s