The rising cost of shipwreck removal

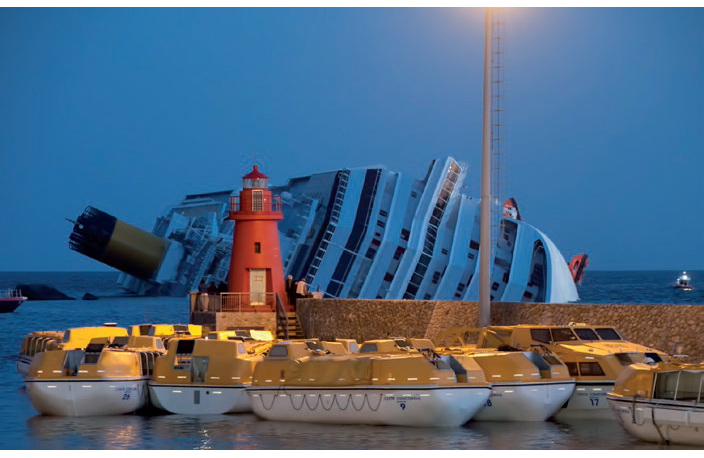

Due to increasing vessel sizes and growing cargo volumes, the cost of removing shipwrecks, such as the stricken Costa Concordia, is spiralling, marine experts warn.

Shipwrecks are often a massive media event, frequently combining reports of heroism on the high seas with dramatic scenes of stricken vessels spilling their cargoes. But after the TV crews have moved on, the essential and sometimes dangerous work of wreck removal gets underway. And, as a new report from Lloyd’s reveals, the cost of this complex job is rising fast - with insurers and reinsurers, and ultimately shipowners, having to foot the bill.

The wreck of the Costa Concordia cruise ship, which spectacularly ran aground off the coast of Italy last year, has highlighted the issue of rising wreck removal costs. It has already cost significant sums of money and the wreck has not even been moved yet.

The bill for removing the wreck of the MV Rena, a container ship which sank off New Zealand in 2011, currently stands at $240 million. The removal of the MSC Napoli, which attracted thousands of scavengers to the UK’s south coast in 2007, took two and a half years to complete and cost $135 million.

Vessels are usually insured by mutual insurers called P&I Clubs, which pool their larger risks and buy reinsurance in the open market (including Lloyd’s) for risks exceeding $70 million. To show how both P&I Clubs and their reinsurers have been impacted, the total cost of the top 20 most expensive wreck removals in the past decade is $2.1bn and rising.

Size matters

The Lloyd’s report, Complex Cases, Costly Solutions: The Challenges and Implications of removing Shipwrecks in the 21st Century, explains how increasing vessel sizes and growing cargo volumes are driving up wreck removal costs.

In the cruise sector there are 51 vessels currently in service of greater than 100,000 gross tonnes, a further seven under construction and more on order. By comparison, in 2007, there were only 40 such vessels in service or under construction. Container vessels have grown in size too. In the 1990s a large container vessel carried some 5000 “twenty foot equivalent units” (TEU). By the mid-2000s containerships with a capacity of 12,000TEU were coming into service. The largest containership in service today has a capacity of 16,000 units.

Global media coverage and lobbying from environmental groups has added to the pressure on international and local authorities, intensifying their oversight of wreck removal and adding to costs. Environmental considerations, related to the wreck’s cargo or own bunker fuel, have a significant impact on costs, especially the removal of bunker fuel, the report explains.

Technology has pushed the boundaries of what is feasible for wreck removal specialists. Fuel and cargo, for example, can be recovered from a wreck lying in deep water and, if it is achievable, the authorities increasingly demand for it to be done.

The report notes that in three particularly expensive cases – the Napoli, Rena and the Costa Concordia – the influence of the authorities was the most significant factor in increasing the cost of the operation and could be the key factor determining the total cost of removals.

Call for consistency

The rising cost of wreck removal to insurers and reinsurers is inevitably passed on to shipowners, pushing up their operating costs in turn. It is therefore in all stakeholders’ interest to improve the management of wreck removal.

Consistency and fairness by authorities in their approach to wreck removal across different territories is one of several important recommendations made within the Lloyd’s report. Shipowners and insurers should consider a formal, international campaign of engagement with relevant stakeholders such as influential coastal states, the International Maritime Organisation, the EU and International Harbour Masters, it says.

A practical challenge facing the shipping industry is the gap that has developed between the increasing size of vessels – notably containerships, passenger vessels, bulk carriers and LNG vessels – and the capability and equipment available to handle them, either as casualties or wrecks. Closing this gap is an important consideration for shipowners, the ship design industry, the salvage industry and liability and hull insurers to explore together, the report suggests.

Reducing human factors in marine casualties is a risk management imperative for the shipping industry, as human error continues to be the single most significant cause of shipwrecks. Shipowners and operators should ensure that seafarers are well trained and that operations are conducted safely, supported by appropriate technology, the report adds.

The increasing cost and complexity of wreck removal is an important issue for the marine insurance market. But there are implications for stakeholders all along the shipping industry’s economic value chain, according to Judy Knights, marine and energy class of business executive at Lloyd’s. “The findings of this comprehensive report should encourage and inform dialogue between these stakeholders, as well as the relevant authorities, to help contain wreck removal costs,” Knights said. “Importantly, the report will also contribute to loss prevention and risk management in the shipping industry.”

Click on the images from the report below to find out more.