What is a captive syndicate?

A captive syndicate is a type of Lloyd’s syndicate set up by a group enterprise seeking to retain first or related third party risks:

- First party: An insurance policy where the claimant is the parent entity or group.

- Related Third Party: Products offered to a limited population affiliated with the group such as employees, customers, contractors or partnerships. These risks are either better understood by the group, or the group has some degree of control, risk mitigation or alignment of incentives.

- Third Party business is not permitted to be written into a captive syndicate.

Why establish a captive syndicate?

- Licensing access leads to potential cost efficiency: All syndicates at Lloyd’s, including captive syndicates, can use Lloyd’s international underwriting permissions, including the ability to underwrite direct insurance in 80 countries, and to use fronting partners where Lloyd’s does not have insurance permissions. A captive with a significant volume of business in multiple territories where Lloyd’s has permission to underwrite insurance can find this a more cost-effective model.

- Control and consistency: The potential absence of fronting arrangements provides the captive with the ability to set and control their own risk appetites, retentions and wording, with the support of their managing agent, and the oversight of Lloyd’s.

- Capital: Captive syndicates share the financial strength rating of the Lloyd’s market. This can result in lower collateral requirements where fronting arrangements are necessary.

Cost of fronting arrangements

Lloyd’s reduces the need for fronting partners and associated variable cost

Through Lloyd’s underwriting permissions that give direct insurance access in 80 countries

Unable to write related third party risk

A captive syndicate can write both first-party and related third-party risks

Related third-party risks includes related entities where there is alignment of interests and a degree of control over risk mitigation e.g. employees, partners, contractors, group customers etc

Limited control over wordings & coverage

A captive syndicate sets its own coverage, retentions and wording

Changing appetite of fronting partners

Reduced reliance on fronting arrangements means a captive syndicate has more control over its risk appetite

Ensuring captives have continuity of cover

Hard to recognise profit

Profit is released every 3 years

As a result of Lloyd’s reinsurance to close mechanism

Non Rated Paper

increases collateral requirements with fronting partners

Captive syndicates share the financial strength rating of the Lloyd’s market.

- Resulting in lower collateral requirements where fronting arrangements are required- Meets internal insurance purchasing risk appetites

The benefits of a captive syndicate at Lloyd’s

Lloyd’s Global Licence Network

Lloyd’s global licences covers onshore insurance in 80 countries, onshore reinsurance in 100 countries and offshore reinsurance in over 200 countries:

- Allows the captive owner to write cross-border business in 80 countries without the need for fronting partners, reducing variable cost. Subject to local regulatory requirements, this can be on a single policy written out of London - complemented by Lloyd’s subsidiaries where required (Europe, Japan and China).

- Central premium payment and local claims payment possible depending on local requirements.

- Lloyd’s reinsurance licences permit syndicates to reinsure local direct writers where Lloyd's does not have permission to underwrite directly.

- Lloyd’s shared financial strength rating may mean that fronting collateral is reduced, where fronts are required.

Lloyd’s Capital Structure

All syndicates benefit from Lloyd’s Financial Strength Rating

Reinsurance to close enables members to release profits after three years.

Lloyd’s capital requirements will be assessed upfront to provide an early assessment for captive owners.

Capital set in line with UK implementation of Solvency II. Additional protection may be required if risks are volatile.

London Bridge provides a cost effective and flexible route for affiliated third party capital providers such as suppliers or financiers.

Control

Lloyd’s captive syndicates can set their own policy wordings, retentions and structures.

All syndicates must meet Lloyd’s requirements, including operating in accordance with the Principles for doing business at Lloyd’s but it is for each syndicate to implement controls that are appropriate for their business.

The managing agent will be able to provide a range of services to the captive syndicate where desired. Functions can also be delegated back to the captive group or to a third party.

Lloyd’s oversight of the captive syndicate will be proportionate to the business proposed.

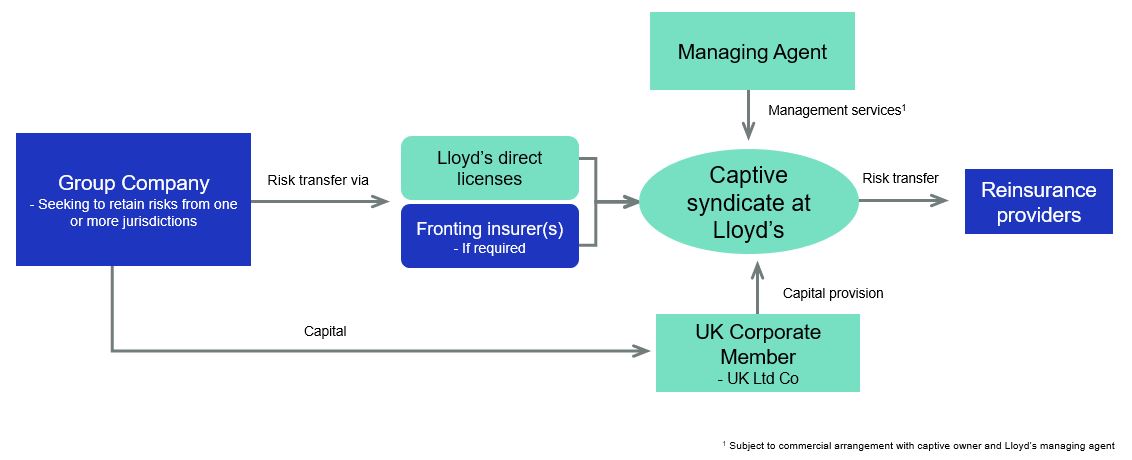

How a captive syndicate operates at Lloyd’s

Lloyd’s assessment criteria

Lloyd’s has established overarching criteria for the assessment of all new entrants; these criteria are provided for by the Underwriting Byelaw and are set out in full in the requirements made pursuant to the Underwriting Byelaw.

More broadly, Lloyd’s will also consider the extent to which the applicant’s proposed business adds value to the Lloyd’s market having regard to:

- the nature and robustness of the business plan of the syndicate;

- whether the applicant is a competent, proficient and capable organisation;

- whether the applicant is of appropriate reputation and standing;

- whether the applicant has adequate capital and financial resources;

- whether the applicant is able to meet Lloyd’s Principles framework where applicable; and

- the applicant’s support for ‘Future at Lloyd’s’ and other market wide initiatives.

Fees and charges

- Lloyd’s captive syndicate application fee is £100,000 (VAT is not payable).

- The application fee invoice will be issued once the application has been recommended to the Council by the Business Opportunities Committee.

- Please note the application fee is non-refundable.

- Further information on charges payable by members to operate in the Lloyd’s market can be found in the Triage Quantitative Submission.

- We review our charges annually and every September we release a Market Bulletin confirming the charges for the following year.

Next steps

Download the captive syndicate guide to find out more about our assessment criteria and how to apply.

Useful resources

Download the captives at Lloyd's key facts below. You can find all the materials required for your application, including templates, by visiting the Useful resources page.

Find out more about our multinational capability

Find out more about our multinational capability