Key considerations

There are several key considerations for the market to adopt a data-first approach for doing business:

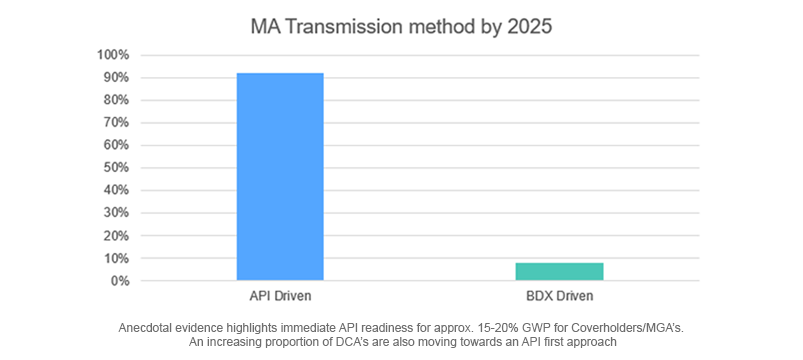

Phased approach – Implementation will need to be phased, with transition services in place to adequately support adoption/pace of individual market participants.

- Dual-Run / Support of multiple transmission methods will likely incur additional cost / complexity for Lloyd’s and the market throughout the transition phase.

Market change required for adoption – Market participants will require technical and business process transformation to enable adoption of API standards/transmission methods.

- This will incur a shorter-term cost of change to the market

- There is consideration for those who have adopted CRS v5.2 to align to a new data standard

Iterative development and testing with market – We will need to iteratively build up a DA Data Standard, starting with binder placement data captured via a Computable BAA, with regular market testing to ensure standards are fit for purpose and support the end-to-end DA journey.