The Lloyd’s Act of Parliament 1982 defines the governance structure and rules under which Lloyd’s operates.

The governance and oversight framework for the Lloyd’s market is designed to ensure that both the Corporation and managing agents in the Lloyd’s market have robust and comprehensive systems of governance, risk management and internal controls. The underlying objective of this overall framework is that the Corporation and the market actively manage risks to the Central Fund, Lloyd’s licences, ratings and brand and to ensure good outcomes for policyholders.

Lloyd’s is regulated by the Prudential Regulatory Authority and Financial Conduct Authority.

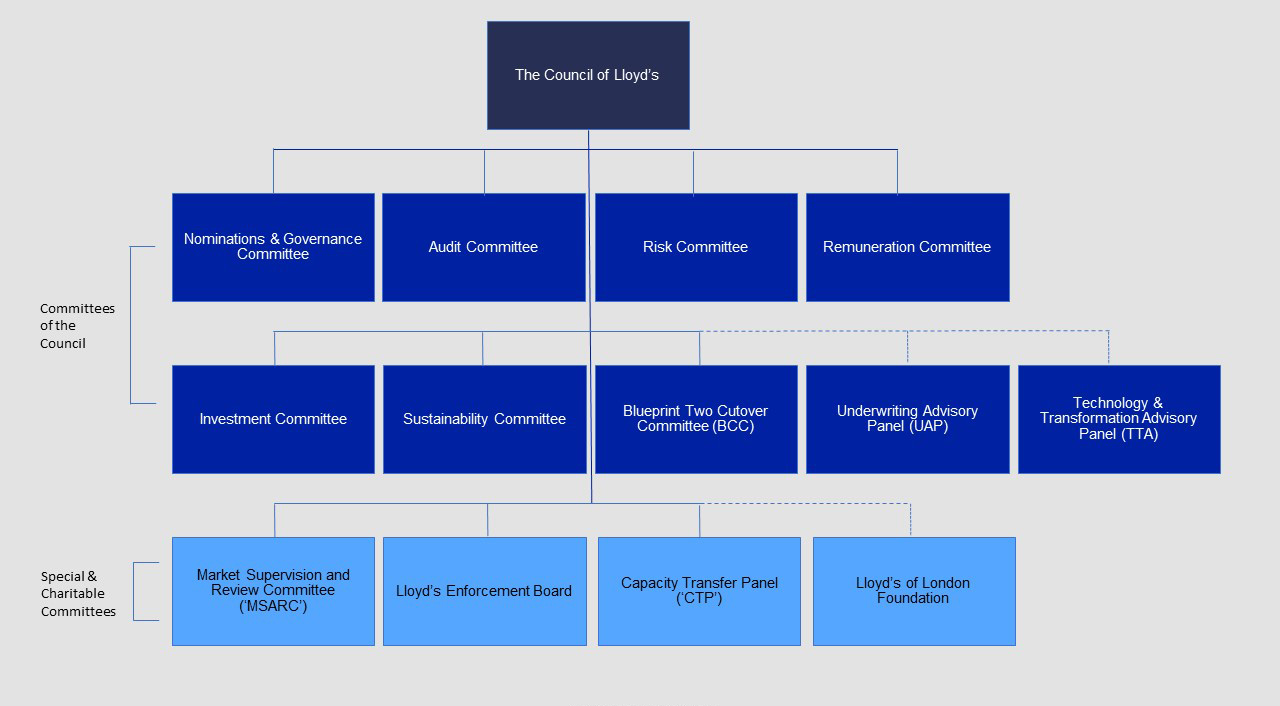

See Council of Lloyd’s members

See Council of Lloyd’s members